|

The Group Securities: Weekly Report on QSE Performance, 29 April - 3

May 2018

General Index Retreats Due to Some Statements Showing Negative

Results

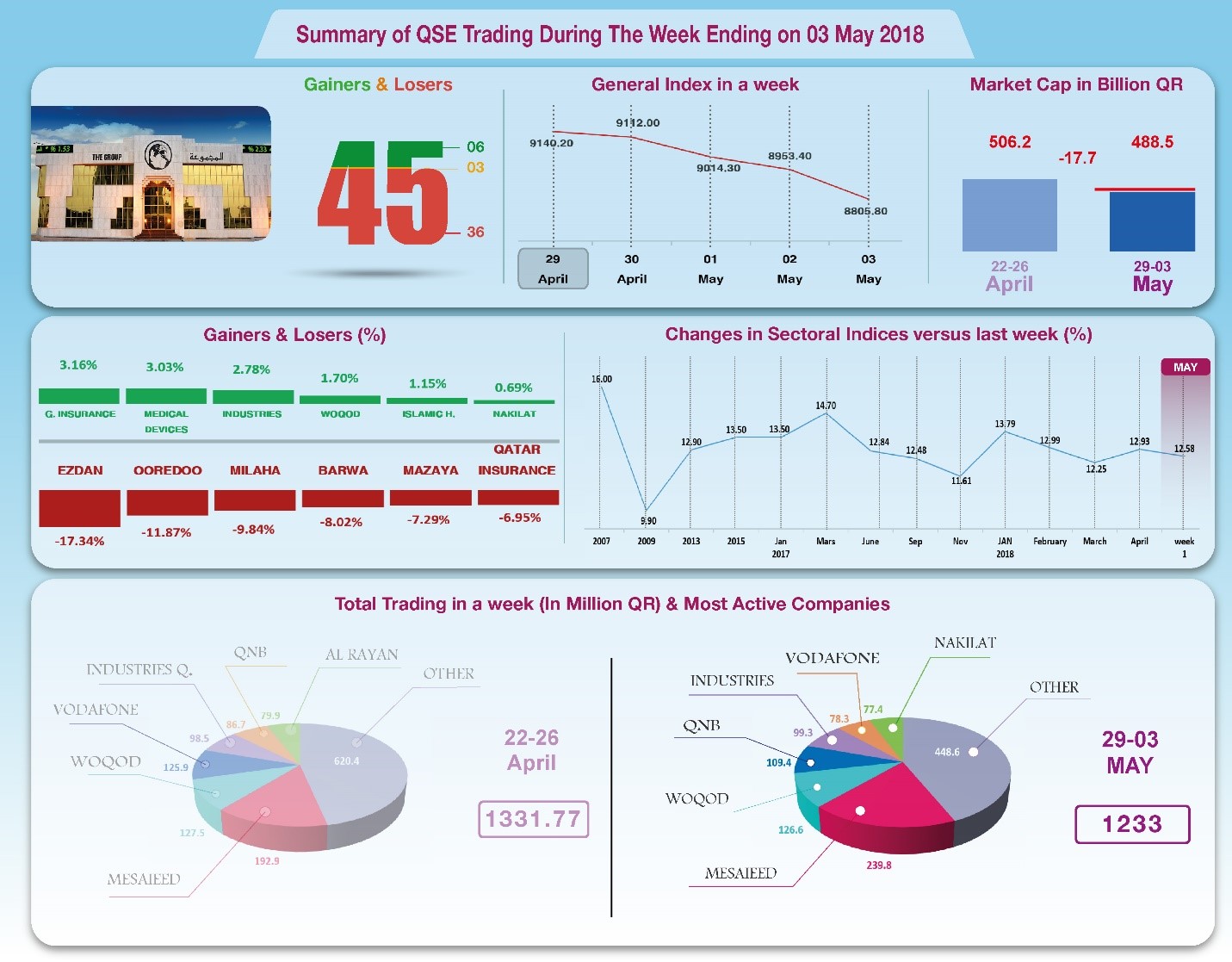

The performance of the stock market was strongly affected last week

by the disclosure of the first quarter results of 17 companies.

Many of these results were surprising, some in a positive way,

others in a negative. On the positive side of things, Industries

Qatar, Woqod, and Mesaieed recorded significant gains in

profits, and Vodafone Qatar escaped loss and made its first

quarterly profit. On the other hand, Qatar First Bank’s losses

deepened, Mazaya became unprofitable, and the profits of Ezdan,

Barwa, Gulf International, UDC, Khaleej Takaful, and Qatar-Oman

declined. Amidst these developments, and with the distribution

of profits to holders of indices units, prices fell after the

first day, and the index fell below 9000 points to reach the

level of 8806 points. Total capitalization shed about QR17.7

billion, and P/E ratio retreated to a multiple of 12.58, in

hopes performance will pick up once again in the second quarter.

In depth, the general index decreased by about 282.3 points or

3.11%, to the level of 8806 points, and Al Rayan Islamic Index

dropped by 3.85%. All sectoral indices declined, especially Real

Estate, Telecommunication, Insurance, and Transportation. The

share price of 36 companies declined, but the shares of 6

companies only rose, while 3 companies maintained a stable share

price. It has been noticed that the share price of Ezdan was the

biggest loser, down by 17.3%; followed by Ooredoo by 11.9%,

Milaha by 9.8%, Barwa by 8%, Mazaya by 7.3%, and Qatar Insurance

by 6.95%. In contrast, the share price of General Insurance was

the top gainer, up by 3.16%; followed by Qatari German Medical

Devices by 3%, Doha Insurance by 5.5%, then Industries Qatar

2.8%.

Total trading volume decreased by 7.4% to QR1233 million in a week,

and the average daily trading declined to QR246.6 million.

Mesaieed led the traded shares with a volume of QR239.8 million,

followed by the share of Woqod with QR126.6 million, QNB with

QR109.4 million, Industries Qatar with QR99.3 million, Vodafone

with QR78.3 million, and Nakilat with QR77.4 million. It was

noticed that Qatari individual investors made net purchases of

QR27.9 million, while non-Qatari individuals made total net

purchases of QR1.12 million. Qatari portfolios on the other hand

made net sales of QR4.7 million, whereas non-Qatari portfolios

made net sales of QR24.3 million. As a result, QSE’s total

capitalization decreased by QR17.7 billion to reach QR488.5

billion, and P/E ratio decreased to a multiple of 12.53 from

13.03 recorded in the previous week.

Corporate News:

1.

Industries

Qatar’s net profit amounted to QR1.2 billion in the first

quarter of 2018, compared to QR928 million for the same period

last year. The company’s earnings per share recorded QR2.1,

versus QR1.53 for the corresponding period of 2017. IQ’s gross

profit for the first quarter of 2018 increased by 29.2% to

QR329.2 million, while general and administrative expenses

decreased by 55% to QR38.8 million. The selling expenses rose to

QR14.4 million, and the company's share in the results of joint

ventures and associates achieved a 33.6% hike to QR879.7

million. As a result, the net profit increased by 36.6% to

QR1267 million.

2.

The net profit

of Al Khaleej Takaful amounted to QR5.83 million in the first

quarter of 2018, compared to QR13.87 million for the same period

last year. The company’s earnings per share recorded QR0.23 in

this first quarter, versus QR0.54 for the corresponding period

of 2017. This quarter’s net surplus increased to QR24.8 million.

After deducting other expenses, the income surplus is multiplied

to settle at QR16.8 million, compared to QR3.1 million for the

corresponding period of 2017. The gross income from investments

declined by 37.2% to QR14.5 million, and expenses dropped

slightly to QR8.7 million, and the net income decreased by 58.3%

to QR5.8 million.

3.

Woqod’s net profit amounted to QR317.8 million in the first quarter

of 2018, compared to QR204.7 million for the same period of the

previous year. The company’s earnings per share recorded QR3.03

in this quarter, versus QR1.77 in the previous year. The gross

profit from Woqod’s activity increased by 16.4% to QR310.5

million, and general and administrative expenses dropped by

24.8% to QR100.2 million. As a result, the net profit increased

by 55.1% to QR317.8 million, of which QR301.2 million was

attributable to shareholders. The company incurred a loss

resulting from a negative change in the fair value of some

investments worth QR30.6 million. The comprehensive income

reached QR271.6 million.

4.

Mannai net profit amounted to QR91.4 million in the first quarter

of 2018, compared to QR90.1 million for the same period last

year. The corporation’s earnings per share recorded QR1.99 in

this quarter, versus QR1.97 in the previous year. Mannai’s gross

operating profit multiplied to QR580.9 million. The company

generated QR26.5 million from other income and from its share in

the profits of associates. Expenses shot up to more than the

double, amounting to QR392.5 million, financing costs increased

as well to QR57.8 million, and the cost of amortization rose to

QR48.7 million. After deducting QR17.1 million in taxes, the net

profit increased slightly to QR90.7 million attributable to

shareholders.

5.

Qatari German Medical Devices net loss amounted to QR2.23 million

in the first quarter of 2018, compared to a net loss of QR2.21

million for the same period last year. QGMD’s loss per share

stood at QR0.19 unchanged from last year. QGMD’s gross profit

recorded a slight increase to QR275 thousand in the first

quarter of 2018, while other revenues decreased slightly to

QR645 thousand. In contrast, total expenses rose slightly to

QR2.5 million, while financing expenses dropped to less than

QR900 thousand. As a result, the loss in this first quarter

stood at QR2.2 million.

6.

QFB's net loss amounted to QR28.6 million in the first quarter of

2018, compared to a net loss of QR9.56 million. QFB’s loss per

share reached QR0.14, compared to a loss of QR0.5 per share in

2017. The total income decreased by 24% to QR92.4 million in the

first quarter of 2018, of which QR83.7 million were generated

from non-banking activities. Total expenses decreased by 4% to

QR123.9 million. As a result, the company's loss in the first

quarter tripled to about QR28.6 million.

7.

The net profit of United Development Company (UDC) amounted to

QR215 million in the first quarter, compared to QR231 million

for the same period last year. UDC’s earnings per share recorded

QR0.61, versus QR0.65 for the corresponding period of 2017.

UDC’s gross profit stood at QR289.5 million in the first quarter

with a slight increase. General and administrative, as well as

sales and marketing expenses increased by 7.4% to QR89.4

million. Net financing cost stood at QR44.4 million. After

adding other income, the net profit attributable to equity

holders decreased by 7% to QR214.5 million in this quarter.

8.

The net loss of Mazaya Qatar amounted to QR6.32 million in the

first quarter of 2018, compared to QR5.02 million for the same

period last year. The company’s loss per share reached QR5.5,

versus earnings per share of QR4.3 in 2017. Mazaya conducted no

construction activities in the first quarter. Its income

amounted to QR7.2 million and was limited to rent and

properties. After subtracting the operating cost, operations

revenues fell more than half to QR6.3 million. The company

estimated a gain from the fair value of investment property of

QR4.75 million. It was noticed that public and administrative

expenses increased by 47.2% to QR5.3 million, and the cost of

financing increased by 44.6% to QR12.1 million. As a result, the

company recorded a loss of QR6.32 million, versus a profit of

QR5 million in the corresponding period of 2017.

9.

The net profit of Qatar-Oman Investment Company (QOIC) amounted to

QR5.40 million in first quarter of 2018, compared to QR9.57

million in the previous year. QOIC’s earnings per share recorded

QR17.2 in this quarter, versus QR30.4 in 2017. The company’s net

investment and interest income decreased in the first quarter by

42.4% to QR7 million, while the total expenses rose by 18% to

QR1.65 million. As a result, the net profit decreased by 43.5%

to QR5.40 million. It should be noted that the company incurred

a loss resulting from a negative change in the fair value of

some investments amounting to QR3.2 million, which resulted in

the decrease of the comprehensive income to QR2.22 million,

compared to a comprehensive loss of QR401 thousand in 2017.

10.

Al Meera

Consumer Goods’ net profit amounted to QR43.33 million, compared

to QR40.51 achieved during the same period of the previous year.

Al Meera’s earnings per share amounted to QR2.17 in this

quarter, versus QR2.03 in 2017. Al Meera total profit from core

business increased by 10% to QR115.7 million, and its revenues

from shop rentals and other sources increased by 3% to QR 26

million. Total expenses increased by 7.5% to QR 98 million. As

result, net profit posted in this quarter increased by 7% to

QR43.33 million. The fair value of some investments knew a

positive change worth QR5.1 million, thus pushing the

comprehensive income up to QR48.5 million.

11.

Gulf

International Services' net profit reached QR9.5 million in the

first quarter of 2018, compared to QR15.1 million in 2017. The

company’s earnings per share stood at QR0.05, versus QR0.08 in

the previous year. GIS gross profit increased by 7.5% in the

first quarter to QR94.4 million, and other revenues climbed to

QR17.8 million. In contrast, general and administrative expenses

decreased by 4.5% to QR58.8 million, and net financing cost

increased by 51% to QR43.8 million. As a result, the net profit

decreased by 37.1% to QR9.5 million, and the comprehensive

income retreated to QR7.1 million.

12.

Barwa net

profit amounted to QR405 million in the first quarter of 2018,

compared to QR479 million for the same period last year. The

company’s earnings per share recorded QR1.04, versus to QR1.23

in 2017. The company’s net rental and leasing income increased

by QR5 million to QR255.1 million in the first quarter of 2018,

while the net revenues generated from advisory services rose

slightly to QR25.6 million. The fair value gains from real

estate investments declined by 12.3% to QR211 million, and

general and administrative expenses dropped by half to reach

QR25.9 million. After deducting depreciation and other expenses,

the net profit fell by 15.5% to QR404.9 million, and

comprehensive income reached QR407 million.

13.

Milaha’s net

profit reached QR260 million for the first quarter of 2018,

compared to QR236 million for the same period of the previous

year. The company’s earnings per share amounted to QR2.29,

versus QR2.08 for the same period of 2017. Milaha’s gross

operating profit in the first quarter of 2018 increased by 7.7%

to QR697.8 million. The total expenses also increased, this time

by 9.7% to QR202.8 million. On another hand, the net profit rose

by 10% to QR259.8 million. It should be noted that the company

had a net profit of QR147.5 million, which all resulted in the

increase of the comprehensive income to QR407.3 million.

14.

The net profit

of Mesaieed Petrochemical Holding amounted to about QR357

million in the first quarter of 2018, an increase of 68%

compared to QR212 million achieved in the same period of the

previous year. The holding’s earnings per share reached QR0.28

versus QR0.17 for the corresponding period of 2017. Mesaieed’s

first quarter revenue increased by 65.7% to QR329.7 million.

Expenditures rose by 47.7%, or QR6.5 million, and tax rebates

increased by 88.8% to QR34 million. As a result, the net profit

rose 68% to QR356.6 million.

15.

Vodafone

Qatar's net profit amounted to QR17.5 million compared to a net

loss of QR74.2 million for the same period last year. The

company’s earnings per share reached QR0.02 in Q1 2018, versus a

loss per share of QR0.09 for the corresponding period in 2017.

The revenues of Vodafone Qatar rose slightly in the first

quarter of 2018 to QR531.9 million. The company’s connectivity

and network expenses decreased marginally to QR336.9 million,

and personnel costs rose to QR60.4 million. As a result, the

company recorded its first net profit of QR18.9 million, versus

a loss of QR74.2 million in the corresponding period of 2017.

16.

The net profit

of Aamal amounted to QR115.8 million for the first quarter of

2018, compared to QR114.5 million for the same period last year.

Aamal’s earnings per share recorded QR0.18, unchanged compared

to the corresponding period in 2017.

The gross profit of Aamal retreated by 46.4% to QR117.1 million in

the first quarter of 2018, and expenses dropped by 13.7% to

QR28.9 million. The company's share of profits from investments

in other companies amounted to QR31.2 million in this quarter,

compared to QR2.2 million recorded at the same period in 2017.

As a result, the company's profit decreased by 16.9% to QR116.1

million.

17.

Ezdan’s net

profit amounted to QR103 million, compared to QR946 million for

the same period of the previous year. The company’s earnings per

share recorded QR0.04 versus QR0.36 for the corresponding period

in 2017.

Economic

Developments:

1.

OPEC oil price in Qatar stabilized during the previous week

until Thursday 2nd May over US $70 per barrel, a

decrease of US $0.53 to US $70.47 per barrel, compared to the

previous month’s price tag of US $71 per barrel.

2.

Qatar‘s trade balance achieved a surplus of QR13.4 billion during

the month of March, an increase of 45.3% and about QR4.2

billion, compared to the same month of the previous year.

3.

Dow Jones index lost about 392 points to drop to the level of

23930 points until closing on Thursday. US dollar increased to

$1.20 against the euro, but decreased against the yen at ¥109.06

per dollar. Gold decreased by about US $8 to the level of

$1318.5 per ounce.

|