|

The Group Securities: Weekly Report on

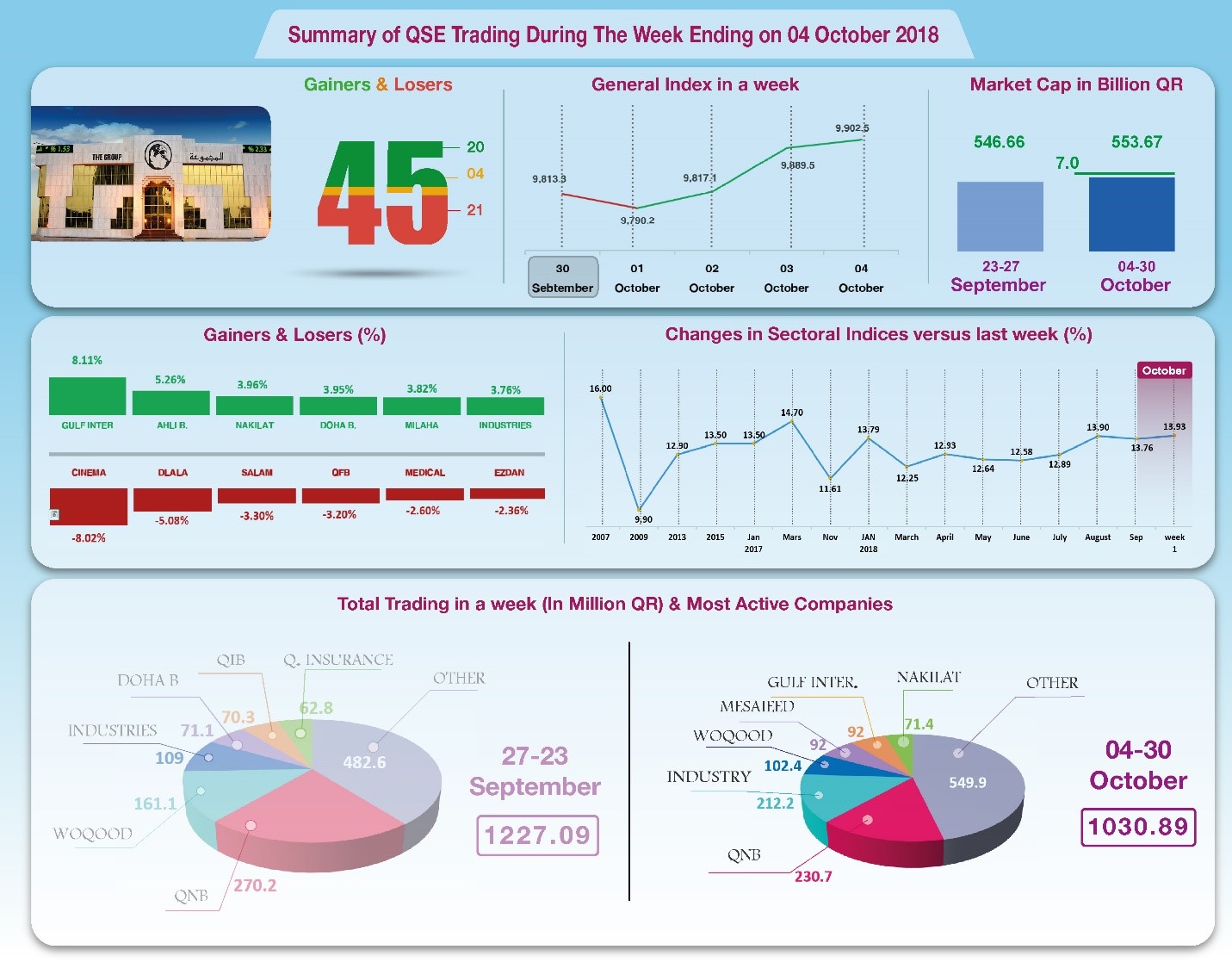

QSE Performance, 30 Sep – 4 Oct 2018 General Index Climbs Marginally to Hover above 9900 Points

September 30, 2018

In light of the rise of OPEC oil price to

the level of US $83.64 per barrel, and the approaching Q3

financial statements disclosure period, the stock market’s final

outcome was the rise of the shares prices of 20 companies;

mostly leading entities such as QNB, Industries Qatar, and

Woqod; and the drop in the share prices of 21 companies, along

with a 16% decrease in the total trading volume. As a result,

the general index climbed by 1.21% to 9902 points, and the Al

Rayan Islamic Index rose by 0.70%.

In depth, the general index increased by about 118 points, or 1.21%

to the level of 9902 points, while Al Rayan Islamic Index rose

by 0.70%. Sector indices have increased, namely Transport,

Industry and Services. It has been noticed that the share price

of

Gulf International Services

was the top gainer, up by 8.11%;

followed by Ahli Bank by 5.26%, Nakilat by 3.96%, and Doha Bank

by 3.95%, then Milaha by 3.82%. In contrast, the share price of

Qatar Cinema was the biggest loser, down by 8%, followed by

Dlala by 5.08%, Salam International by 3.3%, and Qatar First

Bank by 3.2%, then Qatari-German Medical Devices by 2.6%.

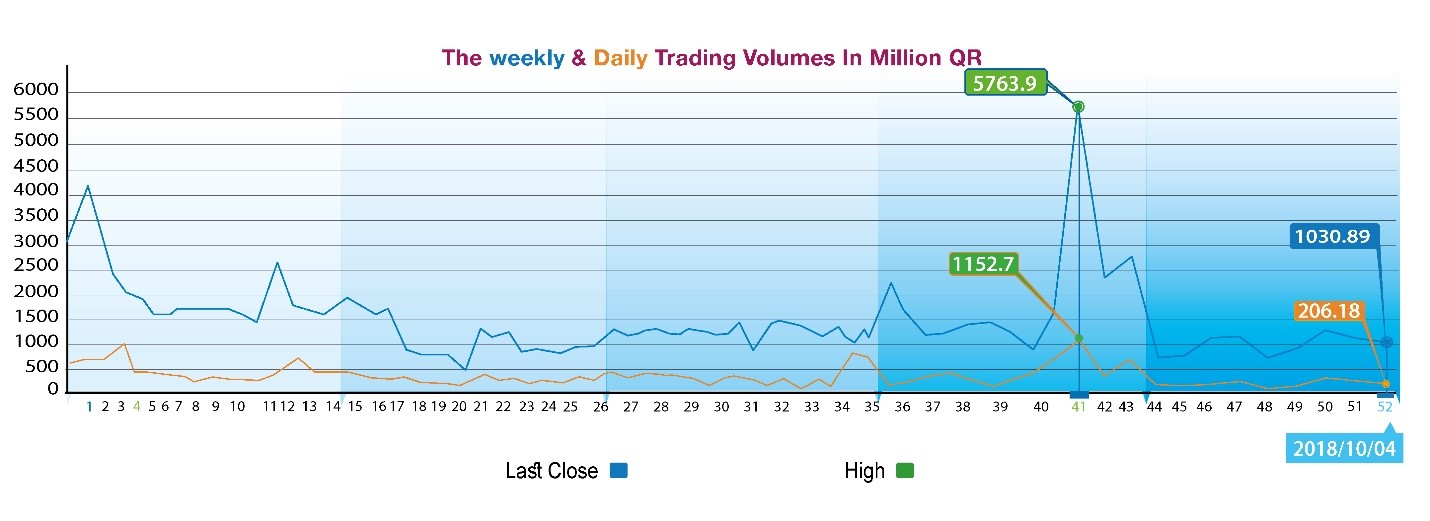

The total trading volume decreased by 15.99% to the level of

QR1030.9 million in a week, so the average daily trading volume

dropped to QR206.2 million. QNB led the traded shares with a

volume of QR164.1 million, followed by the share of Industries

Qatar with QR132.9 million, Qatar Fuel with QR127.1 million, and

Mesaieed with QR67.1 million. It was noticed that Qatari

portfolios made net sales of QR17.8 million, while Non-Qatari

portfolios dominated purchases with a net of QR121.2 million.

Qatari individuals made total net sales of QR96.3 million,

whereas foreign individual investors made net sales of QR7.1

million. As a result, QSE’s total capitalization increased by

QR7 billion to reach QR553.7 billion, and the P/E ratio rose to

a multiple of 13.93 from last week’s 13.75.

Corporate News:

1-

As part of its expansion plans to be able to serve every area in

Qatar, “Woqod” opened a fuel station in Fereej Kulaib on

Wednesday, increasing the number of its permanent and portable

gas stations to 64 in total.

2-

Al Khaliji Commercial Bank succeeded in the issuance and pricing of

a USD 500 million five-year senior unsecured bond. The

transaction saw strong demand from local and international

investors, with an approximate USD 1.6 billion order book, an

oversubscription by three times the offering amount. The bond

was issued carrying a coupon at a flat rate interest of 4.7%.

3-

Vodafone Qatar announced completing the deployment of its

world-class mobile coverage infrastructure in the three

constructed phases of “Msheireb Downtown Doha”, at an investment

that exceeds QR100 million.

Financial & Economic Developments:

1-

Qatar Central Bank issued Treasury Bills on Wednesday for the

periods of 3, 6 and 9 months, where the total amount of issuance

amounted to QR500 million distributed amongst the different

periods.

2-

Qatar Petroleum announced that prices of its onshore and offshore

crude oil for the previous month of September have climbed by

about 7%, its onshore crude oil official price for settled at US

$79.3 per barrel, compared to US $74 in the previous month of

August. OPEC oil price also increased to US $83.64 per barrel

until Wednesday.

3-

Dow Jones stood at the level of 26252 points until closing on

Thursday. US dollar rose to $1.15 against the Euro, and against

the yen at ¥113.91 per dollar. Gold fell to US $1201.7 per

ounce.

|