|

The Group Securities: Weekly Report on

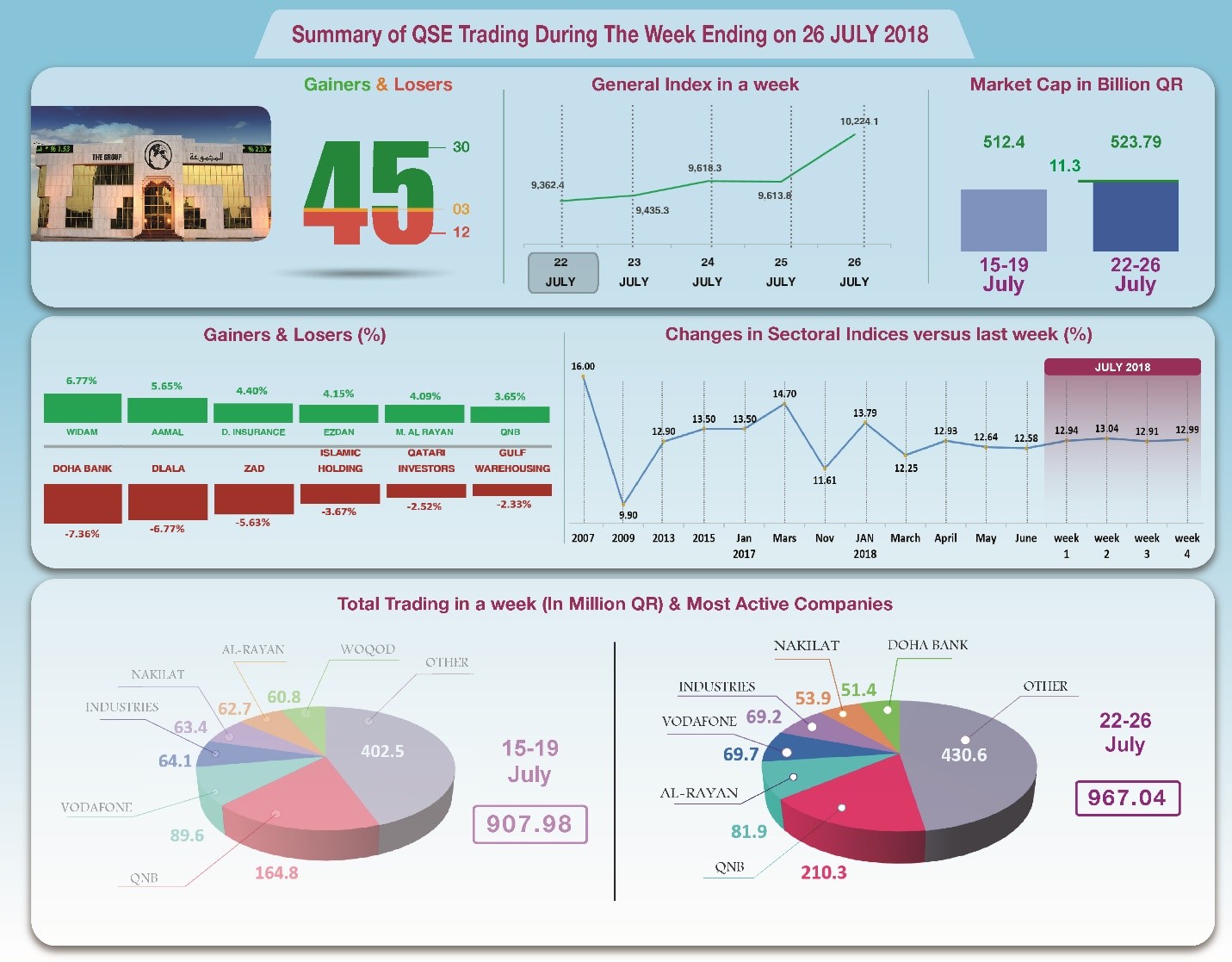

QSE Performance, 22-26 July 2018 “General Index Breaks the Resistance Barrier at 9500 Points”

Of the 9 companies whose results were

released last week, 6 had their net profit decline, Qatar Cement

profits stabilized, and Vodafone and Alijarah became profitable.

In terms of comprehensive income - which includes changes in the

fair value of investments – Dlala made had a comprehensive loss,

while the comprehensive income of Barwa, Qatar Insurance,

Alijarah and QIMC decreased. However, the performance of the

stock market improved following a limited increase in the

trading volume, and a strong rise in indices, especially as the

general index broke the 9500 points barrier. The share price of

30 companies increased, while the share price of 12 others

declined. The general index rose by 187 points to 9608 points,

while the total capitalization increased by QR11.3 billion to

QR523.8 billion, and the P/E ratio climbed to a multiple of

12.99.

In depth, the general index increased by about 187 points or 1.99%,

to the level of 9608 points, while Al Rayan Islamic Index

increased by 1.73%. Six sectoral indices increased, especially

Real Estate, Transportation and Telecommunication. It has been

noticed that the share price of Widam was the top gainer, up by

6.77%; followed by Aamal 5.65%, Doha Insurance by 4.40%, Ezdan

4.15%, then Al Rayan 4.09%. In contrast, the share price of Doha

Bank was the biggest loser, down by 7.36%; followed by Dlala by

6.77%, Zad by 5.63%, and Islamic Holding by 3.67%, then Qatari

Investors by 2.52%.

Total trading volume climbed by 6.5% to the level of QR967 million

in a week, so the average daily trading volume increased to

QR193.4 million. QNB led the traded shares with a volume of

QR210.3 million, followed by the share of Al Rayan with QR81.9

million, Vodafone Qatar with QR69.7 million, and Qatar

Industries with QR69.2 million. It was noticed that Qatari

portfolios made net purchases of QR19.7 million, while

Non-Qatari portfolios made net purchases of QR176.8 million.

Qatari individuals made total net sales of QR178.4 million,

whereas foreign individual investors made net sales of QR18

million. As a result, QSE’s total capitalization climbed by

QR11.3 billion to reach QR523.8 million, and the P/E ratio rose

to a multiple of 12.99 compared to 12.91 from last week.

Corporate News:

1-

Qatar National

Cement’s net profit amounted to QR168.5 million, compared to

QR168.1 million in the same period last year, while the

company’s earnings per share recorded QR2.58, versus QR2.57 in

the corresponding period of 2017. Qatar National Cement's

revenues decreased by 22% to QR434.6 million, in the first half

of 2018. The total profit from the company’s activities

decreased by 8% to QR156.8 million. Other revenues rose by QR4

million to QR27 million. General and administrative expenses

decreased by 29.8% to QR16.5 million. As a result, the net

profit stabilized slightly by QR168.5 million. Since the decline

in fair value was limited this year compared to a decline in the

corresponding period of the previous year, the total income

amounted to QR162.4 million compared to QR134.1 million in the

corresponding period of 2017.

2-

Qatari Investors Group’s net profit amounted to QR135.67 million in

the first half of 2018, a 10.8% drop compared to QR152.21

million for the same period last year, while the group’s

earnings per share reached QR1.09, versus QR1.22 for the

corresponding period of 2017. Although Qatari Investors’ sales

revenue declined in the first half of 2018, the much lower cost

of sales led to an increase in revenues of 6% to QR216.2

million, in addition to a limited increase in other types of

income to QR18.3 million. On the other hand, sales and

administrative expenses increased by 17.7% to QR50.5 million,

while the cost of financing climbed by 52.6% to QR40.3 million.

As a result, the net profit attributable to shareholders

declined by 10.8% to QR135.7 million. There have been limited

positive changes in the fair value, which led to the increase in

the comprehensive income to QR136.7 million.

3-

Dlala Brokerage & Investment Holding net profit amounted to QR1.34

million, compared to QR12.841 million for the same period of the

previous year, while its earnings per share reached QR0.05,

versus QR0.45 for the same period in 2017. Dlala's net income

decreased by 36.8% to QR17.7 million in the first half of 2018,

of which QR13 million in net commissions and brokerage income.

The company’s total expenses increased by 7% to QR16.4 million,

which led the net profit to decline by 87.8% to QR1.34 million.

In addition to that the net loss in the fair value amounted to

QR2.39 million, turning the profit into a comprehensive loss of

QR1.05 million.

4-

Qatar-Oman Investment Company net profit amounted to QR5.44

million, compared to QR10.55 million in the same period last

year, while its earnings per share amounted to QR0.17 in first

half of 2018, versus QR0.33 in 2017. Total revenues of

Qatar-Oman declined by 38.5% to QR8.27 million in the first half of 2018, and total expenses decreased by 3% to

QR2.87 million. Net profit fell 48.4% to QR5.44 million, and the

company recorded a fair value gain of QR26.1 million, which led

to an increase in the comprehensive income to QR31.5 million,

versus the comprehensive loss of QR2.6 million recorded in the

corresponding period of 2017.

5-

Qatar Insurance’s net profit amounted to QR384 million in first

half of 2018, compared to QR505 million for the same period last

year, while its earnings per share recorded QR1.08, versus

QR1.58 from the same period in 2017. The company’s total

revenues decreased by 9.8% to QR774.3 million in the first half

of 2018, of which QR408.2 million in net investments and QR330

million in net insurance, and total expenses increased by 10% to

QR382.5 million. As a result, the net profit decreased by 24% to

QR384.5 million. There was a decline in the fair value of

investments amounting to QR285.8 million, which led to the

decline of the comprehensive income to QR110.1 million.

6-

Vodafone Qatar’s net profit amounted to QR48.7 million, compared

to a net loss of QR131.3 million recorded in the same period

last year. Vodafone’s earnings per share amounted to QR0.06 in

the first half of 2018, versus the loss per share of QR0.16 in

the corresponding period of 2017. Vodafone’s total revenues in

the first half of 2018 increased by 1.7% to QR1051.2 million.

Total operating and administrative expenses increased by half a

percent to QR767.6 million. Depreciation and amortization

expenses - after capital reduction - decreased by 44.5% to

QR214.8 million. As a result, the net profit was QR 48.7 million

compared to a loss of QR131.3 million.

7-

Barwa Real Estate Group’s

net profit amounted to QR804 million, compared to QR 912 million

in the same period last year. The group’s earnings per share

recorded QR2.07 in the first half 2018, versus QR2.34 for the

corresponding period of 2017. Barwa's total rental income from

leasing and finance leases decreased by 1.7% to QR530 million in

the first half. Net fair value dropped as well as gains from the

company’s share in sister companies’ fell 41% to QR310.5

million. On the other hand, total expenditures increased by

QR81.6 million. As a result, the net profit for the period ended

30/06/2018 decreased by 10.9% to QR808.8 million. There was a

fair value loss of $46.8 million, all led the comprehensive

income total income of $756.6 million compared to $ 896.7

million.

8-

Alijarah Holding Company’s net profit amounted to QR3.94 million

in first half of 2018, contrary to the net loss of QR8.96

million recorded in the same period last year, while the

holding’s earnings per share amounted to QR0.08, versus a loss

per share of QR0.18 for the corresponding period of 2017.

Alijarah revenues increased by 30.9% to QR86.8 million in the

first half of 2018, of which QR30.3 million generated from

investment profits in securities, while its total expenses

increased by 3.7% to QR91.8 million. As a result the net loss of

QR8.96 million turned into a net profit of QR3.95 million. The

comprehensive income did not see any changes.

9-

Qatar Industrial Manufacturing Company (QIMC) net profit

amounted to QR108.28 million in first half of 2018, compared to

QR113.42 million for the same period last year, while its

earnings per share amounted to QR2.28 in this period, versus

QR2.39 for the corresponding period of 2017. QIMC’s total sales

revenues fell 4.2% to QR48.7 million, but other revenues

increased by 74.5% to QR21.3 million. Expenses decreased by 3.1%

to QR37.9 million, as well as the results of associates and

investment income by 28.4% to QR67.1 million. As a result, the

net profit dropped by 4.5% to QR108.3 million, with a slight

decline in the fair value of QR5.7 million, versus a drop of

QR26.2 million in the corresponding period of 2017. The

comprehensive income amounted to QR104.9 million, compared to

QR90.7 million in the first half of 2017.

Economic Developments:

1-

OPEC oil price increased by about US $2.89 to the level of US

$72.87 per barrel until Wednesday 25th of July,

compared to US $69.98 per barrel a week prior.

2-

Dow Jones rose again by about 506 points to the level of 25527

points until closing on Thursday. US dollar stood at $1.16

against the Euro, but declined against the yen to ¥111 per

dollar. Gold stood still at US $1222.8 per ounce.

|