|

The Group Securities: Weekly Report on

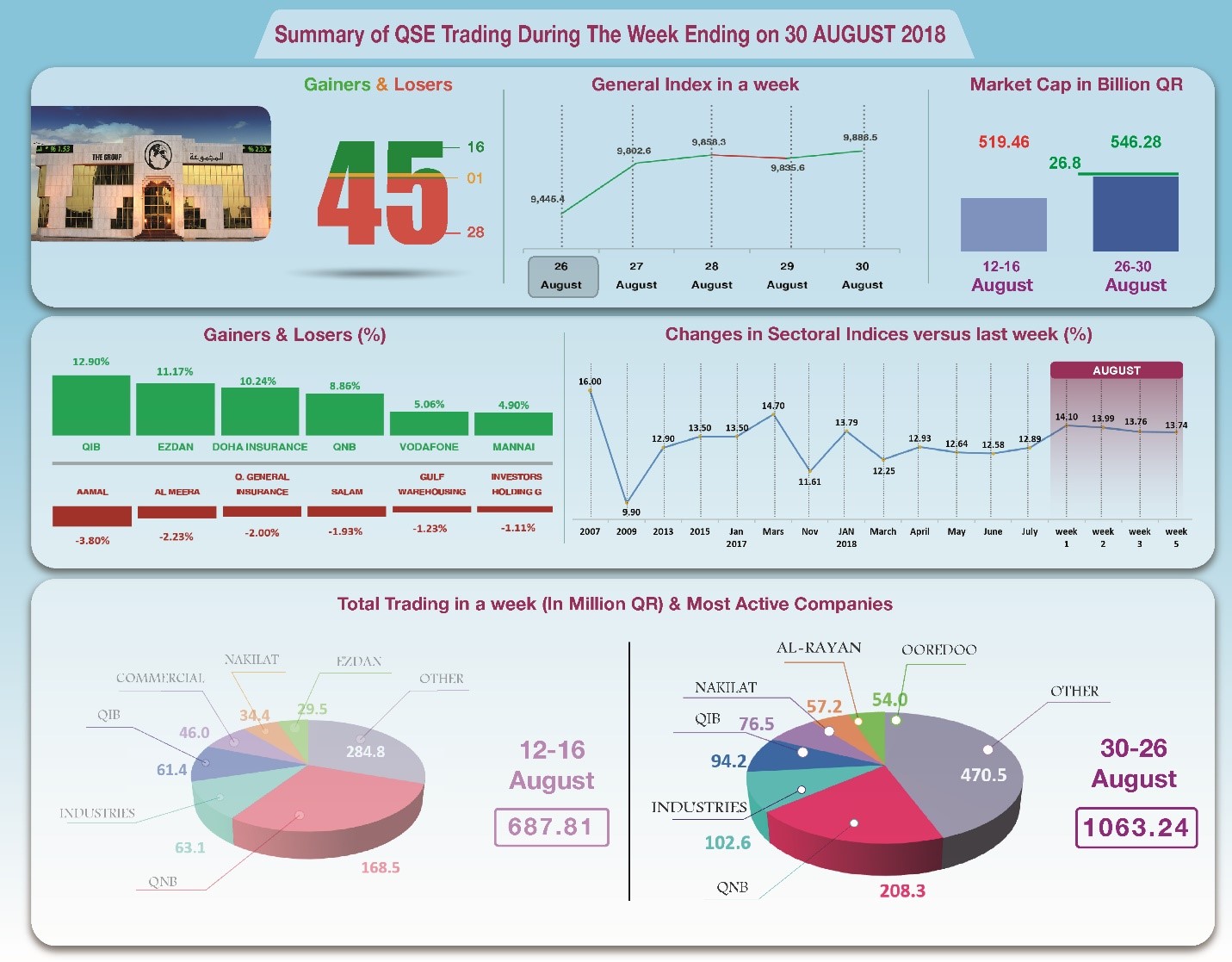

QSE Performance, 26 – 30 August 2018 General Index Climbs Back Up Towards 10,000 Points

02/09/2018

Trading volumes rose back above the level

of one billion Qatari riyals in a week beginning Monday,

averaging QR212.6 million per day, as the stock exchange regains

activity after the Eid holiday, and due to the rise of OPEC oil

price to the level of USD $74.48 a barrel. These developments

reflected positively on the share prices of 28 companies, while

the share prices of 16 companies declined, and all sectoral

indices increased. As a result, the general index climbed by

4.6%, approaching once again the level of ten thousand points.

In depth, the general index increased by about 439 points or 4.64%,

to the level of 9886 points, while Al Rayan Islamic Index

increased by 2.47%. All sectors indices have increased, namely

Real Estate, Banks, and Telecommunication. It has been noticed

that the share price of QIB was the top gainer, up by 12.9%;

followed by Ezdan by 11.2%, Doha Insurance by 10.2%, and QNB by

8.9%, then Vodafone by 5.1%. In contrast, the share price of

Aamal was the biggest loser, down by 3.8%, followed by Almeera

by 2.2%, General Insurance by 2%, and Salam by 1.9%, then GWC by

1.2%.

The total trading volume increased by 54.6% to the level of

QR1063.2 million in a week, so the average daily trading volume

climbed to QR212.6 million. QNB led the traded shares with a

volume of QR208.3 million, followed by the share of Industries

Qatar with QR102.6 million, QIB with QR94.2 million, and Nakilat

with QR76.5 million. It was noticed that Qatari portfolios made

net sales of QR52.8 million only, while Non-Qatari portfolios

dominated the net purchases by QR192.3 million. Qatari

individuals made total net sales of QR113.2 million, whereas

foreign individual investors made net purchases of QR26.3

million. As a result, QSE’s total capitalization climbed by

QR26.8 billion to reach QR546.3 billion, and the P/E ratio

stabilized at a multiple of 13.74.

Corporate News:

1-

Vodafone Qatar

announced that it has connected its first enterprise customer

“Gulf Bridge International” (GBI) - to Vodafone’s 5G network.

2-

CEO of Qatar Industrial Manufacturing Co. declared that the company

has completed an acquisition by buying the foreign partner's

share in one of the associates, Qatar Plastic Products Company.

The acquisition was financed by a profit – based guarantee and

very competitive terms medium term loan from a local bank. The

company’s capital structure after the (33.33%) share acquisition

becomes 66.66%, with the remaining share belonging to Qatar

Industrial Manufacturing Company (QIMCO).

3-

Meetings are

being planned between Doha Insurance Group, Arab Insurance Group

(ARIG), Gulf Warranties Home Office, and all regional branches

of Gulf Warranties to consider ways to resolve outstanding

matters and potential problems. We intend to explore the future

of the relationship between concerned parties, and to address

Gulf Warranties’ business continuity in Qatar, mainly whether

they intend to continue or to stop their operations in part or

in full. We intend to address the responsibilities of each party

for the questionable transactions that took place, and we will

insist that Gulf Warranties and ARIG appoint a new director to

head the Qatar branch.

Economic Developments:

1-

Qatar’s trade balance recorded a surplus of QR16.9 billion during

the month of July, an increase of QR5 billion or 42.7%, compared

to the same month of last year, and a decrease of QR1.1 billion

or 6.1% versus the previous month of June.

2-

OPEC oil increased by about US $5, to the level of US $74.48 per

barrel until Wednesday 28 August.

3-

Dow Jones increased by about 397 points until closing on Thursday

to the level of 26010 points. US dollar dropped to $1.17 against

the Euro, and stabilized against the yen at ¥110.98 per dollar.

Gold gained about US $28 to climb up to the level of US $1210

per ounce.

|