|

The Group Securities: Weekly Report on

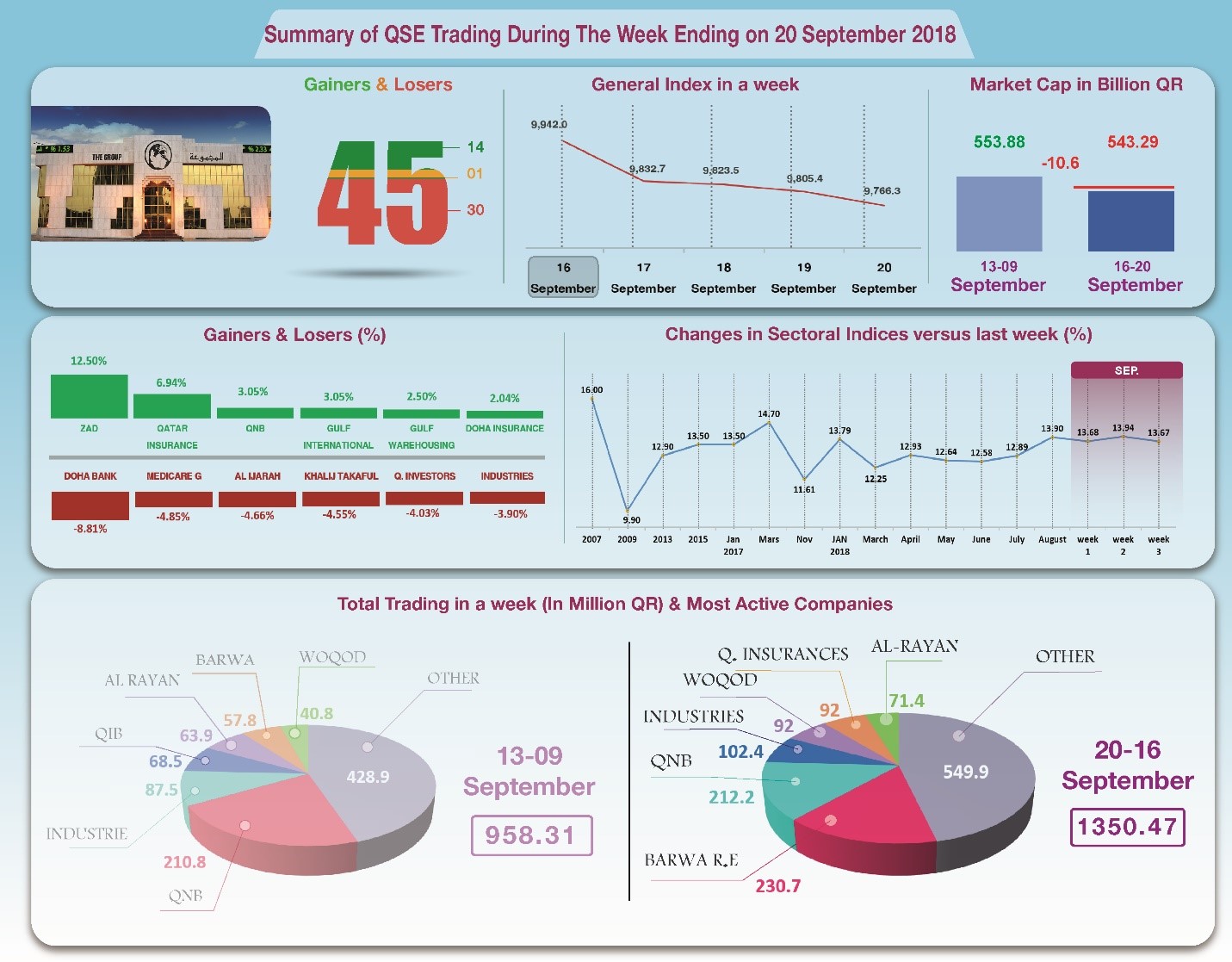

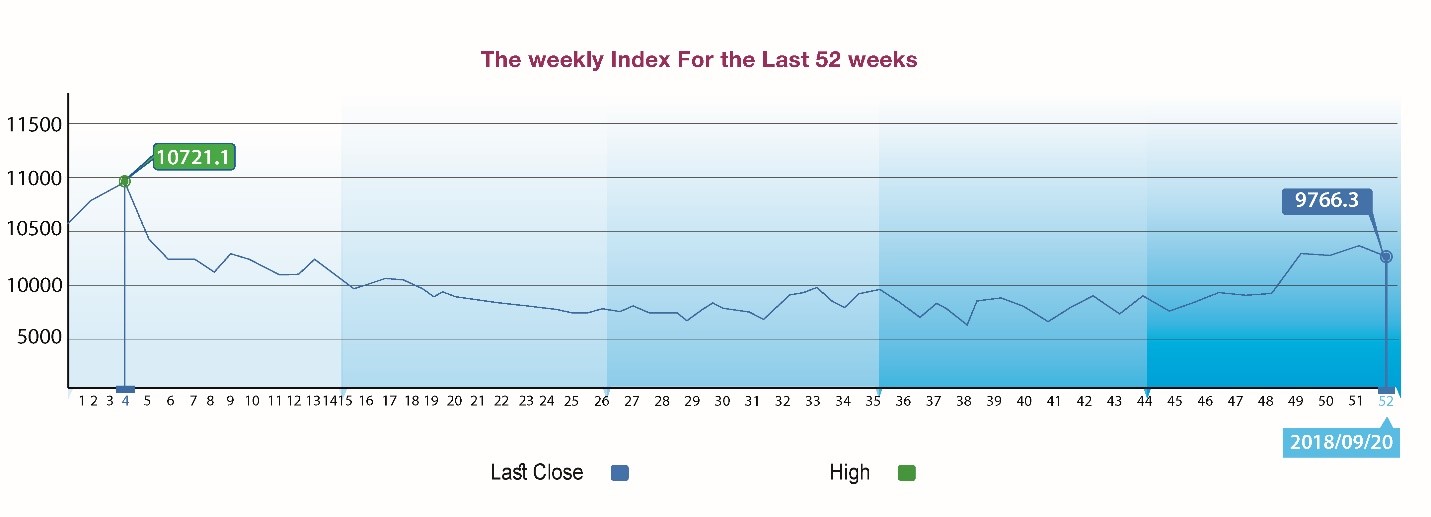

QSE Performance, 16-20 September 2018 General Index Retreats to below 10,000 Points

September 23, 2018

Amid the state of anticipation that

prevailed in the stock market for two important events; the

certain upcoming disclosures of the results of the third quarter

as of mid-October, and the uncertain IPO of Qatar Aluminum, in

addition to the stability of oil prices, the shares of 30

companies dropped, of which Doha Bank’s share incurred the most

loss, and the general index lost about 256 points to fall back

to the level of 9766 points. This occurred despite a 41%

increase in trading volumes to QR1.35 billion in a week, an

average of QR270 million per day. Also, five out of seven sector

indices fell, mostly the telecommunications index.

In depth, the general index decreased by about 256 points or 2.55%,

to the level of 9766 points, while Al Rayan Islamic Index

dropped by 2.14%. Five sector indices have decreased, namely

Telecommunications, Banking and Industry. It has been noticed

that the share price of Doha Bank was the biggest loser, down by

8.81%; followed by MediCare by 4.85%, Alijarah by 4.66%, and

Alkhaleej Takaful by 4.55%, then Qatari Investors by 4.03%. In

contrast, the share price of ZAD was the top gainer, up by

12.50%, followed by Qatar Insurance by 6.94%, QNB by 3.05%, and

Gulf International Services by 3.05%, then GWC by 2.50%.

The total trading volume increased by 40.9% to the level of

QR1350.5 million in a week, so the average daily trading volume

climbed to QR270.1 million. Barwa led the traded shares with a

volume of QR230.7 million, followed by the share of QNB with

QR212.2 million, Industries Qatar with QR102.4 million, and

Woqod with QR92 million. It was noticed that Qatari portfolios

made net sales of QR199.9 million, while Non-Qatari portfolios

made net purchases of QR291.3 million. Qatari individuals made

total net sales of QR104.4 million, whereas foreign individual

investors made net purchases of QR13 million. As a result, QSE’s

total capitalization dropped by QR10.6 billion to reach QR543.3

billion, and the P/E ratio fell to a multiple of 13.67 from last

week’s 13.94.

Corporate News:

1-

Rumors

circulating in social media platforms reported that about 245.5

million shares of Qatar Aluminum are soon to be listed on the

stock exchange at QR10 per share. The news faced skepticism

since they were not released by Qatar Petroleum.

2-

Qatar Electricity & Water Co. announced that Nebras Power has

acquired a controlling 75% equity stake in Zon Exploitatie

Nederland Holding, a leading developer and operator of solar

power generation assets in the Netherlands. The acquisition

provides Nebras with access to the fast-growing Netherlands

renewable power market and is in line with Nebras stated

objectives of establishing itself as a leading international

power developer.

Economic Developments:

1-

OPEC oil stabilized at the level of US $77.06 per barrel in a week

until Wednesday 19 September, with a very slight drop compared

to last week.

2-

Dow Jones rose by about 557 points until closing on Thursday to the

level of 26740 points. US dollar dropped to $1.18 against the

Euro, and climbed against the yen at ¥112.82 per dollar. Gold

gained about US $2 to climb up to the level of US $1213 per

ounce.

|