(The Group’s Comment) Al Khalij

Commercial Bank Results

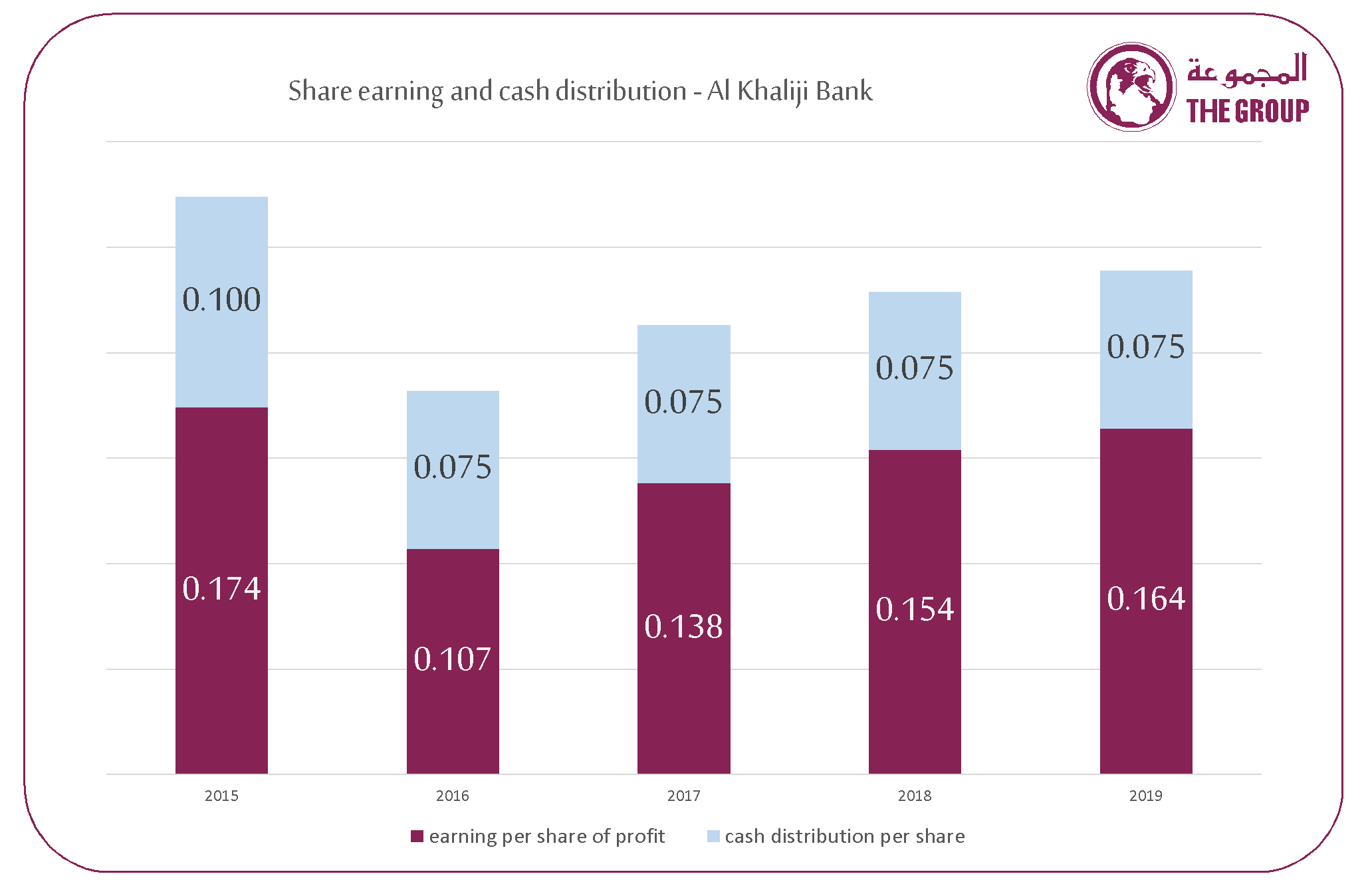

Net Profits: Bank’s net profits, free of payment of interests on

the additional capital, amounted to QAR 591.25 million compared to QAR

553.40 million of 2018, an increase of 6.8% while earnings per share

amounted QAR 0.164 vs QAR 0.154 for 2018.

Comprehensive

Income: The Bank recorded valuation profits of QAR

116.4 million versus losses of QAR 568 thousand for the preceding year

2018.

Operating

Income: Operating Income increased by 3% to reach

QAR 1177.7 million compared to QAR 1143.5 million. Net interests

increased by QAR 64.6 million recouping the decline in fee revenues and

foreign exchange profits.

Operating

Expenses and Provisions: This item

has declined by QAR 14.1 million to reach QAR 505.4 million against QAR

519.4 million for the preceding year 2018 attributed to the reduction of

the provisions avoided for the amortization of loans’ losses by QAR 14

million.

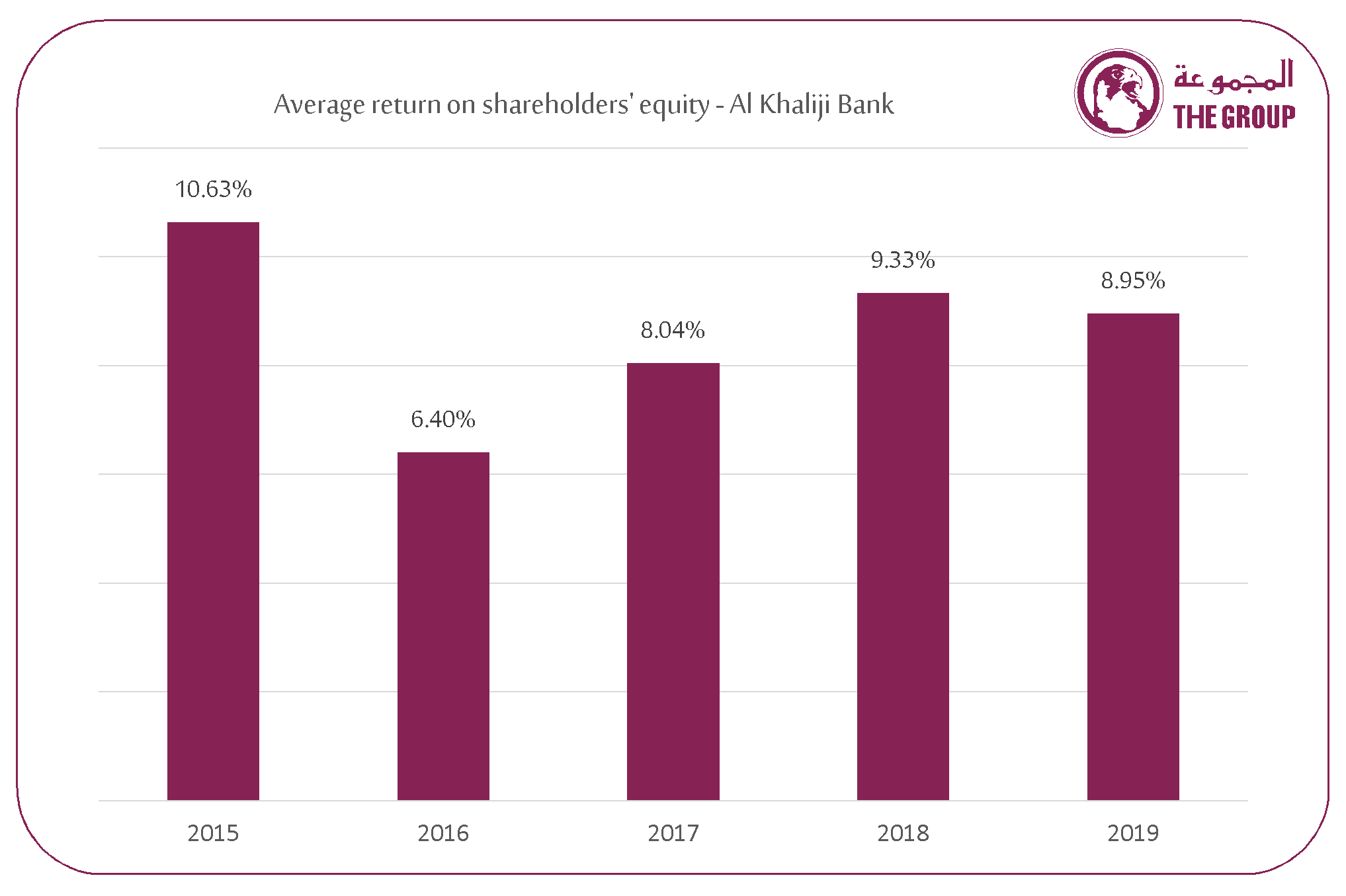

Assets: Loans and advances at the end of the year declined by

2.6%, an amount of QAR 820 million while customer deposits increased by

1.2%. Loans to customers’

deposits ratio was 105.5% while irregular loans to total loans ratio was

1.86%. Return on shareholders’ equity stood at 9.85% and the share book

value stood at QAR 1.67 per share.

Dividends

distributions and market ratios:

The Board of

Directors has submitted its recommendation to the shareholders’ AGM to

distribute a percentage of 7.5 of the share par value (QAR 0.075 per

share) cash dividends for the year 2019 representing 46% of the year’s

net profit. Dividend payout per share stood at 5.47% and the share is

traded at a multiplier of 8.35 times.