|

The Group Securities: Weekly Report on

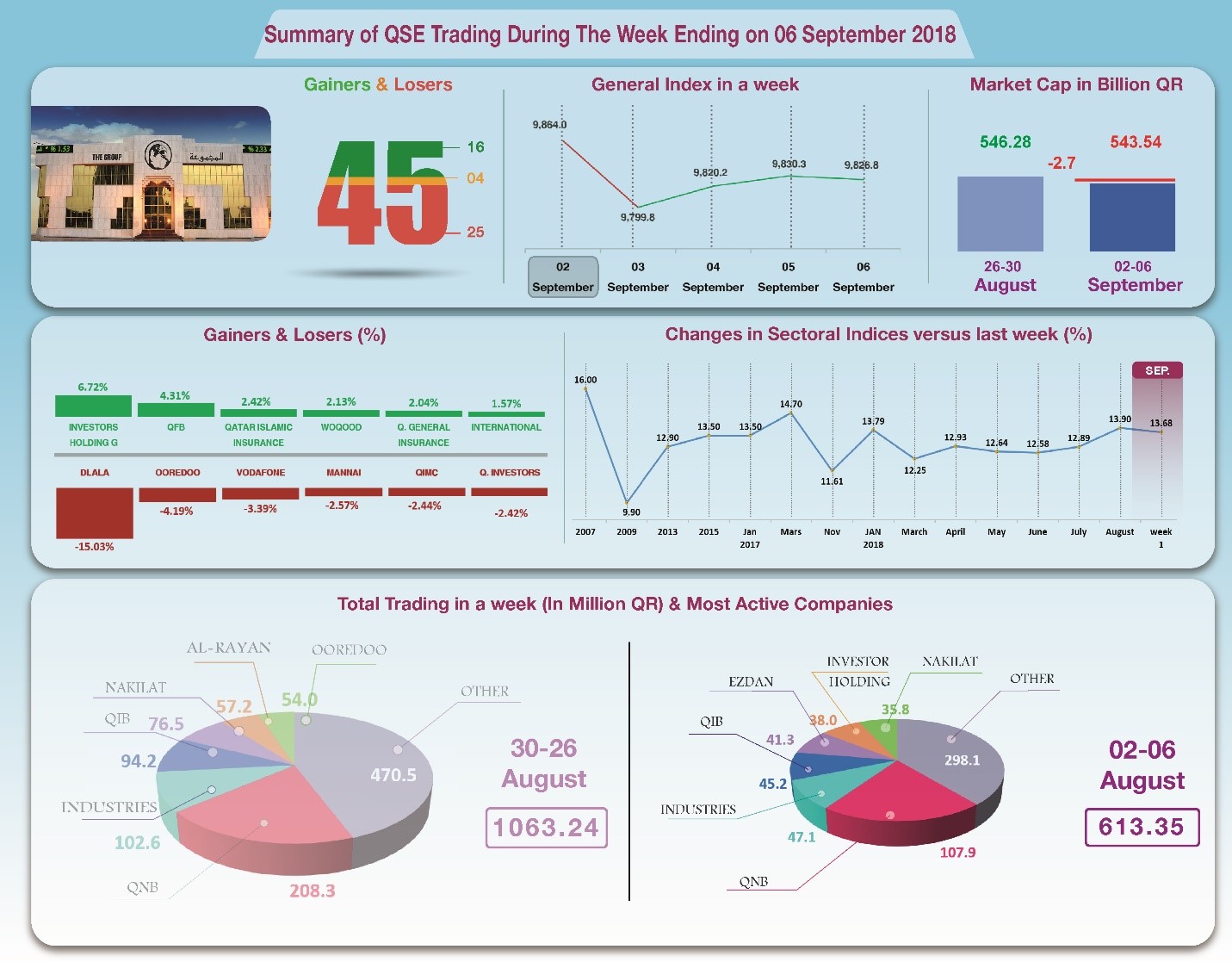

QSE Performance, 2-6 September 2018 Trading Volume Declines and General Index Hovers Over 9800 Points

September 9, 2018

Trading volumes fell again below QR1

billion in a week, averaging QR122.7 million per day. This had a

negative impact on the prices of shares; as the shares of 25

companies dropped, led by the share price of Dlala, followed by

Ooredoo, while the share price of 16 companies increased, mainly

Investment Holding. Additionally, six sector indices declined,

particularly telecommunication. As a result, the general index

fell by 0.6% but remained above the level of 9800 points.

In depth, the general index decreased by about 60 points or 0.60%,

to the level of 9827 points, while Al Rayan Islamic Index

dropped by 0.42%. Six sector indices have decreased, namely

Telecommunication, Transportation and Insurance. It has been

noticed that the share price of Dlala was the biggest loser,

down by 15%; followed by Ooredoo by 4.19%, Vodafone by 3.39%,

and Mannai by 2.57%, then QIMC by 2.44%. In contrast, the share

price of Investment Holding was the top gainer, up by 6.7%,

followed by Qatar First Bank by 4.3%, Islamic Insurance by 2.4%,

and Qatar Woqod by 2.1%, then General Insurance by 2.04%.

The total trading volume decreased by 42% to the level of QR613.4

million in a week, so the average daily trading volume dropped

as well to QR122.7 million. QNB led the traded shares with a

volume of QR107.9 million, followed by the share of Industries

Qatar with QR47.1 million, QIB with QR45.2 million, and Ezdan

with QR41.3 million. It was noticed that Qatari portfolios made

net sales of QR16.6 million only, while Non-Qatari portfolios

made net purchases of QR70.5 million. Qatari individuals made

total net sales of QR57.3 million, whereas foreign individual

investors made net purchases of QR3.4 million. As a result,

QSE’s total capitalization dropped by QR2.7 billion to reach

QR543.5 billion, and the P/E ratio declined to a multiple of

13.68 from last week’s 13.75.

Corporate News:

1-

Qatar Islamic

Bank stated that it has no knowledge of any information that has

not been disclosed in accordance with the instructions of Qatar

Stock Exchange. The Bank adheres fully to the principle of

disclosure and transparency of any matters that may affect the

share price and investor decisions.

2-

Al Meera - Sultanate of Oman Branch - announced that it is gearing

up to kick off construction work for its new branch in the area

of Amerat in September. It is worth mentioning that the

estimated cost of construction is approximately QR70 million.

3-

Dlala Islamic

Brokerage Co. announced that Thursday, 6/9/2018 will be the last

working day of the company, according to the plan to merge Dlala

Islamic Company and Dlala Brokerage Company approved by Qatar

Financial Markets Authority.

Economic Developments:

1-

Qatar Central Bank (QCB) announced on Tuesday that it had issued

treasury bills worth QR1100 million distributed as follows:

- QR600 million for three months at an interest rate of 2.18%

- QR300 million for six months at an interest rate of 2.48%

- QR200 million for nine months at a rate of 2.73%

2-

OPEC oil decreased by about US $1.14 to the level of US $75.18 per

barrel until Wednesday 5 September. Also Qatar Petroleum

announced that the prices of Qatar oils for the month of August

have declined to the level of US $74 per barrel, versus US

$75.25 during the month of July.

3-

Dow Jones increased by about 397 points until closing on Thursday

to the level of 26010 points. US dollar dropped to $1.17 against

the Euro, and stabilized against the yen at ¥110.98 per dollar.

Gold gained about US $28 to climb up to the level of US $1210

per ounce.

|