|

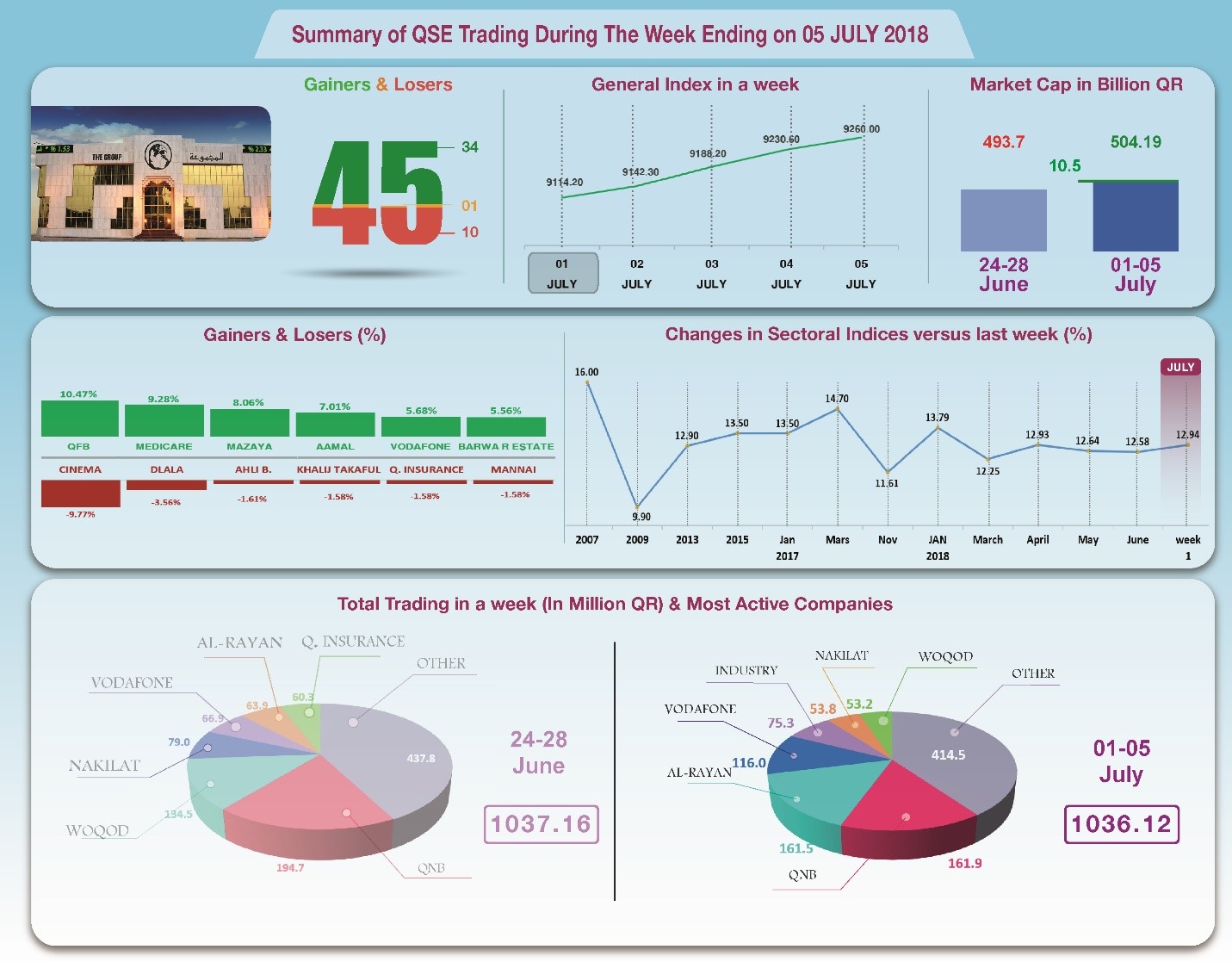

The Group Securities: Weekly Report on

QSE Performance, 1-5 June 2018

General Index Keeps Climbing Towards

9500 Points

Qatar stock exchange benefited from last

week’s strong rebound of oil prices. Despite unchanged trading

volumes that stayed put at QR1036 million, the shares prices of

34 companies rose, and the shares prices of 10 companies

declined. As a result, the general index climbed by 2.61% to the

level of 9260 points. Total capital increased by QR10.5 billion,

to QR504.2 billion, and the P/E ratio increased to a multiple of

12.94.

In depth, the general index increased by about 235.9 points or

2.61%, to the level of 9260 points. The All Share index rose by

2.12%, while Al Rayan Islamic Index increased by 3.68%. Six

sectoral indices increased, especially Industry,

Telecommunication and Real Estate. It has been noticed that the

share price of QNB was the top gainer, up by 10.47%; followed by

MediCare by 9.28%, Mazaya by 8.06%, Aamal by 7.01%, then

Vodafone Qatar by 5.68%. In contrast, the share price of Qatar

Cinema continued its sharp decline and was the biggest loser,

down by 9.77%; followed by Dlala by 3.56%, Ahli bank by 1.61%,

and the trio of Alkhaleej Takaful, Qatar Insurance and Mannai by

1.58% each.

Total trading volume stood at QR1036.1 million in a week, with an

average daily trading of QR207.2 million. QNB led the traded

shares with a volume of QR161.9 million, followed by the share

of Al Rayan with QR161.5 million, Vodafone with QR116 million,

and Industries Qatar with QR75.3 million, then Nakilat with

QR53.8 million, and Woqod with QR53.2. It was noticed that

Qatari portfolios made net sales of QR10.3 million, while

Non-Qatari portfolios dominated net purchases with QR126.9

million. Qatari individuals made total net sales of QR103.9

million, whereas foreign individual investors made net sales of

QR12.7 million. As a result, QSE’s total capitalization climbed

by QR10.5 billion to reach QR504.2 million, and P/E ratio rose

to a multiple of 12.94 compared to 12.54 from last week.

Corporate News:

1-

Barwa Real Estate Group announced that it has been awarded

construction of the Al Khor Sports Facilities Expansion Project

with a value of QR105 million. The project will be completed in

18 months.

2-

Widam and Ezdan Holding

set 17/7/2018 to disclose their 2018 semi-annual financial

statements. UDC and QWEC chose 18/7/2018 as the official date

for the disclosure, while Ahli Bank, Alkhaleej Bank, Islamic

Holding, QIIB and GWC scheduled their semi-annual disclosure on

19/7/2018. Qatar Cement will release the statements on

23/7/2018, Alijarah and QIMC on 26/7/2018, Ooredoo on 29/7/2018,

Islamic Insurance on 30/7/2018, then Doha Insurance on

31/7/2018.

3-

Investment

Holding Group has announced that, Ahli Bank Qatar has filed a

legal case amount of QR178.5 million against Investment Holding

Group and a group of defendants, all being guarantors of bank

facilities for Doha Convention Center project, where Investment

Holding Group’s share is 25.5 %. However, while the cases are

running in court, Parties are still attempting to solve the

dispute amicably, in order to settle the account in full with

the Main Contractor.

Economic Developments:

1-

In May 2018,

Qatar’s foreign merchandise trade balance showed a surplus of

about QR14.9 billion, i.e. an increase of about QR4.2 billion or

39.5% compared to May 2017, and an increase of QR0.1 billion or

0.5% compared to the previous month of April.

2-

Oil prices increased more than 2% on Tuesday, as Washington urged

its allies to halt imports of Iranian oil, and following the

drop of United States’ crude oil reserves by 9.2 million

barrels. OPEC oil rose to US $75.38 per barrel until 4th

of June, compared to US $74.31 per barrel a week prior. Qatar

set the price for its onshore oil for the month of June at US

$76.15 per barrel.

3-

Dow Jones fell by about 246 points to the level of 24216 points

until closing on Thursday. US dollar stood still at $1.17

against the Euro, and against the yen at ¥110.58 per dollar.

Gold rose by about US $4 to US $1256 per ounce.

|