|

The Group Securities: Weekly Report on

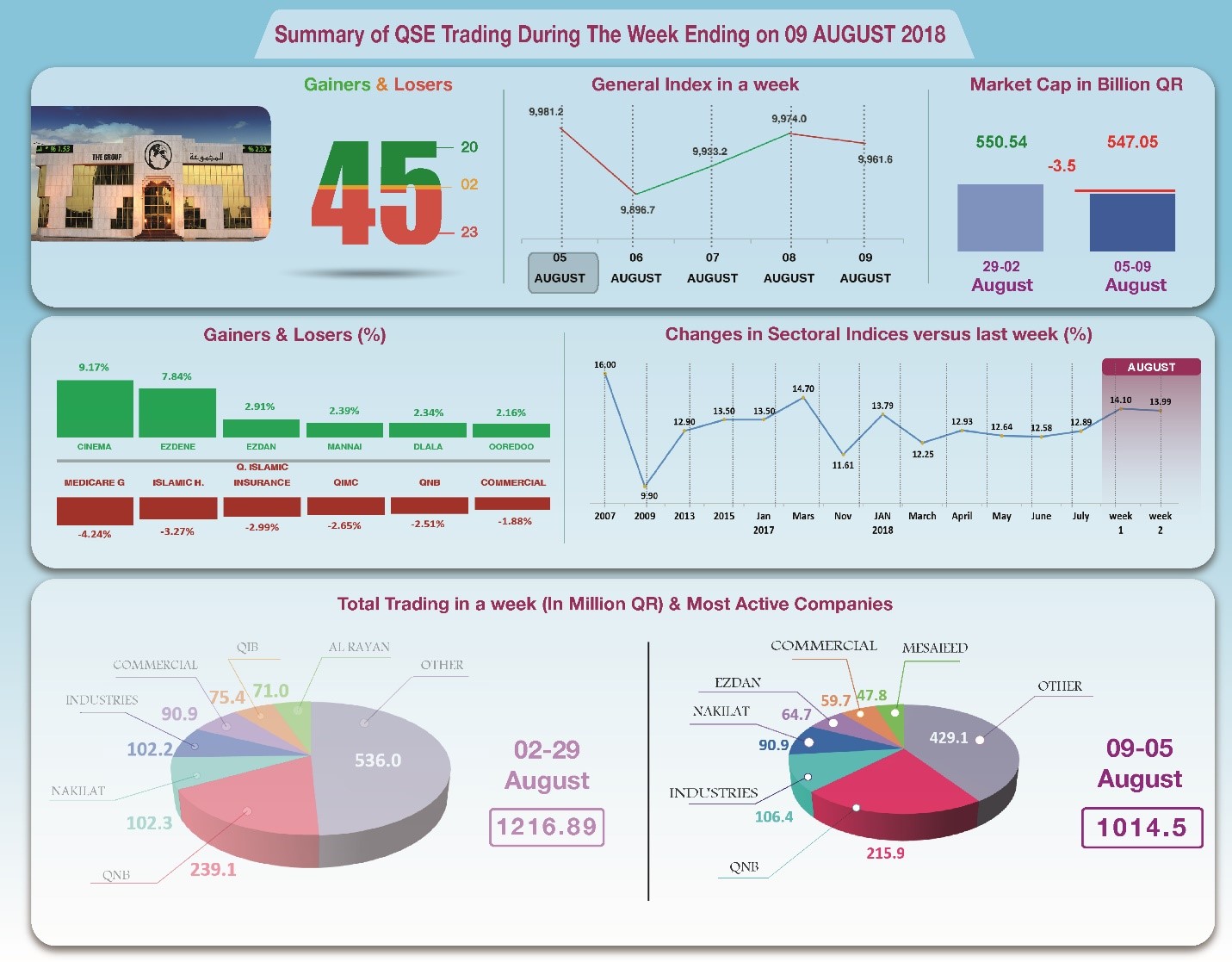

QSE Performance, 5 – 9 August 2018 “General Index Bounces Down after Hitting 10,000 Points”

Last week witnessed the rise of QSE’s

general index to the level of ten thousand points for the first

time this year, and its retreat to around the level of 9900

points during the rest of the sessions. It was noted that

foreign portfolios have dominated the net purchases against the

rest of the other groups. By the end of the week the index had

lost 94.3 points and closed at 9887 points. There was a decline

in total trading of 16.6% to QR1014 million, and total

capitalization decreased by QR3.5 billion to QR547.1 billion.

While the shares of 20 companies went up, those of 23 companies

declined, and the share prices of two companies remained

unchanged.

In depth, the general index decreased by about 94.3 points or

0.94%, to the level of 9886.9 points, while Al Rayan Islamic

Index decreased by 0.91%. Four sectoral indices declined,

especially Banking and Insurance, while three increased, mainly

Real Estate. It has been noticed that the share price of

Medicare was the biggest loser, down by 4.24%; followed by

Islamic Holding by 3.27%, Islamic Insurance by 2.99%, QIMC by

2.65%, then QNB by 2.51%. In contrast, the share price of Qatar

Cinema was the top gainer, up by 9.17%; followed by Ezdan 7.84%,

Alijarah by 2.91%, and Mannai 2.39%, then Ooredoo by 2.16%.

The total trading volume dropped by 16.6% to the level of QR1014.5

million in a week, so the average daily trading volume decreased

to QR202.9 million. QNB led the traded shares with a volume of

QR215.9 million, followed by the share of Industries Qatar with

QR106.4 million, Nakilat with QR90.9 million, and Ezdan with

QR64.7 million. It was noticed that Qatari portfolios made net

sales of QR96.6 million, while Non-Qatari portfolios dominated

the net purchases with QR147.9 million. Qatari individuals made

total net sales of QR33.5 million, whereas foreign individual

investors made net sales of QR17.7 million. As a result, QSE’s

total capitalization declined by QR3.5 billion to reach QR547.1

million, and the P/E ratio retreated to a multiple of 13.99

compared to 14.10 from last week.

Corporate News:

1-

Industries Qatar’s net profit increased by 56% to QR2.5 billion,

compared to QR1.60 billion for the same period last year, while

its earnings per share amounted to QR4.15, versus QR2.66 for the

corresponding period of 2017. Industries Qatar total profit for

the first half of the year increased by 81.6% to QR624.5

million. The company's share of the results of investments in

associates and joint ventures increased by 40% to QR1.8 billion,

and other income increased by 11.3% to QR209.4 million, while

the total expenses decreased by 15.1% to QR118.8 million. As a

result the net profit increased by 56% to QR2.5 billion.

2-

Qatari German Medical Devices (QGMD) showed a net loss of QR4.39

million, compared to a net loss of QR4.31 million for the same

period last year, while its loss per share amounted to QR0.38,

versus QR0.37 loss per share recorded in the corresponding

period of 2017. QGMD’s net income decreased by 18% to QR2.11

million in the first half of 2017, of which QR 887,000 gross

profit from activity and QR1.22 million from other revenues. The

company’s expenditure dropped by 7.2% to QR4.6 million, while

financing costs slipped slightly to QR1.9 million. As a result,

the net loss increased by 1.9% to QR4.4 million, and there was

no change in the fair value of assets.

3-

Gulf International Services’ net profit doubled to QR34.24 million,

compared to QR15.82 million for the same period last year, while

its earnings per share amounted to QR0.18, versus QR0.09 for the

same period in 2017. Gulf International Services' gross profit

increased by 13.2% to QR221.6 million for the first half of

2018, while the company’s other revenues increased by 53.3% to

QR32.8 million. On the other hand, expenses decreased by 1.9% to

QR127.7 million, and net financing costs increased by 51.7% to

QR92.4 million. As a result the net profit increased by 116% to

QR34.2 million in this period. After subtracting a limited

decline in fair value of investments, the comprehensive income

amounted to QR33.2 million.

4-

Investment Holding Group’s profits attributable to shareholders

amounted to QR23 million, compared to QR20 million for the same

period last year, while its earnings per share amounted to

QR0.28, versus QR0.25 per share for the corresponding period of

2017. While Investment Holding Group’s total investment profit

from activity increased by 2.4% to QR65.7 million, other

revenues and received dividends decreased, reducing total

revenues by 1.3% to QR76 million. On the other hand, general

expenses and bank interest and depreciation increased by 64.7%

to QR73.3 million. The net profit was expected to fall to QR2.67

million, but the company achieved fair value gains of QR28.8

million resulting in the climb of the comprehensive income - not

the net profit - to QR23.3 million compared to QR21 million in

the corresponding period of 2017.

5-

Medicare Group’s net profit amounted to QR33.24 million, compared

to QR32.58 million for the same period last year, while its

earnings per share reached QR1.18, versus QR1.16 per share for

the corresponding period of 2017. Medicare’s gross profit stood

at QR99.7 million for the first half of 2018, while other

revenues fell marginally to QR5.4 million. On the other hand,

expenses of all types stabilized with a slight decrease to QR87

million. As a result, the net profit increased marginally to

QR33.25 million.

6-

Mesaieed Petrochemicals Holding’s net profit amounted to QR666

million, compared to QR469 million for the same period of the

previous year, while the company’s earnings per share amounted

to QR0.53, versus QR0.37 for the corresponding period of 2017.

Mesaieed Petrochemicals’ total revenues increased by 41.3% to

QR613.2 million in the first half of 2018, of which QR589.6

million was generated from the results of joint ventures.

Mesaieed’s total expenses increased by 31.3% to QR10.9 million,

and the company generated revenues from tax rebates amounting to

QR64.2 million, compared to QR42.8 million from last year. As a

result the net profit increased by 42.2% to QR666 million.

7-

Al Meera Consumer Goods’ net profit attributable to shareholders

amounted to QR93.28 million, compared to QR102.36 million for

the same period of 2017, while its earnings per share recorded

QR4.66, versus QR5.12 for the corresponding period last year. Al

Meera’s total revenues rose by 5.2% to QR298.1 million for the

first half of 2018, of which QR250.7 million profit from

activity. The company’s total expenses and costs increased by

13.1% to QR204.7 million, which took a toll on the net profit

causing it to decrease by 9% to QR93.28 million. The change in

fair value was positive by QR6.1 million, compared to the

corresponding period of 2017 where it declined by QR11.6

million. As a result, the comprehensive income increased by 9.4%

to QR99.4 million.

Economic Developments:

1-

OPEC oil stabilized at the level of US $72.21 per barrel until

Wednesday 8 August, unchanged from the previous week. Qatar set

the price for its onshore oil for the month of July at US $75.25

a 1% decrease from the previous month.

2-

Dow Jones stabilized at until closing on Thursday with a limited

increase to the level of 25395 points. US dollar increased to

$1.15 against the Euro, and dropped against the yen to ¥110.70

per dollar. Gold stood still at the level of US $1215.3 per

ounce.

|