|

The Group Securities: Weekly Report on

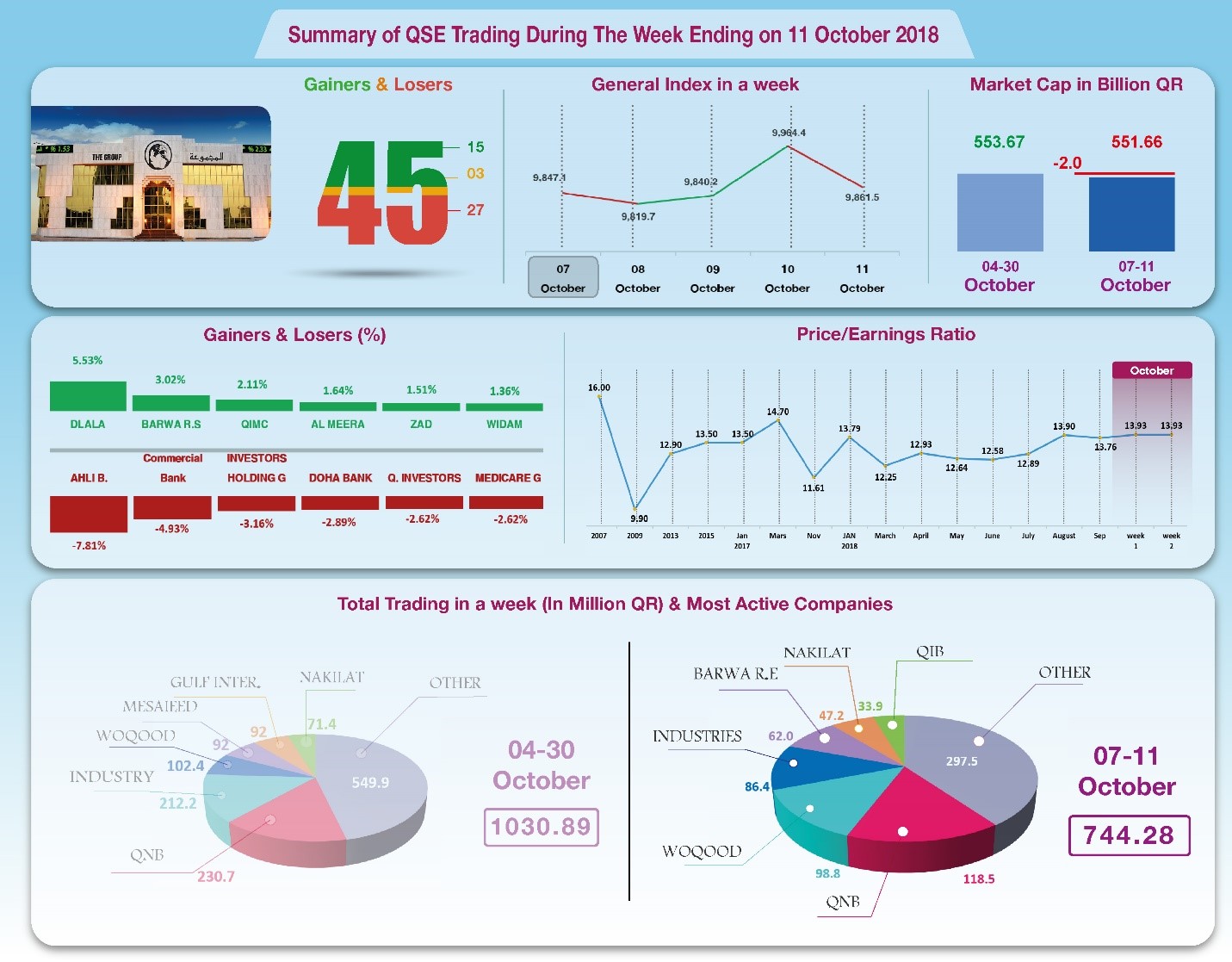

QSE Performance, 7 – 11 October 2018 General Index Drops below 9900 Points

October 14, 2018

The price of OPEC oil fell to US $82.6 per

barrel, coinciding with the release of QNB’s financial

statements for the third quarter 2018 that showed that despite

the increase in the bank’s net profit in the first 9 months of

2018, its comprehensive income has incurred losses of QR4.47

billion, mostly due to exchange rate differences, which reduced

the bank's comprehensive income to QR6.42 billion. As a result,

the share prices of 27 companies declined, while the share

prices of 15 companies rose. The final outcome of the stock

market in a week was that the total volume of trading decreased

by 16% to QR744 million, and the general index dropped by 0.41%

to the level of 9861.5 points.

In depth, the general index decreased by about 41 points, or 0.41%

to the level of 9862 points, while Al Rayan Islamic Index fell

by 0.14%. Four sector indices have decreased, especially

Transport, Banking and

Insurance. It has been noticed that the share price of

Ahli Bank was the biggest loser, down by 7.8%; followed by

Commercial Bank by 4.9%, Investment Holding by 3.16%, and Doha

Bank by 2.9%, then Qatari Investors by 2.6%. In contrast, the

share price of Dlala was the top gainer, up by 5.5%, followed by

Barwa by 3%, QIMC by 2.1%, and Al Meera by 1.64%, then Zad by

1.5%.

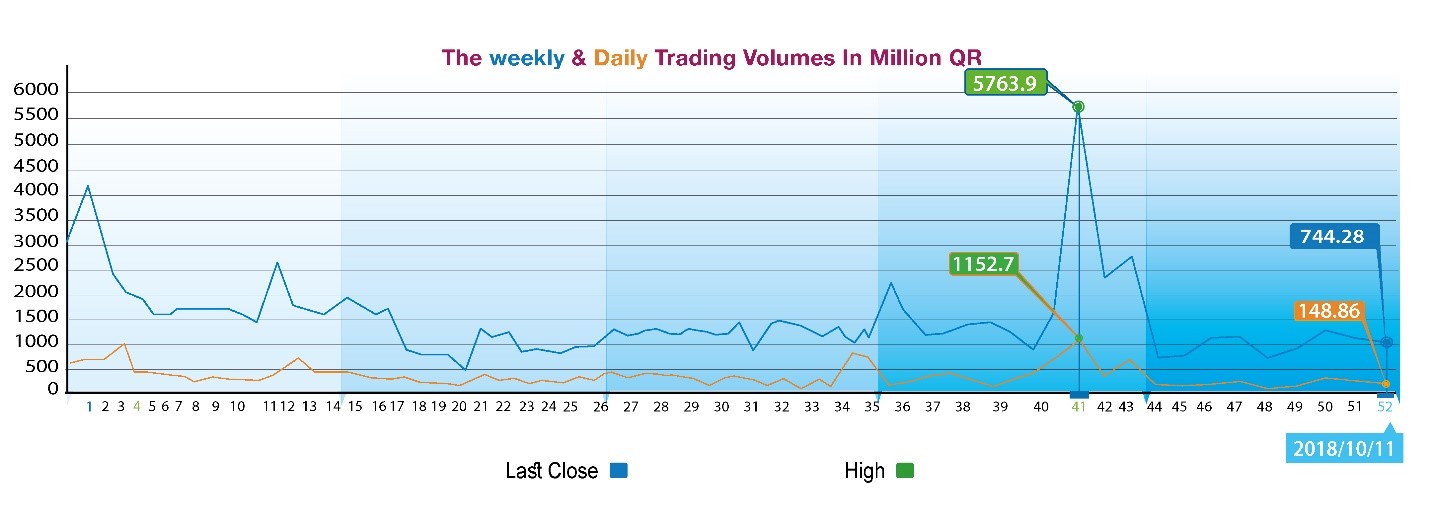

The total trading volume decreased by 27.8% to the level of QR744.3

million in a week, so the average daily trading volume dropped

to QR148.9 million. QNB led the traded shares with a volume of

QR118.5 million, followed by the share of Woqod with QR98.8

million, Industries Qatar with QR86.4 million, and Barwa with

QR62 million. It was noticed that Non-Qatari portfolios have

dominated the net purchases compared to all other segments with

a total of QR68 million, while Qatari portfolios made net sales

of QR32.8 million. Qatari individuals made total net sales of

QR28.1 million, whereas foreign individual investors made net

sales of QR7.1 million. As a result, QSE’s total capitalization

decreased by QR2 billion to reach QR551.7 billion, and the P/E

ratio stood at a multiple of 13.93.

Corporate News:

1-

QNB Group’s net

profit amounted to QR10.82 billion, compared to QR10.25 billion

recorded in the same period last year, while the bank’s earnings

per share reached QR11.4, versus QR10.7 for the same period in

2017. The operating income of Qatar National Bank Group

increased by 5.5% to QR17.9 billion for the first nine months of

the current year, of which QR14.1 billion from interest.

Expenditures rose by 8.7% to QR6.54 billion, of which QR1.66

billion went to losses of loans and loans to customers, noting

that the latter’s losses rose by 7.3% compared to the

corresponding period of the previous year. As a result, the net

profit attributable to shareholders increased by 5.6% to QR10.82

billion. The bank incurred a significant increase in its

comprehensive income loss that reached QR4.47 billion due to

exchange rate losses. All resulted in the decline of the

comprehensive income by 34.4% to QR6.42 billion.

2-

Vodafone Qatar

announced that it has obtained the approvals of Qatar Financial

Markets Authority and the Ministry of Economy & Trade with

regards to the reduction of the company's capital from QR 8,454

million to QR 4,227 million through reducing the nominal value

of the company's shares from QR10 per share to QR5 per share.

Vodafone Qatar is currently completing the necessary procedures

to ratify the proposed amendments to the company's Articles of

Association, which were previously approved by Vodafone Qatar's

shareholders on March 19, 2018 to reflect the capital reduction

and related amendments in its Commercial Register.

3-

Qatar Fuel Co. (Woqod) announced that it has increased the number

of its petrol stations to 65 varying between permanent and

mobile, following the inauguration of a new station in Old

Salata today, as part of its strategic plan to expand its

network of stations and serve all regions of the country.

Financial & Economic Developments:

1-

Qatar's GDP grew in the second quarter of this year by 2.5%

compared to the same period last year. According to the data of

the Ministry of Development Planning & Statistics, the GDP at

constant prices amounted to about QR204.4 billion in the second

quarter compared to QR199.3 billion in the same period of 2017.

The GDP at current prices grew by 17.9% year-on-year to QR171.5

billion.

2-

OPEC oil price decreased by about US $0.95 per barrel to the level

of US $82.6 per barrel until Wednesday.

3-

Dow Jones dropped by 739 points to the level of 25513 points until

closing on Thursday. US dollar declined to $1.16 against the

Euro, and against the yen to ¥112.43 per dollar. Gold climbed by

about US $18 to US $1219.5 per ounce.

|