|

(The Group’s Comments) Al Khaliji’s Net Profit Rises 6%

to QAR 497 Million in Q3 2019

Ø

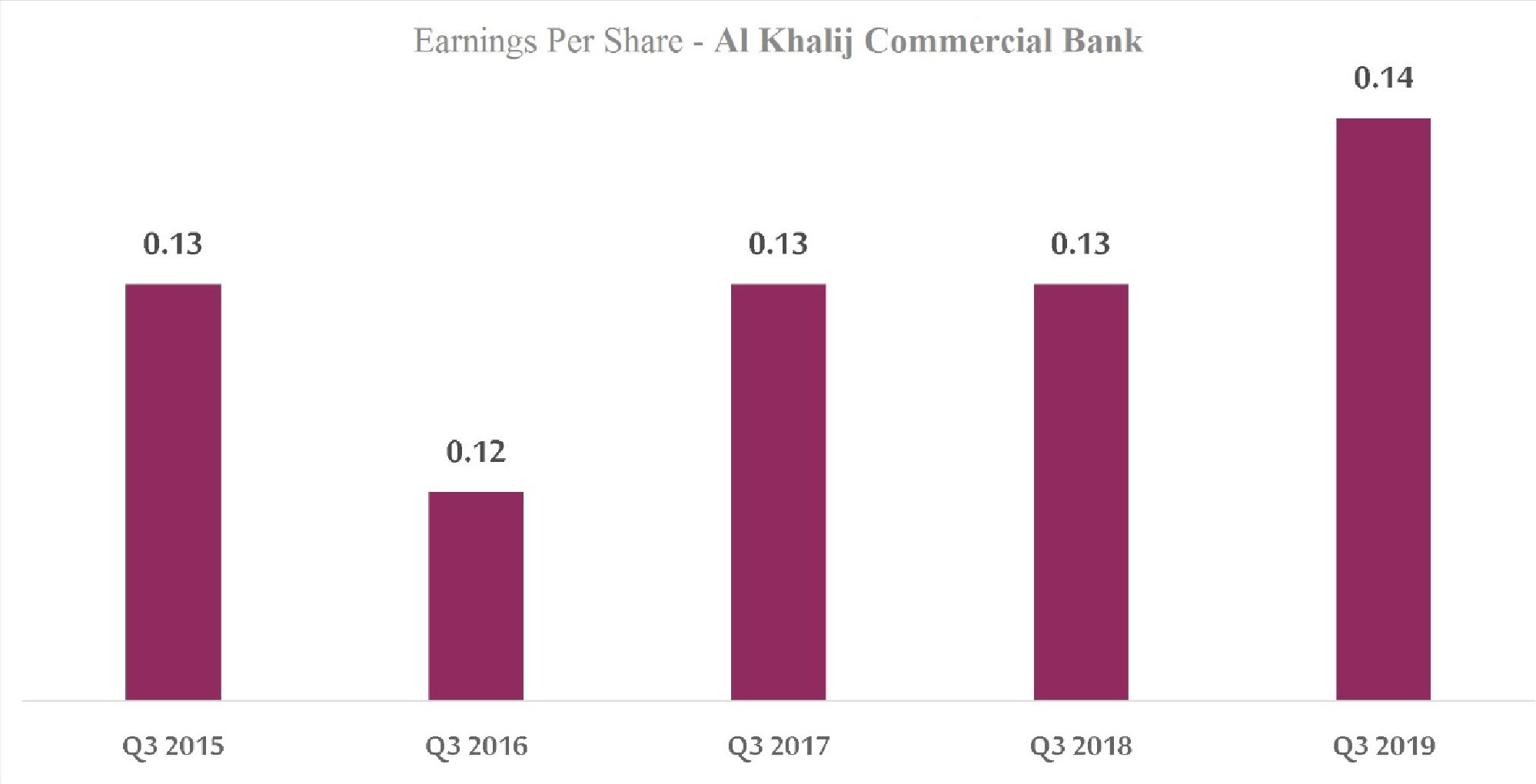

Profits: increased by 6% to QAR 28 million for the nine months period ended

30 September 2019, recording QAR 497 million, compared to QAR

469 million for the same period in 2018. The bank’s earnings per

share amounted to QAR 0.138 compared to QAR 0.13 for the

corresponding period of the previous year. As for the profits of

the third quarter, they stood at QAR 144.8 million, compared to

QAR 133.7 million for the same period in 2018.

Ø

Comprehensive Income: The bank posted an assessment profit through the statement of

comprehensive income near QAR 55.66 million, versus QAR 61.47

million recorded in the previous year.

Ø

Operating Income: climbed by 1.1% to QAR 896 million, in comparison to QAR 887

million in the same period last year, due to an increase of QAR

42.5 million in the net interest income. In contrast, net

commission income decreased by QAR 16.1 million, and foreign

currency profits by about QAR 17 million.

Ø

Operating expenses & Allocations: dropped by QAR 23 million to settle at QAR 383 million, compared to

QAR 406 million in the same period of last year. This drop was

due to the QAR 23 million decrease in the allocations for the

decline in loans and advances of customers, which stood at about

QAR 136 million, compared to QAR 159 million for the

corresponding period of 2018.

Ø

Assets: loans and advances decreased by 9% compared to the same period in

2018, while client deposits dropped by 14 %. The ratio of loans

to customer deposits stood at about 109.9%, and non-performing

loans settled at 1.93% of the total loans. As for return on

equity for the third quarter of 2019, it amounted to 7.24%,

compared to 7.14% for the corresponding period of 2018, and the

bank’s book value amounted to QAR 1.91 per share.

|