|

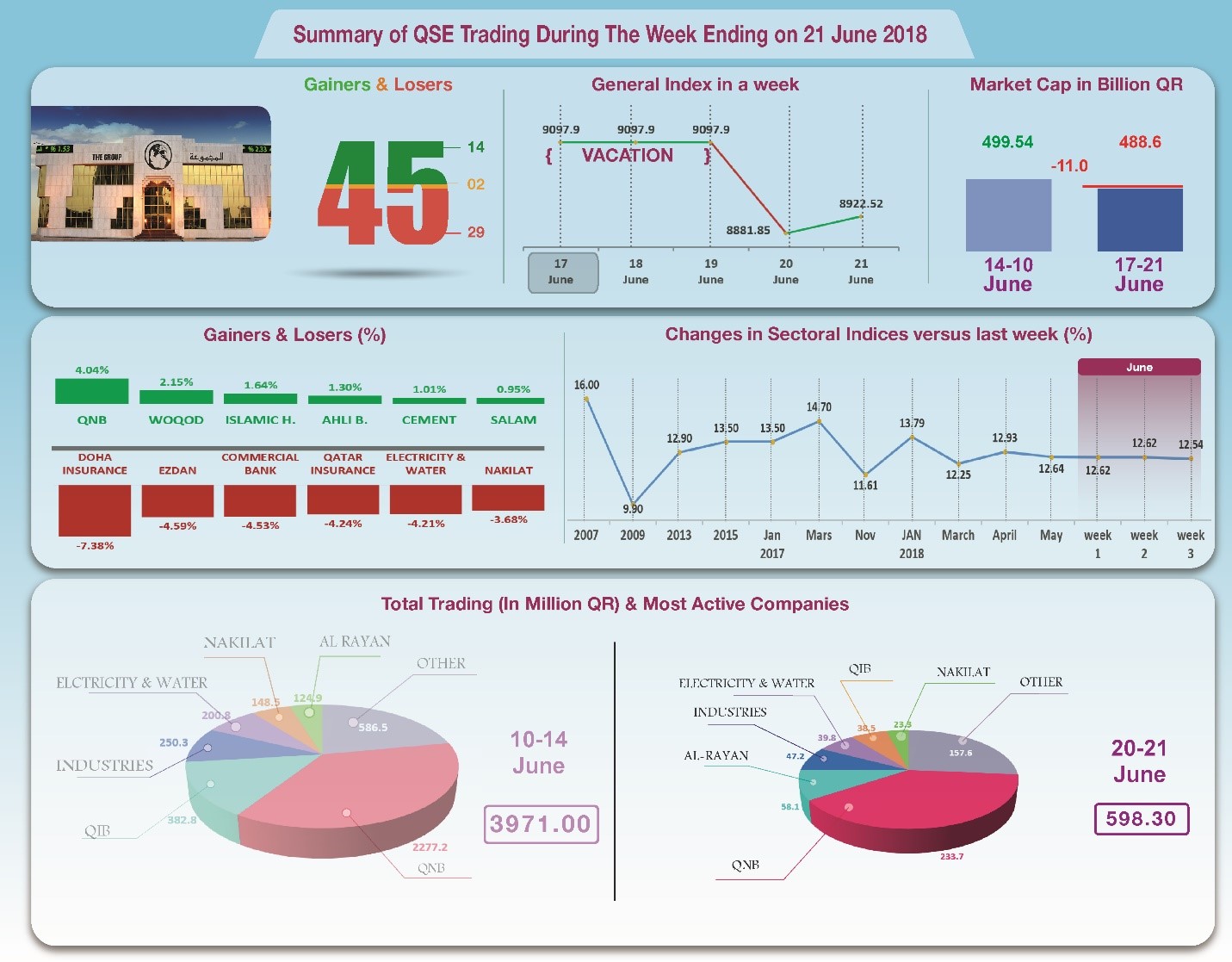

The Group Securities: Weekly Report on

QSE Performance, 20-21 June 2018

The trading volume suffered significantly

in the absence of numerous traders during the Eid al-Fitr

holiday, and was limited to a total of QR598 million in two

days. Prices of shares and indices declined in the first day,

but rebounded slightly on the second day. The share price of 29

dropped, while the price of the shares of 14 companies rose.

Consequently, the general index fell by 175 points, to the level

of 8923 points. The total capitalization decreased by about QR11

billion, to QR489 billion, and the P/E ratio fell to a multiple

of 12.54 from 12.62 recorded in the previous week.

In depth, the general index decreased by about 175 points or 1.93%,

to the level of 8923 points. The All Share index dropped by

2.16%, while Al Rayan Islamic Index fell by 1.20%. Sectoral

indices decreased, especially Insurance, Banking, Real Estate,

and Transportation. It has been noticed that the share price of

Doha Insurance was the biggest loser, down by 7.38%; followed by

Ezdan by 4.59%, Commercial Bank by 4.53%, Qatar Insurance by

4.24%, then Qatar Electricity & Water by 4.21%. In contrast, the

share price of Woqod was the top gainer, up by 2.15%; followed

by Islamic Holding by 1.64%, Ahli Bank by 1.30%, and Qatar

Cement by 1.01%, then Industries Qatar by 0.94%.

Total trading volume dropped by 84.9% to QR598 million in a week,

and the average daily trading rose to QR299 million. QNB led the

traded shares with a volume of QR233.7 million, followed by the

share of Al Rayan with QR58.1 million, Industries Qatar with

QR47.2 million, and Qatar Water & Electricity with QR39.8

million. It was noticed that Qatari portfolios made net sales of

QR2.3 million, while Non-Qatari portfolios made net sales of

QR38.9 million. Qatari individuals made total net purchases of

QR40.7 million, whereas foreign individual investors made net

purchases of QR0.5 million. As a result, QSE’s total

capitalization fell by QR11 billion to reach QR489 million, and

P/E ratio dropped to a multiple of 12.54 compared to 12.62 from

last week.

Corporate News:

1-

Dlala Brokerage &

Investment Holding Co. announced that they obtained the final

approval from QFMA on the Dlala Islamic Brokerage Co. and Dlala

Brokerage Co. merger plan, therefore the last trading day for

Dlala Islamic Brokerage Co. will be on 6/9/2018.

2-

Doha Bank announced its intention to disclose the bank’s financial

reports for the period ending 30/6/2018, on Thursday 19/7/2018.

Economic Developments:

1-

Qatar Central Bank announced that it has raised its deposit rate by

25 basis points to 2%. The move mimics the US Federal Reserve

and comes amid expectations that the US Federal Reserve would

raise its basic interest rate twice more this year.

2-

OPEC oil price dropped during the previous week until 20th

June, by about US $0.87 to US $72.48 per barrel, compared to the

previous week’s price tag of US $73.35 per barrel.

3-

Dow Jones fell by about 628 points to the level of 24462 points

until closing on Thursday. US dollar stood still at $1.16

against the Euro, but dropped against the yen to ¥109.99 per

dollar. Gold dropped by about US $11 to US $1271 per ounce.

|