|

The Group Securities: Weekly Report on

QSE Performance, 8-12 June 2018

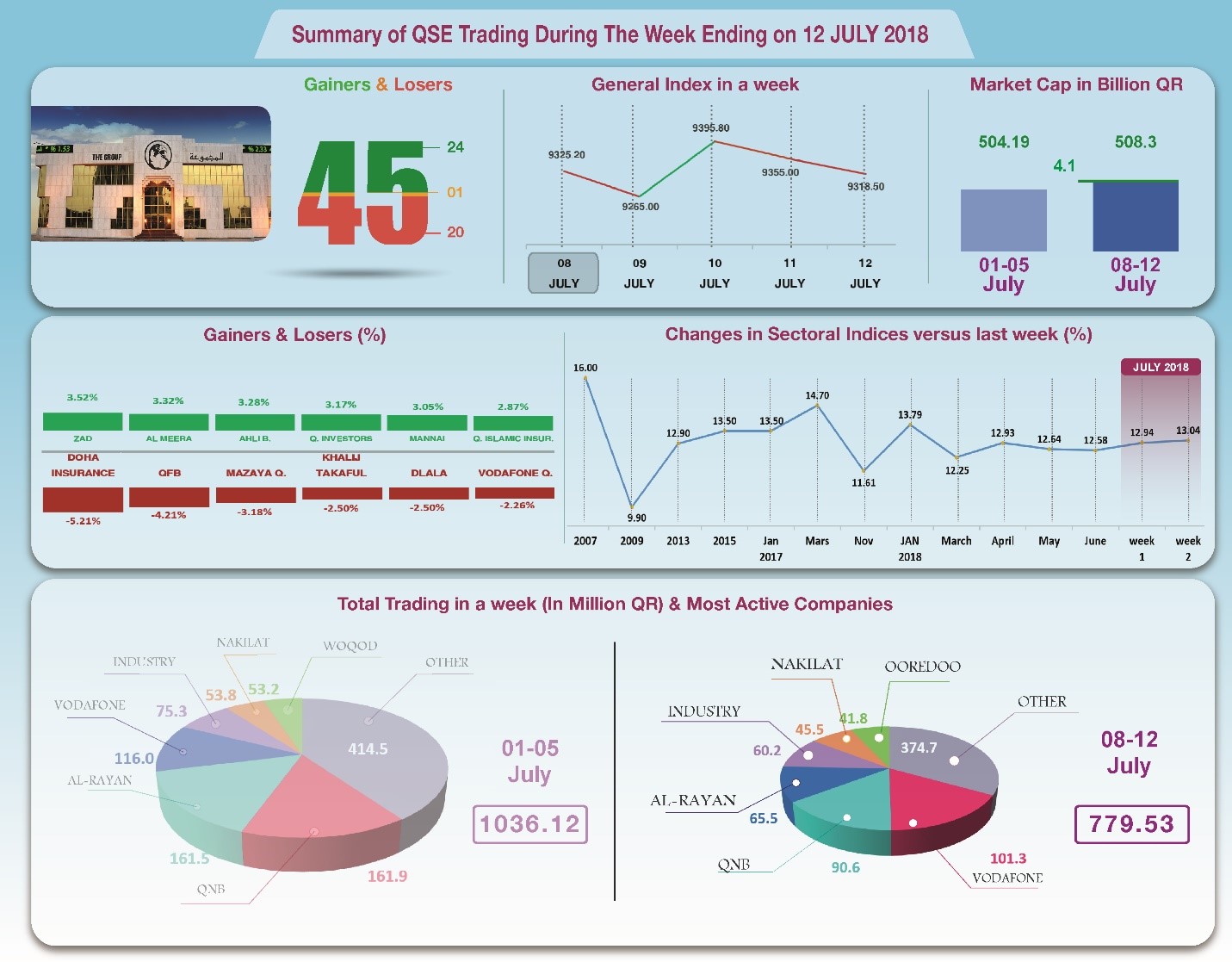

General Index Crawls Slowly Towards 9500

Points

The developments that unfolded during the

week did not allow for an upward momentum to drive the general

index towards the 9500 points mark. On one hand, QNB's earnings

met the usual expectations, with a slight decline in the

comprehensive income, and on another, global oil prices

declined. As a result, the total trading volume decreased by a

quarter to QR779.5 million. While the share prices of 24

companies rose, the share prices of 20 companies declined in

turn, resulting in the rise of the general index by a mere 59

points to the level of 9319 points. Total capitalization

increased by QR4.1 billion, to QR508.3 billion, and the P/E

ratio rose to a multiple of 13.04.

In depth, the general index increased by about 59 points or 0.63%,

to the level of 9319 points. The All Share index rose by 0.57%,

while Al Rayan Islamic Index increased by 0.25%. Sectoral

indices increased, especially Banking, Services and Industry. It

has been noticed that the share price of ZAD was the top gainer,

up by 3.52%; followed by Al Meera by 3.32%, Ahli Bank by 3.28%,

Qatar Investors by 3.17%, then Mannai by 3.05%. In contrast, the

share price of Doha Insurance was the biggest loser, down by

5.21%; followed by Qatar First Bank by 4.21%, Mazaya by 3.18%,

and Alkhaleej Takaful by 2.50%, then Dlala by 2.50% each.

Total trading volume dropped by 24.8% to the level of QR779.5

million in a week, with an average daily trading of QR155.9

million. Vodafone led the traded shares with a volume of QR101.3

million, followed by the share of QNB with QR90.6 million, Al

Rayan with QR65.5 million, and Industries Qatar with QR60.2

million. It was noticed that Qatari portfolios made net

purchases of QR10.4 million, while Non-Qatari portfolios made

net purchases with QR48.6 million. Qatari individuals made total

net sales of QR53.9 million, whereas foreign individual

investors made net sales of QR5 million. As a result, QSE’s

total capitalization climbed by QR4.1 billion to reach QR508.3

million, and P/E ratio rose to a multiple of 13.04 compared to

12.94 from last week.

Corporate News:

1-

QNB Group net profit in the first half of 2018 amounted to QR7.1

billion, compared to QR6.6 billion for the same period in 2017,

while the group’s earnings per share amounted to QR7.4, compared

to QR7 recorded in the same period of the previous year.

QNB Group’s operating income for

the first half of 2018 increased by 7.1% to QR11.9 billion and

all expenses increased by 12.8% to QR4.43 billion, resulting in

a net profit attributable to shareholders increase of 6.7% to

QR7.1 billion. On another hand, comprehensive income items

including currency differences and hedge reserves recorded a

book loss of QR1.87 billion compared to QR512.7 million in the

corresponding period of 2017. As a result, QNB's comprehensive

income recorded QR5.28 billion in the first half of 2018, a drop

of 12.5% from QR6.03 billion made in the same period of the

previous year.

2-

Nakilat net profit amounted to QR444.1 million in the first half

of 2018, compared to QR408.3 million for the same period in

2017, while the company’s earnings per share recorded QR0.80

versus QR0.74 made in the same period of the previous year.

Nakilat’s operating income increased by 1.49%

in the first half of the year to QR1807 million, while expenses

decreased by 0.7% to QR1362 million, resulting in a profit

increase of 8.6% to QR444.1 million. There have been positive

changes in the fair value of cash hedges in the company and in

joint ventures totaling QR470.5 million, and the total income of

the company has doubled to QR924.3 million.

3-

Qatar Investors said it will disclose its 2018 semi-annual

financial statements on July 23, while Qatar Insurance, Barwa,

and Vodafone chose July 24. Qatar-Oman scheduled the disclosure

on July 25, as for Aamal and Qatar First Bank they decided to on

July 30. Other companies such as Salam and General Insurance

chose July 31 to release their statements.

4-

Ezdan Holding Group announced its intention to hold its

Extraordinary General Assembly Meeting on 23/07/2018 to consider

the amendment of a paragraph relating to the shares of the Board

of Directors to decrease it from of 10 thousand to five thousand

shares.

5-

Milaha announced the arrival of its self-lift vessel off the coast

of West Africa to start working with one of the world's largest

oil companies as part of a long-term contract.

6-

Mazaya

announces that it will not proceed with the takeover deal of the

Tornado Tower.

Economic Developments:

1-

OPEC oil fell by about US $0.98 to the level of US $74.40 per

barrel until 11th of July, compared to US $75.38 per

barrel a week prior.

2-

Dow Jones rose by about 751 points to the level of 24216 points

until closing on Thursday. US dollar rose to $1.16 against the

Euro, and against the yen at ¥112.69 per dollar. Gold rose by

about US $4 to US $1256 per ounce.

|