|

Growth Rates in

the Banking Sector’s Performance Indicators for the Period

2014-2018

April 14, 2019

1.

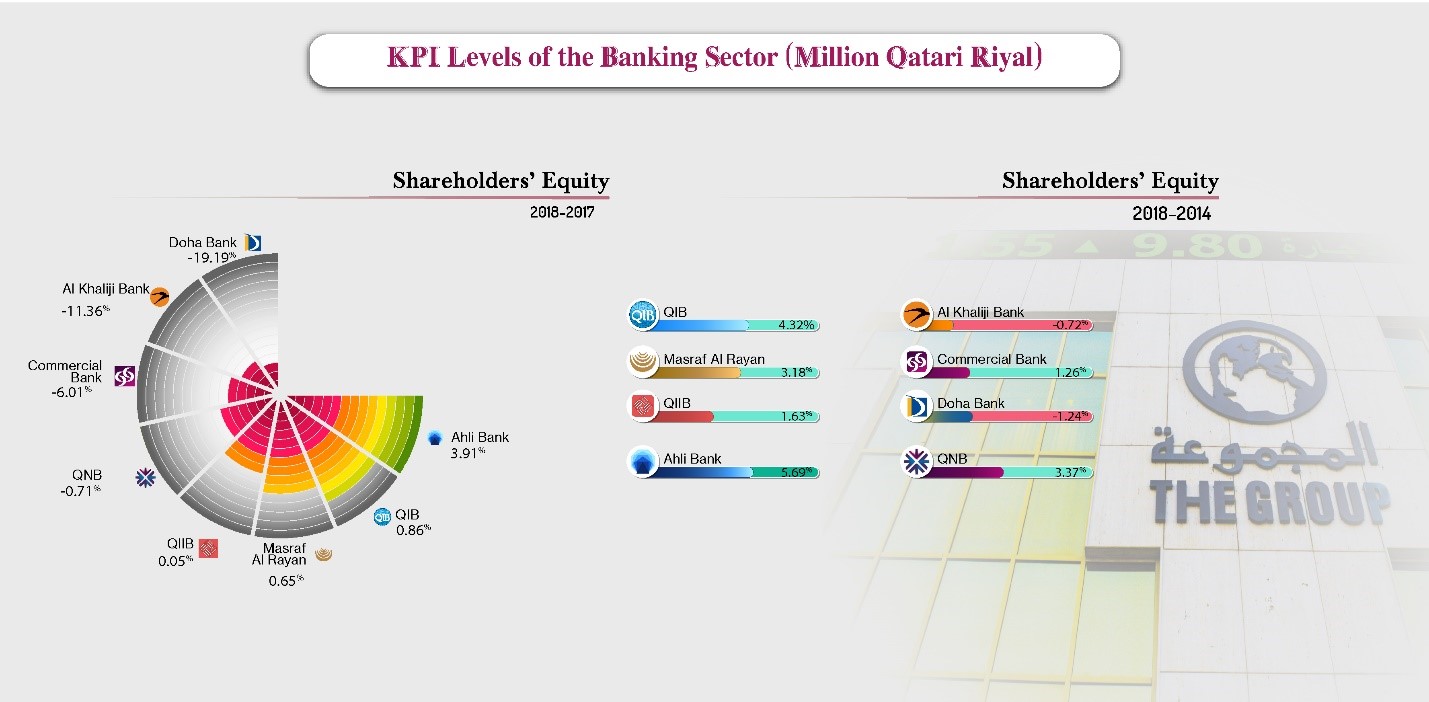

Shareholders’ Equity: The implementation of Accounting

Standard 9 has had a significant impact on shareholders' equity

for the year 2018. Doha Bank was the most adversely affected, as

its shareholders' equity declined by 19%, followed by Al Khaliji

Bank with a drop of 11%, while Ahli Bank was the least affected

and witnessed an increase of its shareholders’ equity of about

4%.

2.

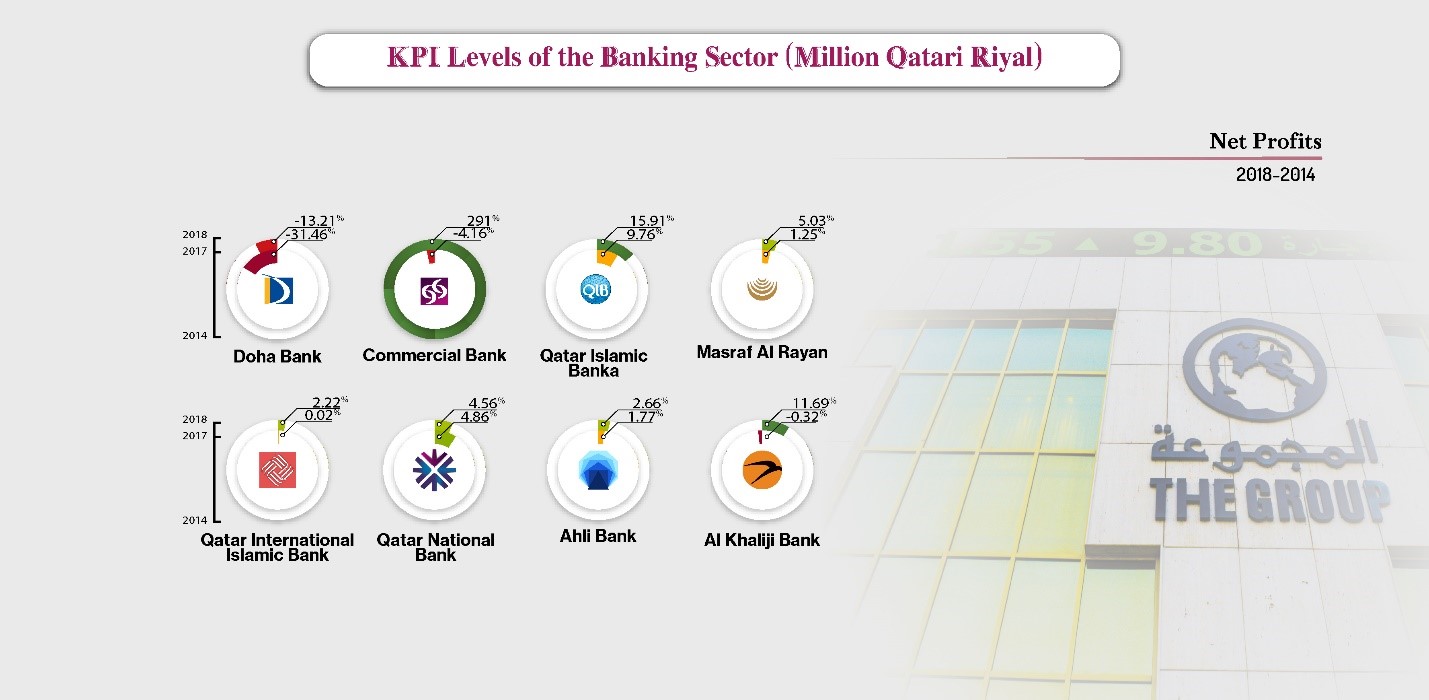

Net Profits: Doha Bank, in addition to being the

biggest loser in terms of shareholders' equity, the bank also

witnessed a considerable decline in profits by about 31%. Its

compound growth rate for the period 2014-2018 dropped as well by

about 13%, the lowest among banks. On the other hand, Qatar

Islamic Bank led the banking sector with an increase in its

compound growth rate of about 10%, followed by QNB with about

5%.

3.

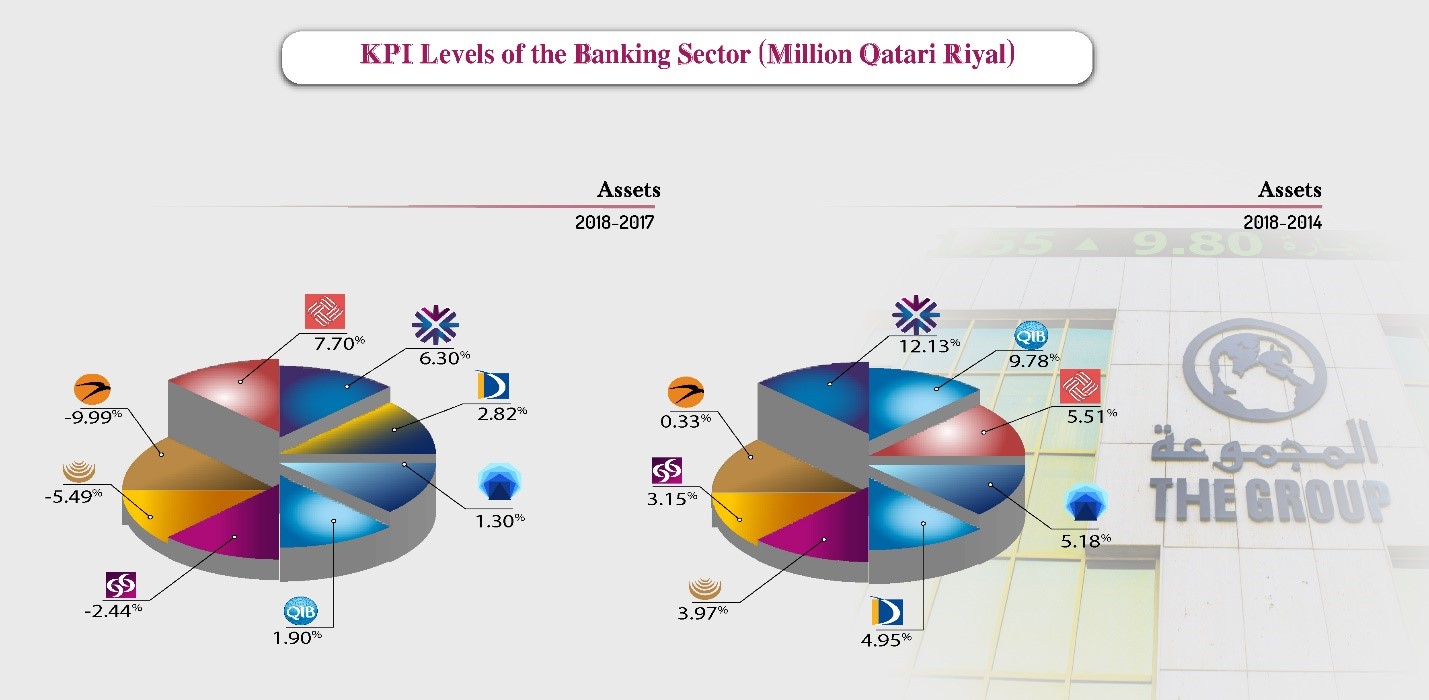

Assets: Al Khaliji Bank ranked the lowest

in terms of assets in 2018, with a decline of about 10%. Al

Khaliji achieved the lowest rates among Qatari banks in terms of

asset size in 2014-2018, with a growth of less than 0.50%.

4.

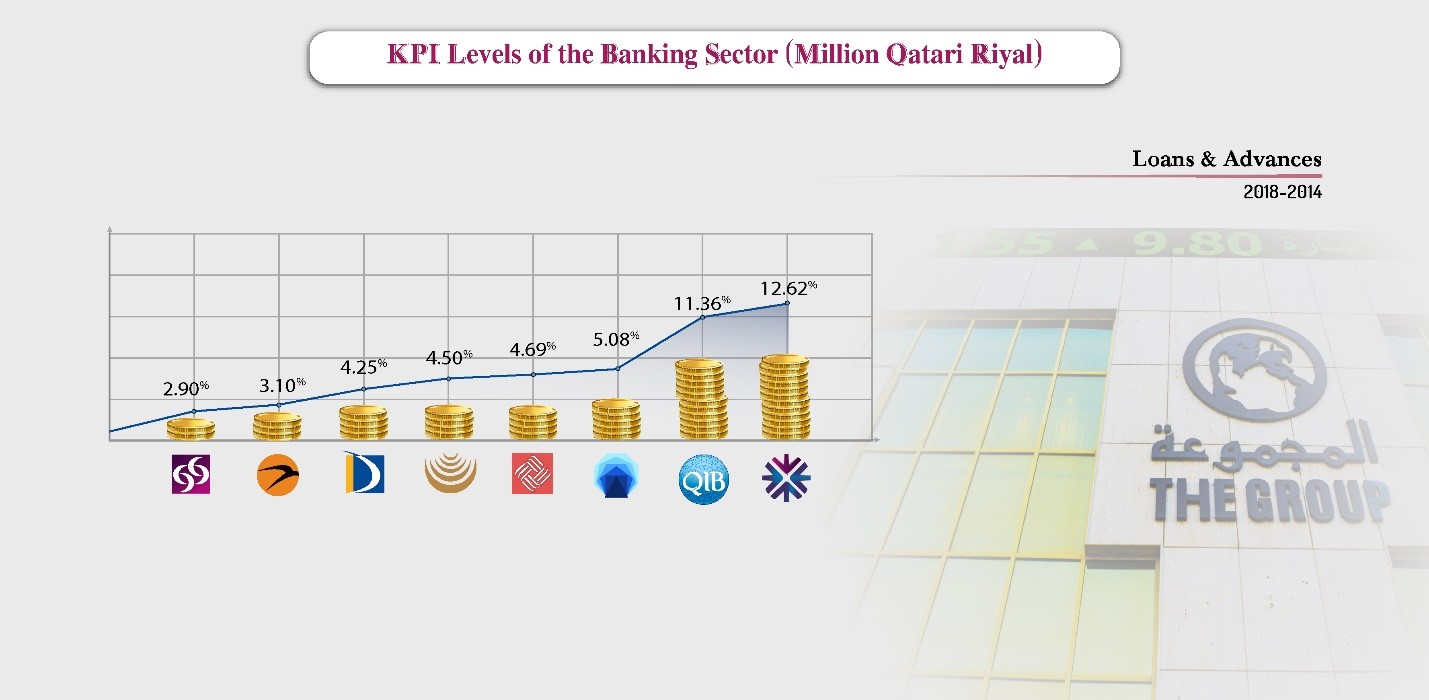

Loans & Advances: Qatar National Bank (QNB) ranked

first in 2018 in terms of loans and advances portfolio by 4.8%.

QNB’s portfolio increased by 13% in the period 2014-2018,

followed by Qatar Islamic Bank (QIB). Qatar International

Islamic Bank (QIIB) however was the biggest loser in 2018 with a

decline of 16%, followed by Al Khaliji Bank by about 11%.

Nonetheless, the bank that fell behind the most in terms of

loans and advances in the past five years was the Commercial

Bank, with a decline of about 3.0%, followed by Al Khaliji Bank.

5.

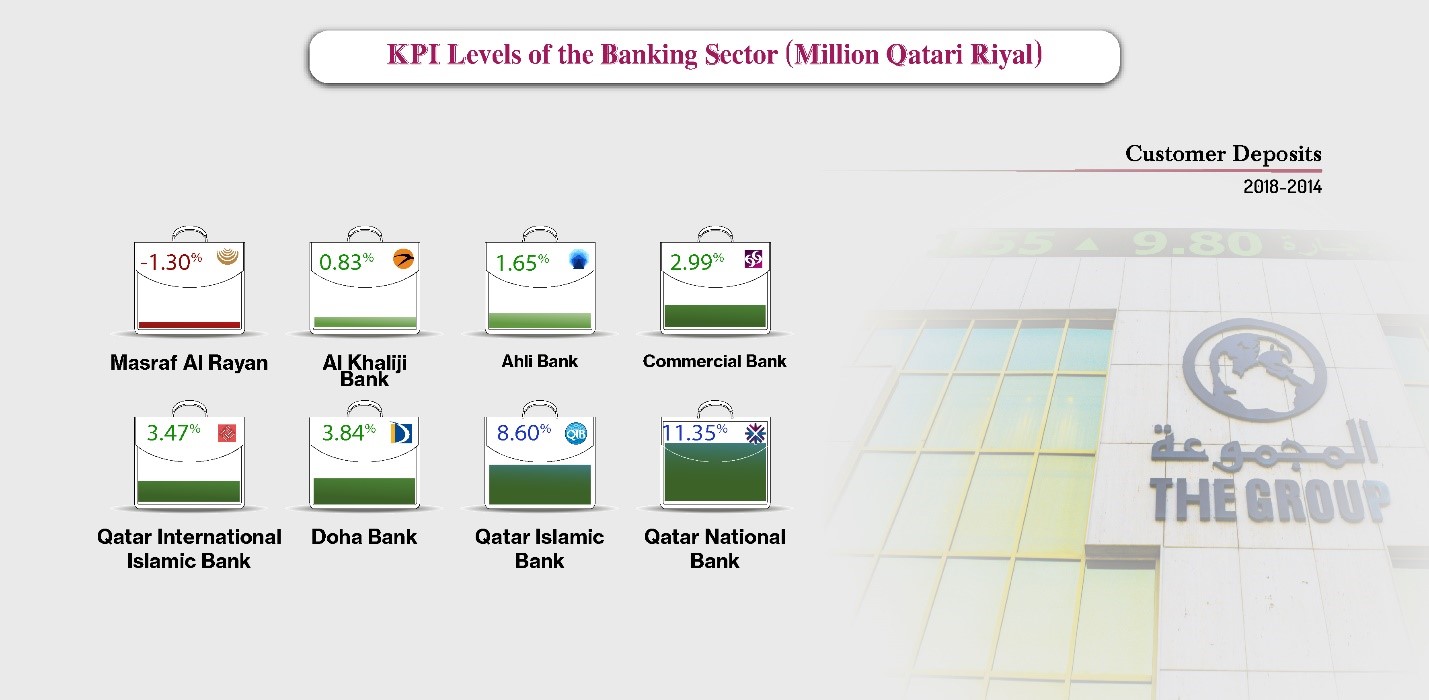

Customer Deposits: QNB was the only bank in the sector

to achieve growth in customer deposits for 2018, with an

increase of 5.3%, while all other banks recorded a decline. The

largest drop was experienced by Al Khaliji Bank, with a drop of

12.5%. Qatar National Bank led this category over the past five

years, with about 11%, while Al Rayan Bank came in last with its

customer deposits down 1.3%.

|