|

The Group Securities: Weekly Report on

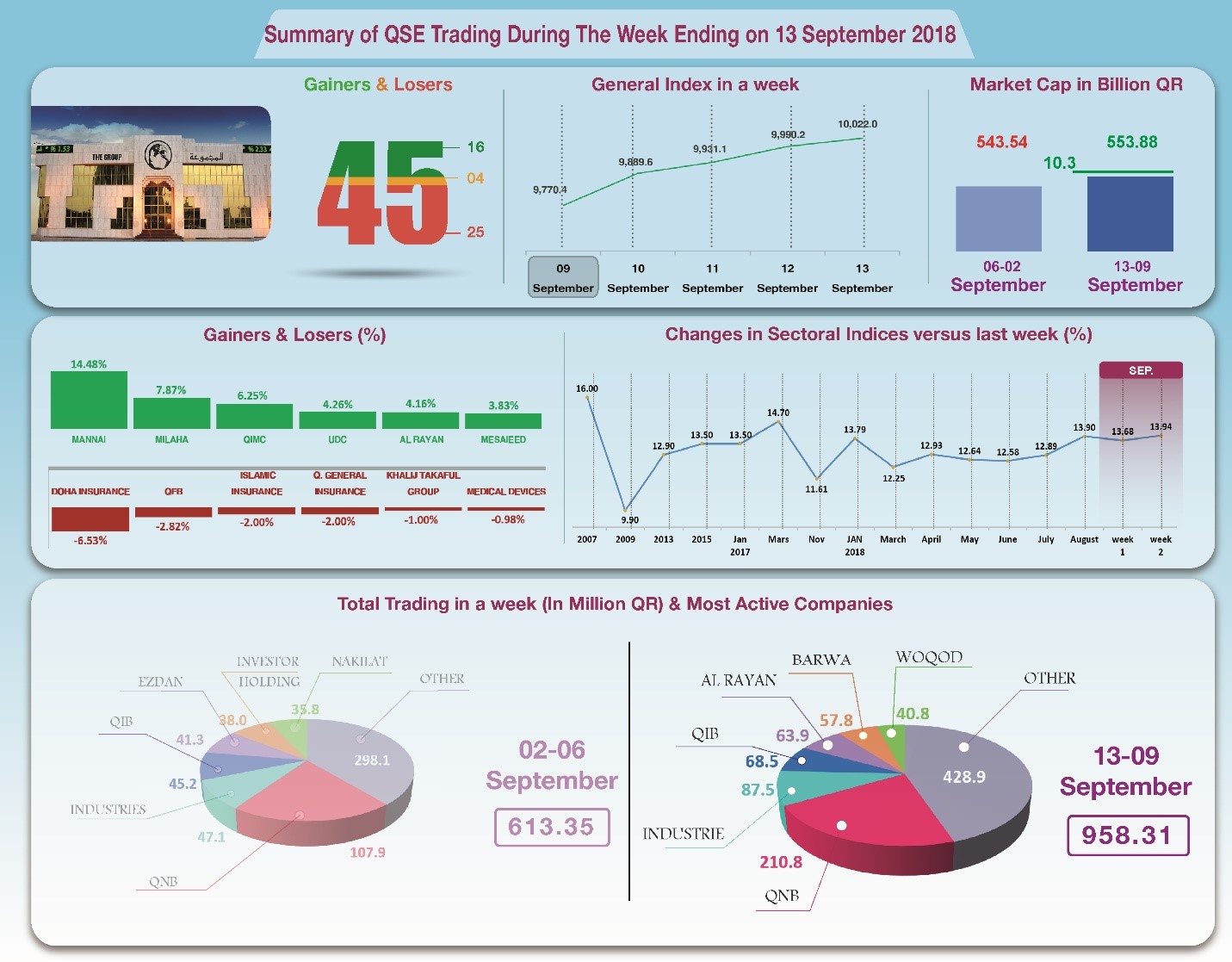

QSE Performance, 9-13 September 2018 General Index Exceeds the Level of 10,000 Points

September 16, 2018

Although they remained below QR1 billion,

Qatar Stock Exchange’s trading volumes climbed back following

the recovery of oil prices, and reached QR958.3 million in a

week, a daily average of QR191.7 million. This had a positive

impact on the share prices leading to an increase in the shares

of 28 companies, headed by Mannai and Milaha. However, the

shares of 14 companies declined, led by Doha Insurance. All

seven sector indices increased, especially transportation. As a

result, the general index rose by nearly 2%, and managed to

exceed the level of ten thousand points.

In depth, the general index increased by about 195 points or 1.99%,

to the level of 10,022 points, while Al Rayan Islamic Index rose

by 1.97%. All sector indices have increased, namely

Transportation, Services and Industry. It has been noticed that

the share price of Mannai was the top gainer, up by 14.48%;

followed by Milaha by 7.87%, QIMC by 6.25%, and UDC by 4.26%,

then Al Rayan by 4.16%. In contrast, the share price of Doha

Insurance was the biggest loser, down by 6.53%, followed by

Qatar First Bank by 2.82%, Islamic Insurance and General

insurance by 2% each, then Alkhaleej Takaful by 1%.

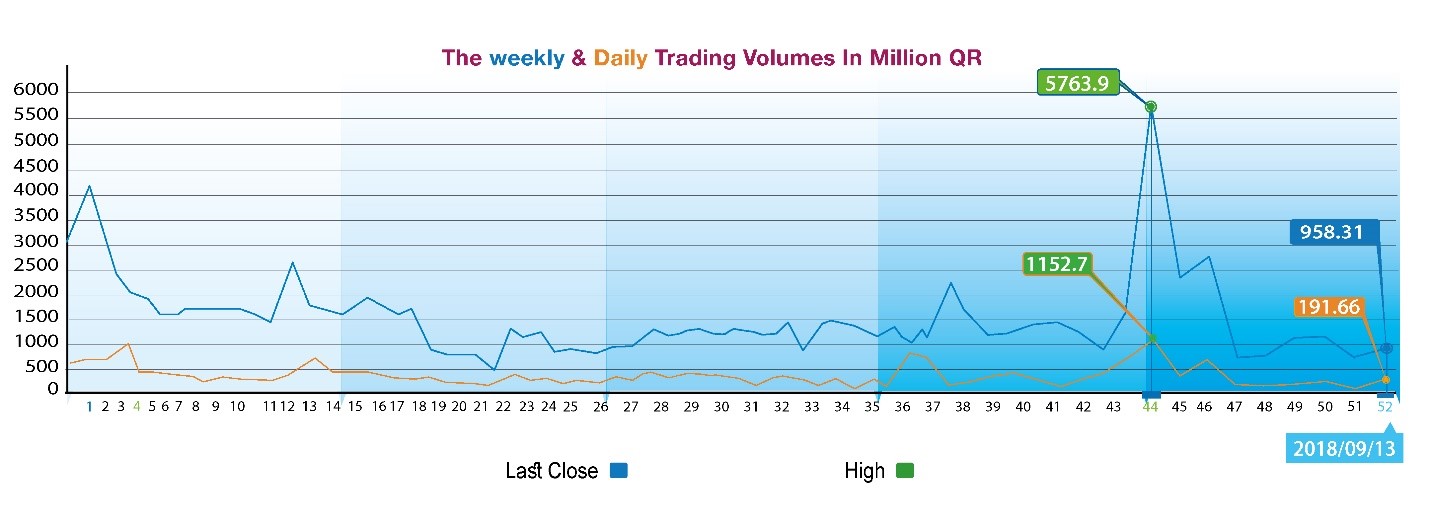

The total trading volume increased by 56.2% to the level of QR958.3

million in a week, so the average daily trading volume climbed

to QR191.7 million. QNB led the traded shares with a volume of

QR210.8 million, followed by the share of Industries Qatar with

QR87.5 million, QIB with QR68.5 million, and Al Rayan with

QR63.9 million. It was noticed that Qatari portfolios made net

sales of QR131.6 million, while Non-Qatari portfolios dominated

the net purchases by QR243 million. Qatari individuals made

total net sales of QR108.1 million, whereas foreign individual

investors made net sales of QR3.3 million. As a result, QSE’s

total capitalization rose by QR10.3 billion to reach QR553.9

billion, and the P/E ratio climbed to a multiple of 13.94 from

last week’s 13.68.

Corporate News:

1-

It has been

decided that the shares of Mesaieed Petrochemical Holding, Qatar

Fuel and Qatar Insurance will replace Al Meera Consumer Goods

Company, Investment Holding Group and Qatari Investors Group in

the QE Index, as of 1st of October 2018.

2-

Qatar First

Bank disclosed that one its subsidiaries signed a conditional

sale agreement to sell all its shares in a Turkish company. The

bank explained that its subsidiary has completed the sale and

transfer of all its owned shares to the buyer. The deal was

consummated at a valuation of US $30 million which is very close

to QFB’s book value. It should be noted that the purchase price

will be paid on a deferred basis. It should also be noted that

the size of the transaction doesn’t represent more than 10% of

the bank’s total assets.

3-

Al Meera

Consumer Goods Company has signed a contract with Qatar Rail to

operate a number of convenience stores in the red and green

lines in Doha Metro.

4-

CEO of Qatar

Fuel (Woqod) said that, the company has recently floated tenders

for the construction of 4 fuel stations on the Orbital Highway

and the new truck road connecting Mesaieed, Hamad Port, Dukhan,

Lusail and Al- Khor. He added that the company has opened and

operated 8 stations during the past months of this year 2018.

The construction work is underway for another 26 permanent and

mobile stations, most of which will be opened by the end of this

year.

5-

Qatar

Industrial Manufacturing Co. (QIMC) announced that it has signed

a memorandum of understanding with a German consulting firm

specialized in providing technical and advisory services to the

glass industry worldwide.

6-

Moody's stops

its evaluation of Ezdan Holding Group.

Economic Developments:

1-

Inflation increased to 0.6% in August, from 0.2% recorded in the

previous month of July.

2-

Oil prices rose more than 2% on Tuesday as Iranian crude exports

suffered U.S. sanctions and after U.S. crude oil production was

forecast to grow at a slower rate than previously expected,

prompting supply concerns.

OPEC oil increased by about US $1.98 to the level of US $77.16 per

barrel until Wednesday 12 September. Qatar Petroleum announced

that the prices of Qatar oils for the month of August have

declined to the level of US $74 per barrel, versus US $75.25

during the month of July.

3-

Dow Jones increased by about 173 points until closing on Thursday

to the level of 26183 points. US dollar stood at $1.17 against

the Euro, and climbed against the yen at ¥111.84 per dollar.

Gold gained about US $1 to climb up to the level of US $1211 per

ounce.

.

|