|

The Group Securities: Weekly Report on

QSE Performance, 24-28 June 2018

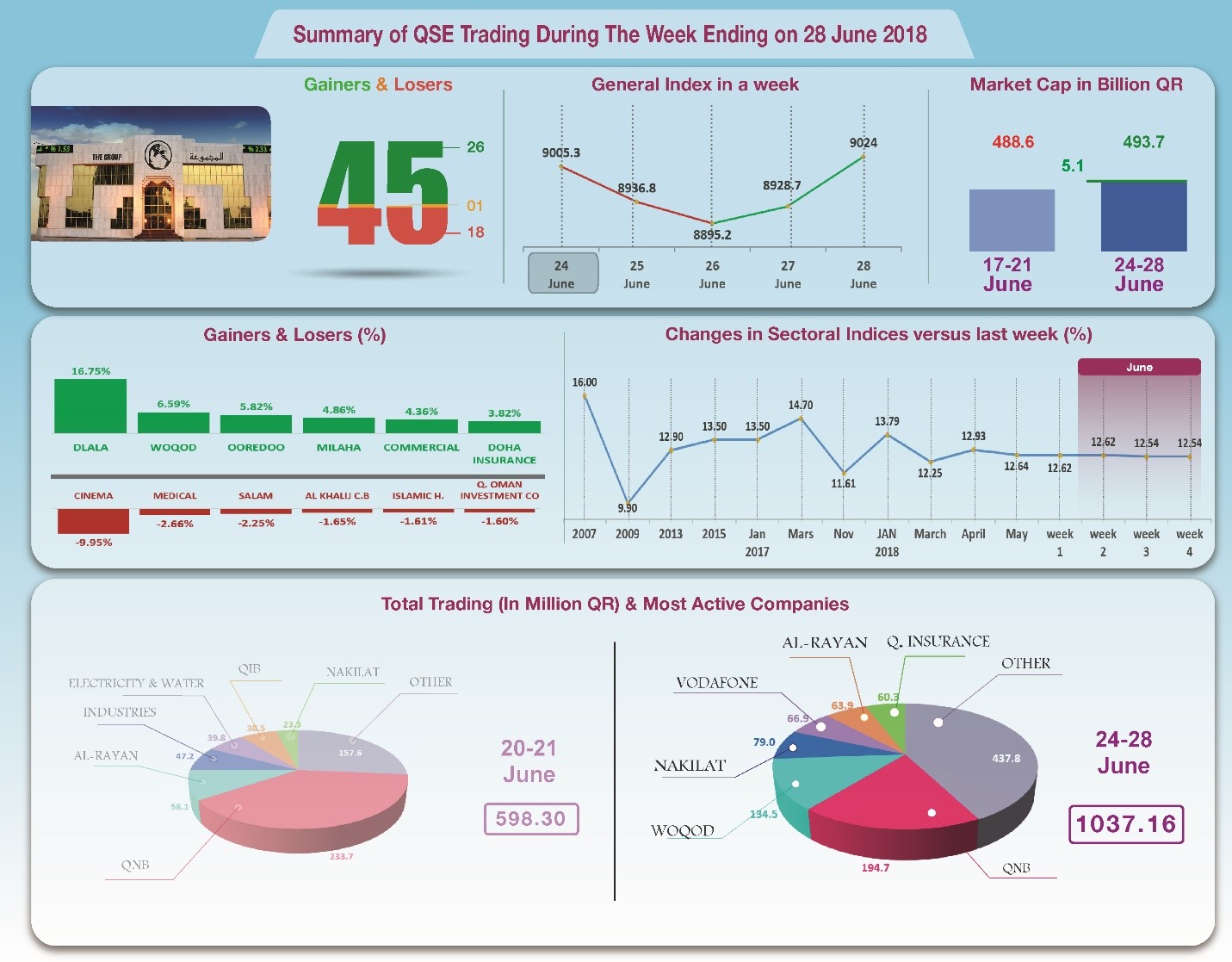

General Index Exceeds the Level of 9000

Points

Qatar Stock Exchange has benefited from

some important developments during the past week, including the

raise of ownership of foreigners in Woqod to 49%, the signing of

Barwa Al Sadd contract to purchase a stake in the Millennium

Hotel, and Qatar National Cement’s

provisional

acceptance of all the parts of the mill No.

5. The market also benefited from the increase in oil prices on

Wednesday and Thursday. The trading volume increased to QR1037

million, recording a daily average of QR207.4 million. These

developments resulted in the rise of shares prices of 26

companies and the decrease of the shares prices of 18 companies.

The general index climbed beyond the level of 9000 points, to

9024 points. Total capitalization increased by QR5.1 billion, to

QR493.7 billion, and the P/E ratio stood at a multiple of 12.54.

In depth, the general index increased by about 101.5 points or

1.14%, to the level of 9024 points. The All Share index rose by

1.05%, while Al Rayan Islamic Index increased by 0.81%. Six

sectoral indices increased, especially Goods, Telecommunication

and Transportation. It has been noticed that the share price of

Dlala was the top gainer, up by 16.8%; followed by Woqod by

6.59%, Ooredoo by 5.82%, Milaha by 4.86%, then Commercial Bank

by 4.36%. In contrast, the share price of Qatar Cinema was the

biggest loser, down by 2.25%; followed by Khaliji Bank by 1.65%,

Islamic Holding by 1.61%, and Qatar-Oman by 1.6%.

Total trading volume rose to QR1037.2 million in a week, and the

average daily trading rose to QR207.4 million. QNB led the

traded shares with a volume of QR194.7 million, followed by the

share of Woqod with QR134.5 million, Nakilat with QR79 million,

and Vodafone with QR66.9 million, then Al Rayan with QR63.9

million. It was noticed that Qatari portfolios made net sales of

QR17.5 million, while Non-Qatari portfolios made net purchases

of QR10.8 million. Qatari individuals made total net purchases

of QR10.8 million, whereas foreign individual investors made net

sales of QR7.5 million. As a result, QSE’s total capitalization

climbed by QR5.1 billion to reach QR493.7 million, and P/E ratio

dropped to a multiple of 12.54 compared to 12.62 from last week.

Corporate News:

1-

Barwa Real Estate Co. announced that Barwa Al Sadd, its wholly

owned subsidiary, has signed a contract to purchase 25% stake in

the Millennium Plaza Hotel and the Health Club located in Barwa

Al Sadd from Katara Hospitality at a price of QR167.2 million.

The acquisition aims to strengthen Barwa's real estate portfolio

and contribute to its sustainable growth and equity development.

2-

Qatar Central Securities

Depository (QCSD) announced that it had amended the foreign

ownership percentage in the shares of Qatar Fuel Company to

become 49% of the company's capital, effective Wednesday, 27

June 2018.

3-

Qatar National Cement Company announced the provisional acceptance

of the kiln and remaining parts of Plant No.5 (crusher and mill

of raw materials, and the homogenizing part).The designed

capacity of the kiln is 5000 ton per day. Accordingly the

initial handover of the plant is concluded in full.

4-

Qatar Islamic Bank (QIB)

announced that it will disclose the bank’s financial statements

for the period ending 30/06/2018, on Sunday 15/7/2018.

Economic Developments:

1-

In May 2018,

Qatar’s foreign merchandise trade balance showed a surplus of

about QR14.9 billion, i.e. an increase of about QR4.2 billion or

39.5% compared to May 2017, and an increase of QR0.1 billion or

0.5% compared to the previous month of April.

2-

Oil prices increased more than 2% on Tuesday, as Washington urged

its allies to halt imports of Iranian oil, which would curb

global supplies. Prices continued to climb in the transactions

following price settlement after the American Petroleum

Institute announced that crude oil inventories in the United

States recorded a sudden drop of 9.2 million barrels, far

exceeding expectations of a decline of 2.6 million barrels.

Brent kept rising in transactions following price settlement to

US $76.61 per barrel, while US crude rose to US $70.76 per

barrel. OPEC oil price rose by about US $1.83 to US $74.31 per

barrel until 27th June, compared to US $72.48 a week

earlier.

3-

Dow Jones fell by about 246 points to the level of 24216 points

until closing on Thursday. US dollar stood still at $1.16

against the Euro, but rose against the yen to ¥110.61 per

dollar. Gold dropped by about US $19 to US $1252 per ounce.

|