The Group’s Comment on QIB Net Profit in 2019 Surges 10.9% to 3.05

Billion Riyals

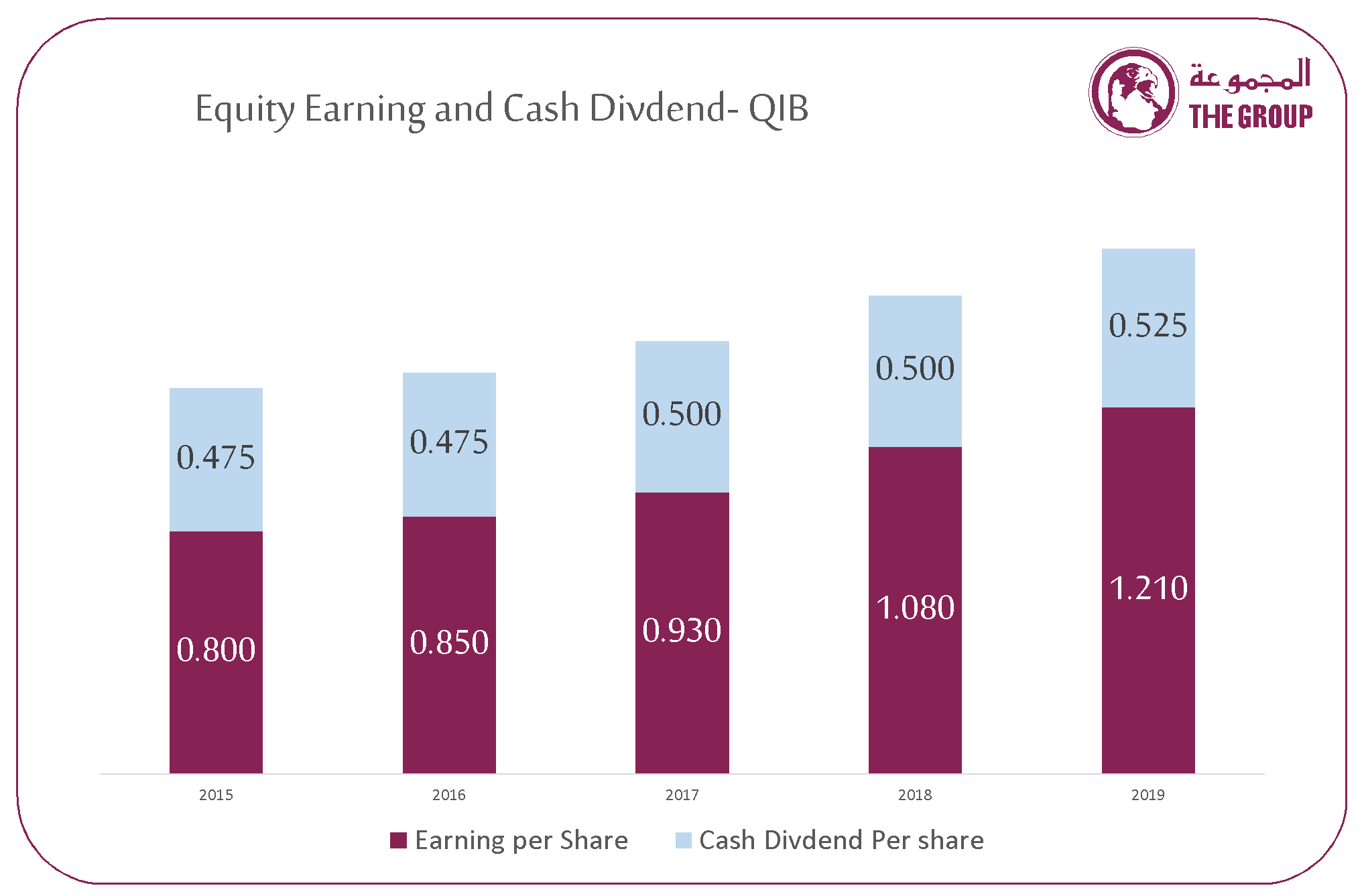

Profits: Net profits after the payment of the profit of Sukuk holders as

additional capital for the year 2019 reached 2,850.4 million riyals

against 2,550.3 million riyals for the year 2018, with a rise of 11.76%.

Earnings per share jumped to 1.21 riyals against 1.08 and regarding the

earnings of the fourth quarter, they it reached 840.1 million riyals

against 750 million riyals for the same period in the former fiscal

year.

Operation

Revenue: the operation income made 12.4% growth during the period and they

reached around 7,738.2 million riyals against 6,882.9 million riyals for

the same period in 2018. This growth occurred as a result of surge in

the net income of financing and investment by 928.6 million riyals and

at a rate of 15.5%. Additionally, net fees and commissions increased by

117 million Riyals. However, on the other hand, profits of foreign

currencies declined by about 200 million riyals.

Assets:

financing assets increased by about 11% in comparison with the same

period in 2018 during which they reached 113,753 million riyals. These

assets constitute about 69.6% of the total assets of the bank. Regard

the quality of these assets, the percentage of unpaid debts reached 1.3%

out of the total loan portfolio. With respect to the holders of

registered accounts (similar to customer deposits in the commercial

banks) increased by 13.3% to reach 96,641 million riyals, to form the

percentage of financing assets for the holders of registered accounts at

about 117%.