|

The Group Securities: Weekly Report on

QSE Performance, 14 – 18 October 2018

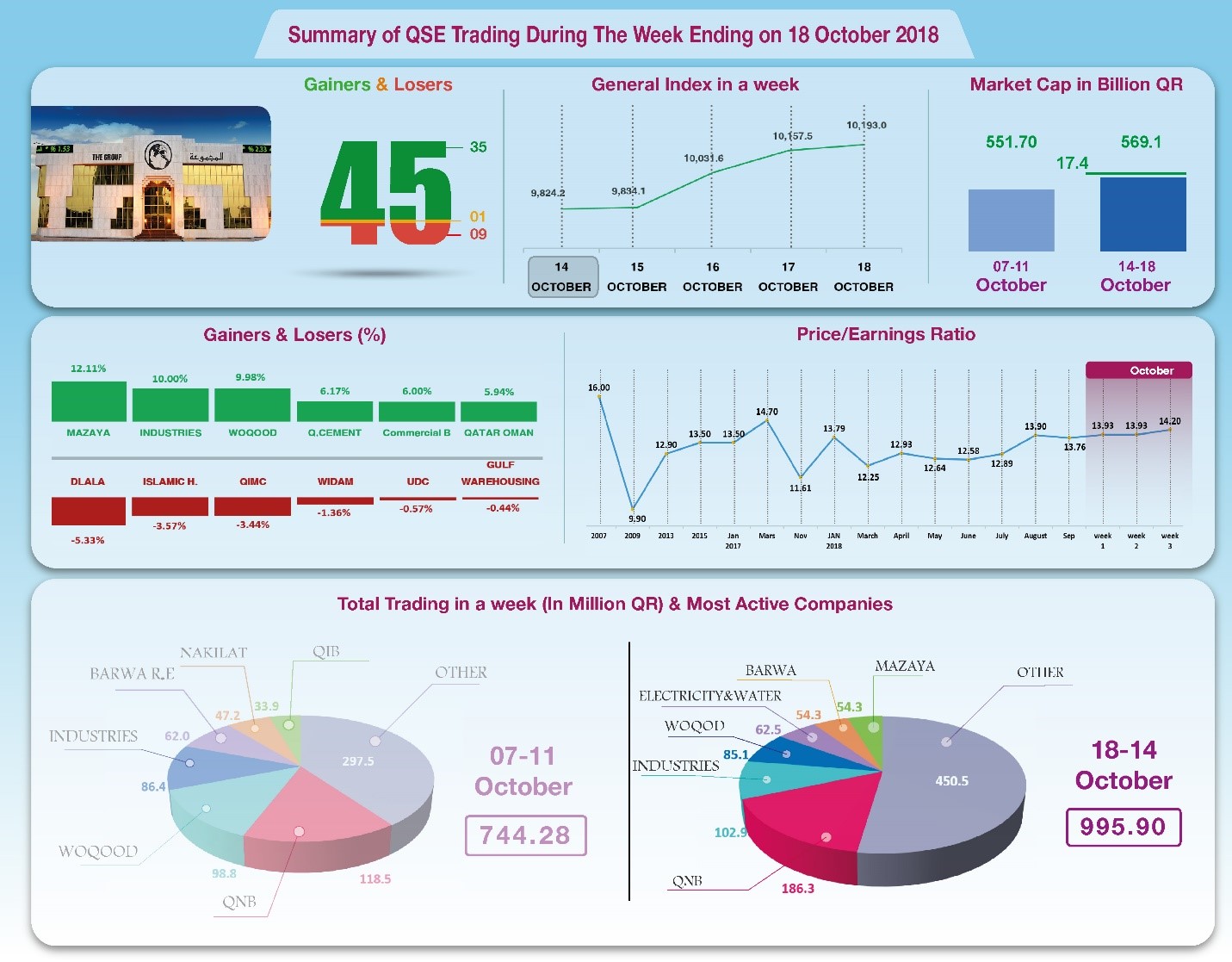

General Index Breaks Through the 10,000

Points Barrier

October 21, 2018

Although the price of OPEC oil continued

its decline for the second consecutive week to the level of US

$79.5 per barrel, and half of the ten companies that disclosed

their results during the week have seen a decline in profits,

with Dlala becoming unprofitable, the trading has been

relatively active, even though the volume stayed below one

billion riyals. Moreover, the share prices of 35 companies

benefited from the positive atmosphere that followed the media

hype around the assassination of Jamal Khashoggi in Istanbul by

Saudi Arabia, and enabled the index to break through the barrier

of ten thousand points.

In depth, the general index increased by about 331.5 points, or

3.36% to the level of 10193 points, while Al Rayan Islamic Index

climbed by 2.56%. All sector indices have increased, especially

Industry by 5.58%, Goods & Services by 3.94%, Transport by

2.57%, Banking by 2.2%, then Real Estate by 1.74%. It has been

noticed that the share price of Mazaya was the top gainer, up by

12.1%, followed by Industries Qatar by 10%, Woqod by 9.98%, and

Qatar National Cement by 6.2%, then Commercial Bank by 6%. In

contrast, the share price of Dlala was the biggest loser, down

by 5.3%, followed by Islamic Securities by 3.6%, and Widam by

1.36%, then UDC by 0.57%.

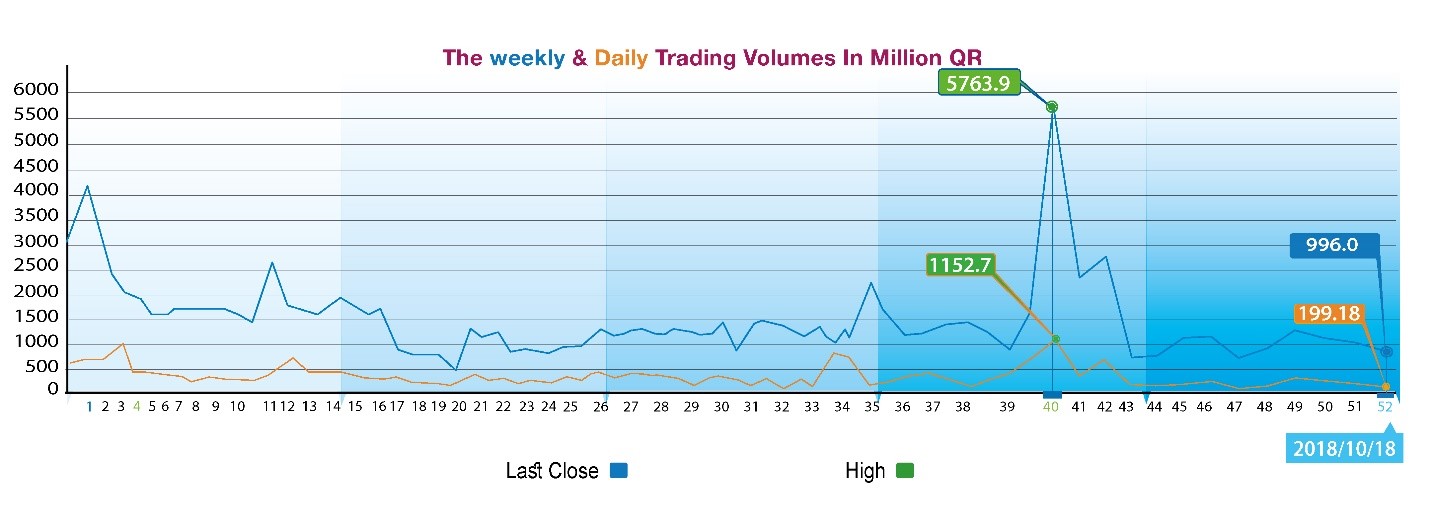

The total trading volume increased by 33.8% to the level of QR995.9

million in a week, so the average daily trading volume climbed

to QR199.1 million. QNB led the traded shares with a volume of

QR186.3 million, followed by the share of Industries Qatar with

QR102.9 million, Woqod with QR85 million, and Qatar Electricity

& Water with QR62.5 million, then Barwa and Mazaya with QR54.3

million for each. It was noticed that Non-Qatari portfolios have

made net purchases of QR172.2 million, while Qatari portfolios

made net purchases of QR2.8 million only. Qatari individuals

made total net sales of QR165.8 million, whereas foreign

individual investors made net sales of QR9.2 million. As a

result, QSE’s total capitalization increased by QR17.4 billion

to reach QR569.1 billion, and the P/E ratio climbed to a

multiple of 14.20.

Corporate News:

1-

Qatar National

Cement Company (QNCC) net profit amounted to QR218.8 million,

compared to QR242.8 million for the same period last year, while

the company’s earnings per share reached QR3.35, versus QR3.72

for the corresponding period of 2017. QNCC revenues decreased by

19.3% to QR633 million in the nine months ended 30/9/2018,

whereas production cost decreased by 21.5% to QR425.7 million.

This resulted in the decrease of the total operating profit by

14.4% to QR207.3 million. In contrast, general expenses

decreased by 15.6% to QR23 million, and after adding another

income of QR34.1 million, the net profit until end of the third

quarter decreased by 9.8% to QR218.8 million. It should be noted

that there was a positive change in the fair value, resulting in

the increase of the comprehensive income to QR226.6 million

compared to QR200.9 million in the corresponding period of 2017.

2-

United

Development Company (UDC) net profit amounted to QR385 million,

compared to QR436 million for the same period last year, while

the company’s earnings per share reached QR1.09, versus QR1.23

for the same period last year. UDC profit declined 9.8% to

QR622.8 million, while other income increased by 40.5% to QR134

million. The company’s general expenses and marketing increased

by 2% to QR222.7 million, and its net financing cost climbed by

4.6% to QR102.5 million. As a result, the net profit

attributable to shareholders decreased by 11.7% to QR384.7

million.

3-

Doha Bank net

profit amounted to QR737.5 million, compared to QR1.05 billion

for the same period last year, while the bank’s earnings per

share reached QR2.38, versus QR3.61 for the corresponding period

of 2017. Doha Bank net operating income for the nine months

ended on 30/9/2018 decreased by 6.4% to QR 2,030 million, of

which QR 1,603.2 million generated by interests. The bank’s

total expenses increased by 15.3% to QR 1,287.5 million, of

which QR 389.5 million spent on staff costs and QR 629.8 million

went to losses in value of loans. Consequently the net profit

fell 29.7% to QR737.5 million. It should be noted that there was

a positive change in the fair value of QR202.7 million. All

resulted in a comprehensive income increase to QR 940.1 million,

although it remained below QR 1,099.2 million recorded in the

corresponding period of 2017.

4-

Qatar

International Islamic Bank net profit amounted to QR735.1

million, compared to QR700.1 million recorded in the same period

last year, while the bank’s earnings per share reached QR4.86,

versus QR4.63 in the corresponding period of 2017. Qatar

International Islamic Bank’s total income from its operating

activities increased by 14.4% to QR1.58 billion, of which QR1.46

billion was from financing activities. The bank’s total expenses

increased by 7.8% to QR382 million. The share of unrestricted

owners in profits increased by 27.2% to QR415.2 million

(although the balance of such deposits decreased by 2.3% to

QR25.6 billion). As a result, net profit attributable to

shareholders increased by 5% to QR735.1 million.

5-

Masraf Al Rayan

net profit amounted to QR1.63 billion in the previous 9 months

compared to QR1.56 billion for the same period last year. The

bank’s earnings per share recorded QR2,176 versus QR 2,083 for

the corresponding period of 2017. Al Rayan’s operating revenues

increased by 15.4% to QR3.66 billion in the period ended

30/9/2018, while its total expenses climbed by 39.4% to QR1.06

billion. Depositors' share in profits increased by 12.9% to

QR950.4 million (although the deposit balance increased by only

4.9%). As a result, the net profit attributable to shareholders

increased by 4.5% to QR1631.9 million.

6-

Dlala Brokerage

& Investment Holding net loss of QR16.062 million, compared to a

net profit of QR16.13 million recorded in the same period last

year, while the holding’s loss per share amounted to QR0.56,

versus earnings per share of QR0.57 for the corresponding period

of 2017. Net operating income decreased by 42.8% to QR22.1

million for the nine months ended 30/9/2018, of which QR16.6

million generated from net brokerage commissions. The holding’s

total expenses increased by 1.4% to QR23.2 million, and

liabilities decreased by QR13.9 million. Deducting depreciation

and amortization of QR1.4 million, the company made a net loss

of QR15.91 million, compared to a net profit of QR16.1 million

in the corresponding period of 2017. In terms of comprehensive

income, the company recorded a fair value loss of QR1.65

million, compared to a loss of QR36.3 million in the same period

of 2017. As a result, the company recorded a comprehensive

income loss of QR17.7 million, compared to a loss of QR20.1

million in the corresponding period of last year.

7-

MediCare net

profit amounted to QR40.75 million, compared to QR36.25 million

for the same period last year, while its earnings per share

recorded QR1.45 for the period ended on 30/09/2018, versus

QR1.29 for the corresponding period of 2017. Medicare’s revenues

increased by 5% to QR357.5 million, while operating expenses

climbed by 9.5%, thus the operating profit stabilized with a

slight slip to QR140.4 million. Administrative and financial

expenses decreased by 11% to QR81.85 million. After adding other

income from deposits and others, and deducting depreciation

expenses of QR23.5 million and financing expenses of QR1.19

million, the result is a profit increased by 12.4% to QR40.75

million in the nine months ending on 30/9/2018.

8-

Qatar

Electricity & Water Company net profit amounted to QR 1,156

million, compared to QR 1,311 million recorded in the same

period of the previous year, while the company’s earnings per

share recorded QR10.51, versus QR11.92 for the corresponding

period of 2017. Qatar Electricity & Water Company revenues

decreased by 14.8% to QR2015.6 million. Its operating expenses

decreased by 15.3% to QR1099 million. As a result, total profit

decreased by 14.1% to QR916.7 million. Public spending fell

slightly to QR96 million, while the cost of financing increased

by 16.5% to QR102.5 million. After adding a share in project

profits of QR280 million and other income of QR94.6 million, the

net profit for the period decreased by 11.8% to QR1156.4

million. On the other hand, the company had a significant change

in fair value with a positive value, against a loss in the

corresponding period of 2017, which caused the comprehensive

income to double to QR 2,227.7 million, compared to QR 1185.5

million.

9-

Widam Food net

profit amounted to QR79.65 million, compared to QR80.15 million

for the same period last year, while its earnings per share

amounted to QR4.42, versus QR4.45 for the corresponding period

of 2017. Widam’s revenues rose by 7.2% to QR400.6 million in 9

months. Operating costs rose 22.8% to QR720.9 million. As a

result, the company's loss increased by 50.3% to QR320.4

million. Government support increased by 33.1% to QR430.9

million. In contrast, general and administrative expenses

increased by 8.6% to QR 40.5 million. After adding another QR9.5

million, the net profit fell marginally to QR79.6 million.

10-

Qatar Islamic

Bank (QIB) net profit amounted to QR2 billion, compared to

QR1.77 billion for the same period last year, while the bank’s

earnings per share recorded QR8.49, versus QR7.51 for the

corresponding period of 2017. QIB's revenues for the nine months

ended on 30/9/2018 rose by 8.2% to QR5.1 billion, of which

QR4.53 billion generated from financing and investments, while

total expenses increased by 4.4% to QR1,040.6 million, of which

QR482.7 million went to staff costs. QIB’s assets recorded a

decrease of QR556 million, and the share of deposit holders in

profit amounted to QR1547.6 million, an increase of 17.2%

compared to the corresponding period of 2017, although the

balance of these deposits increased by only 3.5%. As a result,

the bank’s net profit increased by 13% to QR 2,005 million.

Financial & Economic Developments:

1-

OPEC oil price

decreased by about US $3.10 per barrel to the level of US $79.5

per barrel until Wednesday.

2-

Dow Jones

dropped by 99 points to the level of 25414 points until closing

on Thursday. US dollar climbed to $1.14 against the Euro, and

stood still against the yen at ¥112.45 per dollar. Gold

increased by about US $10 to US $1229.1 per ounce.

|