|

The Group Securities: Weekly Report on QSE Performance, 6-10 May

2018

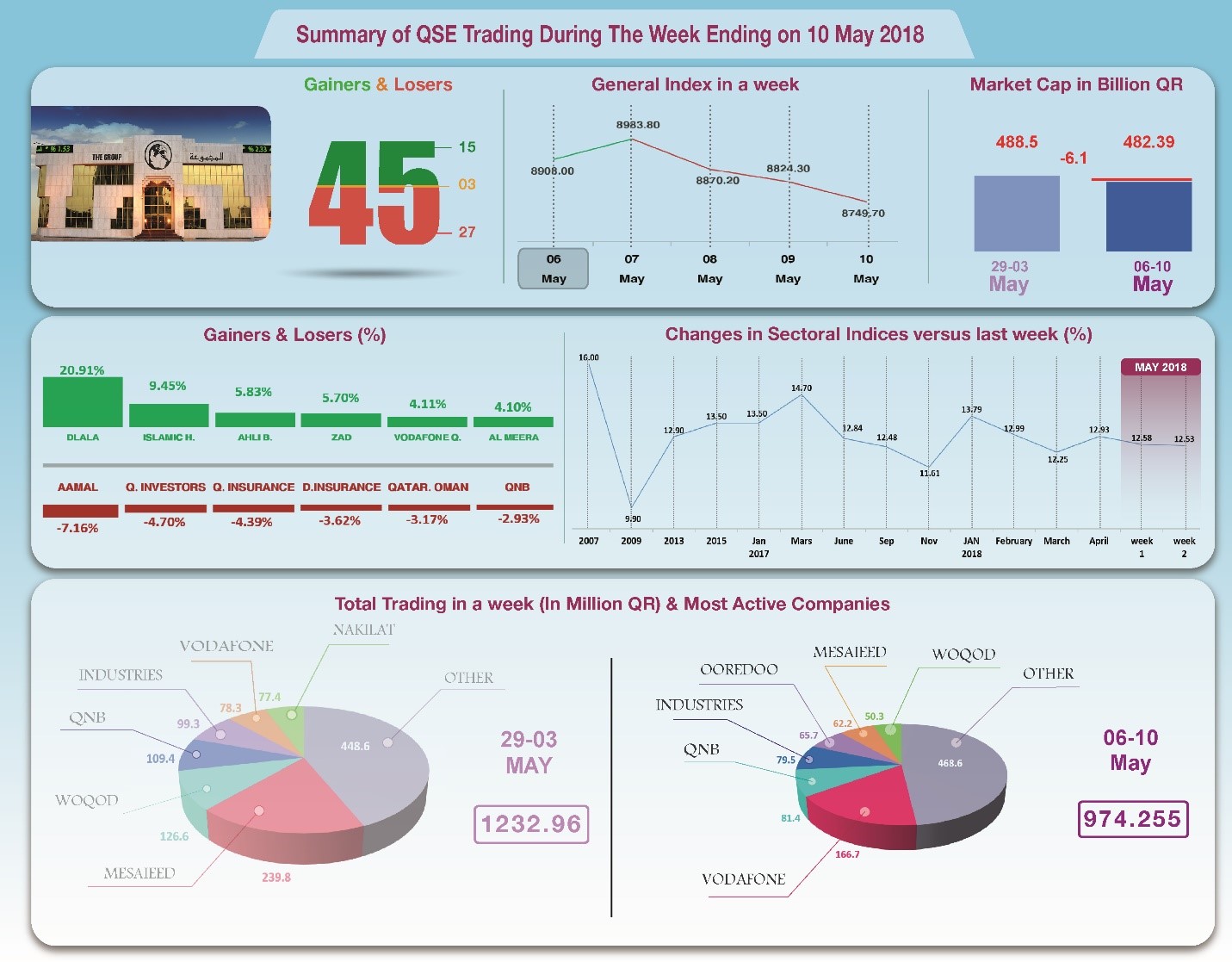

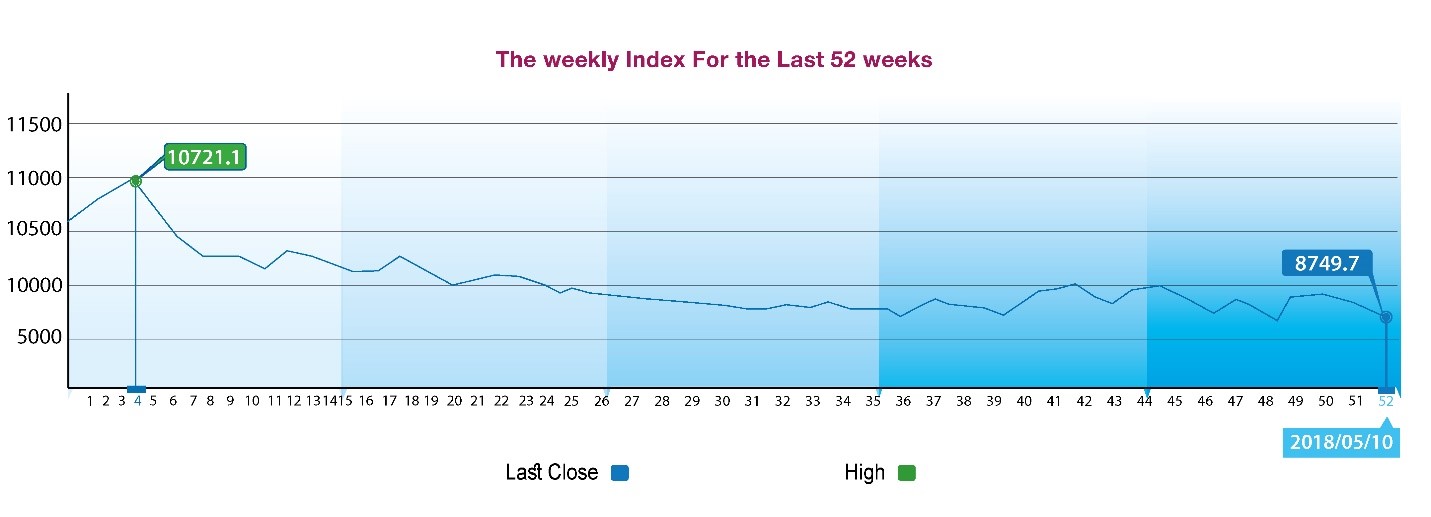

General Index Retreats Due to Geopolitical Tensions

The stock market suffered last week from the

geopolitical pressures of president Trump's decision to withdraw

from the Iran nuclear deal, and the subsequent start of armed

clashes in Syria. While week started in the green with the

general index rising in the first two sessions, it quickly

declined in the next three sessions. The rise in the price of

OPEC oil to over US $72 per barrel did not have enough of a

positive impact on trading. The total volume declined below QR1

billion, averaging QR195 million per day. The general index fell

0.64% to 8749.7 points. Total capitalization shrank by QR6.1

billion to QR484.4 billion, and the profit margin stabilized at

12.53 points.

In depth, the general index decreased by about 56.1 points or

0.64%, to the level of 8749.7 points, and Al Rayan Islamic Index

dropped by 0.65%. Five sectoral indices declined, especially

Insurance, Banking and Real Estate, while two sectoral indices

rose, namely Transportation and Telecommunication. The share

price of 27 companies declined, but the shares of 15 companies

rose, while 3 companies maintained a stable share price. It has

been noticed that the share price of Aamal was the biggest

loser, down by 7.2%; followed by Qatari Investors by 4.7%, Qatar

Insurance by 4.4%, Doha Insurance by 3.6%, Qatar-Oman by 3.27%,

and QNB by 3.2%. In contrast, the share price of Dlala was the

top gainer, up by 20.9%; followed by Islamic Holding by 9.5%,

Ahli Bank by 5.8%, then Zad Holding by 5.7%.

Total trading volume decreased by 21% to QR974.3 million in a

week, and the average daily trading declined to QR194.9 million.

Vodafone led the traded shares with a volume of QR166.7 million,

followed by the share of QNB with QR81.4 million, Industrial

Qatar with QR79.5 million, Ooredoo with QR65.7 million, Mesaieed

with QR62.2 million. It was noticed that Qatari individual

investors made net purchases of QR17.7 million, while non-Qatari

individuals made total net purchases of QR5.8 million. Qatari

portfolios on the other hand made net purchases of QR7 million,

whereas non-Qatari portfolios monopolized sales with a net of

QR30.5 million. As a result, QSE’s total capitalization

decreased by QR6.1 billion to reach QR482.4 billion, and P/E

ratio stayed put at a multiple of 12.53 unchanged compared to

last week.

Corporate News:

1-

Qatar Petroleum announced that it will be offering 49% of its

shares in Qatar Aluminium (Qatalum) for public offering,

following the directives of His Highness Sheikh Tamim bin Hamad

Al Thani, the Emir of the State of Qatar, to offer Qatari

nationals shares in state-sponsored companies that enjoy safe

investment environment and lucrative returns. It is expected

that the necessary procedures and approvals will be taken for

listing on the Qatar Exchange during the last quarter of this

year. Qatar Petroleum will also establish a holding company that

will acquire Qatar Petroleum's stake in Qatalum. Qatalum,

jointly owned by the Norwegian company Hydro, is one of the most

successful joint ventures of Qatar Petroleum, with a total

revenue of QR5.1 billion and a net profit of QR660 million in

2017. The company produces about 645,000 tons per year of high

quality aluminum. Qatalum produces value-added products such as

state-of-the-art foundry alloys that meet the stringent quality

standards of its global customer base. Its products are used in

a variety of industries including automotive and construction.

Qatalum uses the HAL275 system, an environmentally friendly,

energy-efficient technology.

2-

Qatar Gas

Transport Company Ltd. (Nakilat) announced that its

Extraordinary General Assembly meeting has been postponed due to

the lack of quorum.

The next meeting will be held on Sunday, 13 May 2018, at the same

venue. The company’s meeting was postponed for the second times

due incomplete quorum. The meeting necessitates an attendance

that represents over 50% of the company’s source capital.

3-

The Board of

Directors of Mazaya Qatar Real Estate Development has called for

the Extraordinary General Assembly meeting (Third alternative

date) that will be held on Wednesday, 06 June 2018 at 9:30 pm.

Some shareholders have requested the addition of a number of

items to the agenda of the Extraordinary General Assembly.

Economic

Developments:

1-

OPEC oil price

in Qatar rose during the previous week until Wednesday 8th May

by about of US $1.65 to US $72.12 per barrel, compared to the

previous month’s price tag of US $70.47 per barrel.

2-

Dow Jones index

gained about 810 points to rise to the level of 24740 points

until closing on Thursday. US dollar increased to $1.19 against

the euro, and stayed put against the yen at ¥109.29 per dollar.

Gold decreased by about US $5 to the level of $1323 per ounce.

|