|

The Group Securities: Weekly Report on

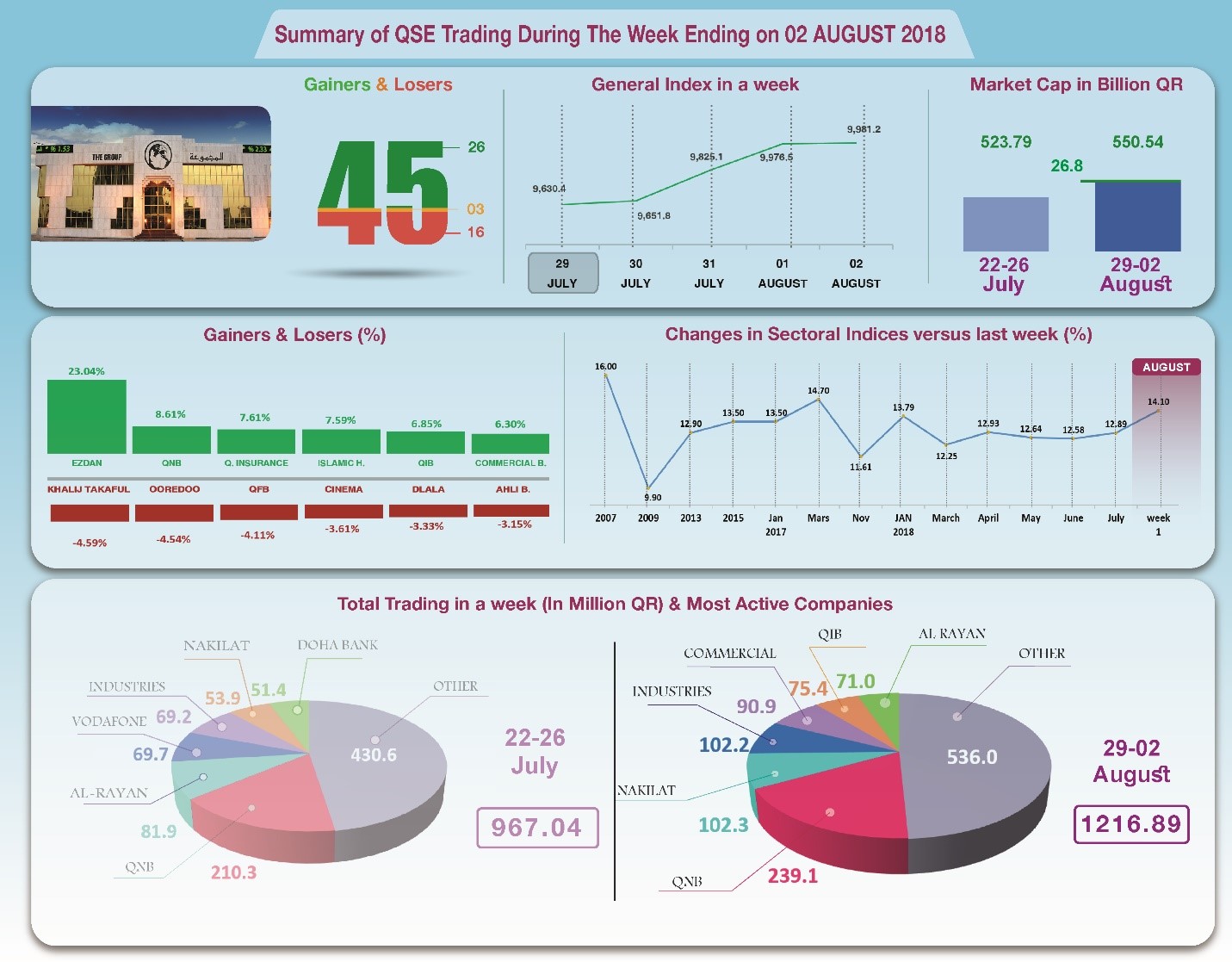

QSE Performance, 29 July - 2 August 2018 “General Index Keeps Climbing and Approaches 10,000 Points”

Although last week’s results of listed

companies were not strong – with the exception of a limited

number of companies – and the total of the disclosed results of

35 companies declined by 1.16% compared to the corresponding

period of last year, and although oil prices were significantly

lower in the beginning of August, the performance of the stock

market was surprising by all accounts. On the one hand, the

overall trading rose by 25.8% to QR1.22 billion. On the other

hand, the general index climbed by 373 points, exceeding its

previous level before the start of the blockade, and reached the

level of 9981 points. The total capitalization also gained about

QR25.8 billion in a week, reaching QR550.5 billion. However, the

share price of only 26 companies rose, while the share price of

16 companies declined, and the share price of 3 companies

remained unchanged.

In depth, the general index increased by about 373 points or 3.89%,

to the level of 9981 points, while Al Rayan Islamic Index

increased by 2.14%. Sectoral indices rose, especially Real

Estate, Banking, and Insurance. It has been noticed that the

share price of Ezdan was the top gainer, up by 23%; followed by

QNB 8.6%, Qatar Insurance by 7.6%, Islamic Holding by 7.59%,

then QIB by 6.85%. In contrast, the share price of Khaleej

Takaful was the biggest loser, down by 4.59%; followed by

Ooredoo by 4.54%, Qatar First Bank by 4.1%, and Qatar Cinema by

3.6%, then Dlala by 3.3%.

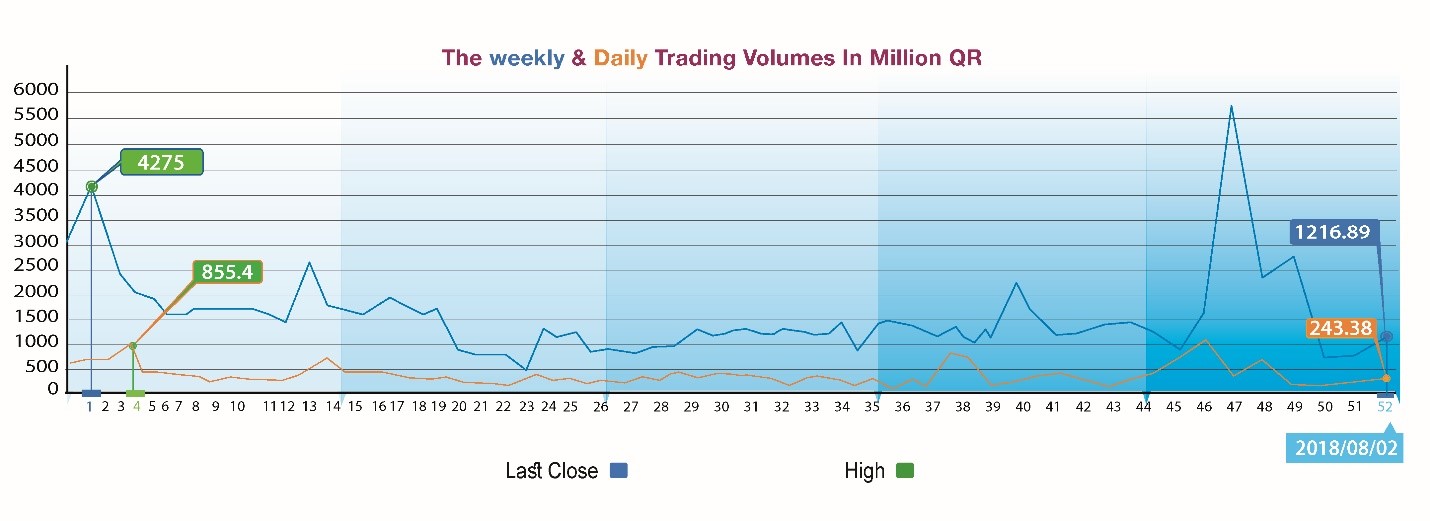

The total trading volume climbed by 25.8% to the level of QR1.217

billion in a week, so the average daily trading volume increased

to QR243.4 million. QNB led the traded shares with a volume of

QR239.1 million, followed by the share of Nakilat with QR102.3

million, Industries Qatar with QR102.2 million, and Commercial

Bank with QR90.9 million. It was noticed that Qatari portfolios

made net sales of QR88.3 million, while Non-Qatari portfolios

dominated the net purchases with QR203.1 million. Qatari

individuals made total net sales of QR88.2 million, whereas

foreign individual investors made net sales of QR26.5 million.

As a result, QSE’s total capitalization climbed by QR26.8

billion to reach QR550.5 million, and the P/E ratio rose to a

multiple of 14.10 compared to 12.99 from last week.

Corporate News:

1-

Aamal’s net

profit amounted to QR228.9 million, compared to QR240.4 million

for the same period last year, while the company’s earnings per

share reached QR0.36 in the first half of 2018, versus QR0.38

for the corresponding period of 2017. Aamal’s total profit from

activity declined by 20.6% to QR243.2 million in the first half

of 2018, but the company generated other income of QR4.4

million. Expenses, on the other hand, rose by 10.5% to QR70.4

million. As a result, operating profit decreased by 30% to

QR177.2 million. The share of other companies' results has

doubled to QR53.9 million, and the cost of financing shrunk to

less than QR1 million, resulting in a net profit decline of 4.8%

to QR228.9 million.

2-

Ooredoo’s net profit amounted to QR689 million in the first half of

2018, compared to QR1,097 million for the same period last year,

while its earnings per share reached QR2.15, versus QR3.42 for

the same period in 2017. Ooredoo’s total operating income

decreased by 6% to QR15.29 billion, while its total expenses

declined by 1.1% to QR14.22 billion. After adding other

revenues, the company’s share in the results of joint ventures

totaling QR352.8 million, compared to QR88.7 million in the

corresponding period of 2017, and deducting privileges and fees

of QR281.7 million, as well as income tax of QR262 million, the

result is a profit attributable to shareholders of QR688.9

million, a drop of 37.2% compared to the corresponding period of

2017. After subtracting currency losses and taking into account

the decline in fair value totaling QR674.4 million – both

generated profits of QR184.2 million in the previous year – the

total comprehensive income shrank to QR140.9 million, compared

to QR1,267.6 million.

3-

Qatar Islamic Insurance’s net profit amounted to QR41.11 million in

first half of 2018, compared to QR36.06 million for the same

period last year, while its earnings per share reached QR2.74,

versus QR2.40. Qatar Islamic Insurance’s total revenues climbed

by 12.4% to QR60.8 million in the first half of 2018, of which

QR50.5 million were generated from insurance brokerage fees, and

QR4.30 million from rents. Expenditures remained relatively

stable at QR16.7 million with a slight increased. As a result

the net income rose by 13.9% to QR41.1 million.

4-

Al Khaleej Takaful’s net profit amounted to QR7.75 million in the

first half of 2018, compared to QR16.45 million in the same

period of the previous year, while its earnings per share

reached QR0.30, versus QR0.64. Al Khaleej Takaful’s total income

from insurance and investments decreased by 31.1% to QR25.3

million in the first half of 2018, while its total expenses

diminished by 13.1% to QR17.6 million. As a result, the

company’s net income declined by 42.8% to QR7.76 million.

5-

Qatar Fuel’s

(Woqod) net profit amounted to QR503 million, compared to QR373

million for the same period last year, while its earnings per

share reached QR5.06 in the first half of 2018, versus QR3.75

for the corresponding period of 2017.Woqod’s total profit from

activity in the first half of 2018 increased by 7.8% QR566.9

million, while other revenues climbed by 45.9% to QR192.4

million. In contrast, expenditures increased by 2% to QR192.4

million. Net profit increased by 34.9% to QR503.2 million, and

there was a limited decline in the comprehensive income QR495.3

million.

6-

Qatar Navigation (Milaha) showed a net profit of QR297 million in

first half of 2018, compared to QR267 million in the same period

of the previous year, while its earnings per share amounted to

QR2.62, versus QR2.35. Milaha’s operating income increased by

9.4% to QR1.25 billion in the first half. Of 2018, as well as

its share in the profits of its associates by 8.5% to QR139.7

million, while its share of joint arrangements multiplied to

QR82.1 million. On another hand, the company’s expenses of all

kinds increased by 2.1% to QR995.7 million, and the net

financing cost doubled to QR48.8 million, while the impairment

loss of ships and businesses doubled to QR140.2 million. As a

result, the net profit increased by 11.1% to QR297.1 million. In

terms of comprehensive income, the company achieved profits of

QR407.8 million during this period, compared to a loss of

QR476.4 million in the corresponding period of 2017. Milaha

achieved a comprehensive income of QR704.8 million, versus a

comprehensive loss of QR208.6 million in the same period last

year.

7-

Qatar First Bank showed a net loss of QR353.87 million in the first

half of 2018, compared to a net loss of QR76.67 million in the

same period last year, while its loss per share amounted to

QR1.77, versus a loss per share of QR0.38 in the corresponding

period of 2017. Qatar First Bank's (QFB) total non-banking

income decreased by 4.4% to QR173.9 million in the first half of

2018. The bank made a total of QR73.6 million in other revenues,

compared to QR42 million in the corresponding period of last

year. However, QFB recorded a loss in the fair value of

investments amounting to QR290.4 million, versus a loss of

QR19.2 million in the corresponding period of 2017. As a result,

the total loss amounted to QR38.3 million against a total profit

of QR229.4 million recorded last year. After deducting the share

of unrestricted investment owners of QR30.9 million, the total

loss rose to QR69.1 million, versus a profit of QR184.4 million

in the corresponding period of 2017, and after subtracting the

total expenses of QR267.6 million, the result is a net loss that

has multiplied to QR366.2 million.

8-

Qatar General Insurance Co. net profit amounted to QR54.03 million

in the first half of 2018, compared to QR39.69 million for the

same period last year, while its earnings per share reached

QR0.62, versus QR0.45. General Insurance’s total revenue from

insurance underwriting increased by 22.7% to QR47 million in

this period, while investments and other income rose by 1.1% to

QR133.4 million. On the other hand, the company’s total expenses

decreased by 4.1% to QR131.5 million. As a result, the net

profit increased by 36.1% to QR54 million, and due to a net

profit in the fair value of the assets, the comprehensive income

increased to QR66.1 million, compared to a comprehensive loss of

QR50.9 million recorded in the corresponding period of 2017.

9-

Doha Insurance Group’s net profit amounted to QR34.9 million in

first half of 2018, compared to QR33.9 million for the same

period last year, while its earnings per share recorded QR0.70

in, versus QR0.68 for the corresponding period of 2017. The

company's total income from insurance revenues increased by

15.5% to QR115.4 million in the first half of 2018. After

payment of claims, the net income increased by 9.8% to QR41.2

million. Total investment income and other income increased by

9.8% to QR31.2 million. On the other hand, total expenses

increased by 12.8% to QR38.7 million. As a result, the profit

attributable to shareholders increased by 2.9% to QR34.9

million. Due to a decline in fair value, comprehensive income

decreased to QR26.9 million, however better than the

comprehensive loss of QR5.4 million recorded in the

corresponding period of 2017.

10-

Salam

International Investment Ltd.’s net loss amounted to QR12.65

million in the first half of 2018, compared to a net profit of

QR17.74 million for the same period in 2017, and its loss per

share reached QR0.11, versus earnings per share of QR0.16 for

the same period last year. The total revenue of Salam

International from activity and investment decreased by 7.4% to

QR332.6 million in the first half of 2018, while its expenses

increased by 10% to QR344.5 million, of which QR147 million went

to employees’ costs, QR101.3 million for administrative and

general expenses, and QR55.3 million as financing costs. As a

result, the net profit turned into a net loss of QR12.65

million. There was a limited decline in the fair value, which

led to a comprehensive loss of QR13.5 million.

11-

Mannai

Corporation’s net profit rises marginally 0.60% to QR167

million, while its earnings per share amounted to QR3.66.

Economic Developments:

1-

Last June, Qatar’s trade balance surplus increased by about QR5.5

or 44.5% compared to June 2017. On a month to month basis, the

surplus climbed by about QR3.1 billion, an increase of 21%

compared to May 2018, reaching QR18 billion.

2-

Oil prices decreased during trading on Wednesday, due to the

pressure of a surprising surge in the United States crude

inventories, in addition to the production surge of OPEC oil in

the previous month; which raises concerns over global

oversupply. Brent crude fell by US $1.82 to US $72.39 a barrel.

OPEC oil prices decreased as well by about US $0.77 to the level

of US $72.10 per barrel.

3-

Dow Jones declined by about 201 points to the level of 25326 points

until closing on Thursday. US dollar stood at $1.16 against the

Euro, and against the yen at ¥111.70 per dollar. Gold dropped to

the level of US $1213.9 per ounce.

|