|

The Group Securities: Weekly Report

on QSE Performance, 07-11 August, 2016

A

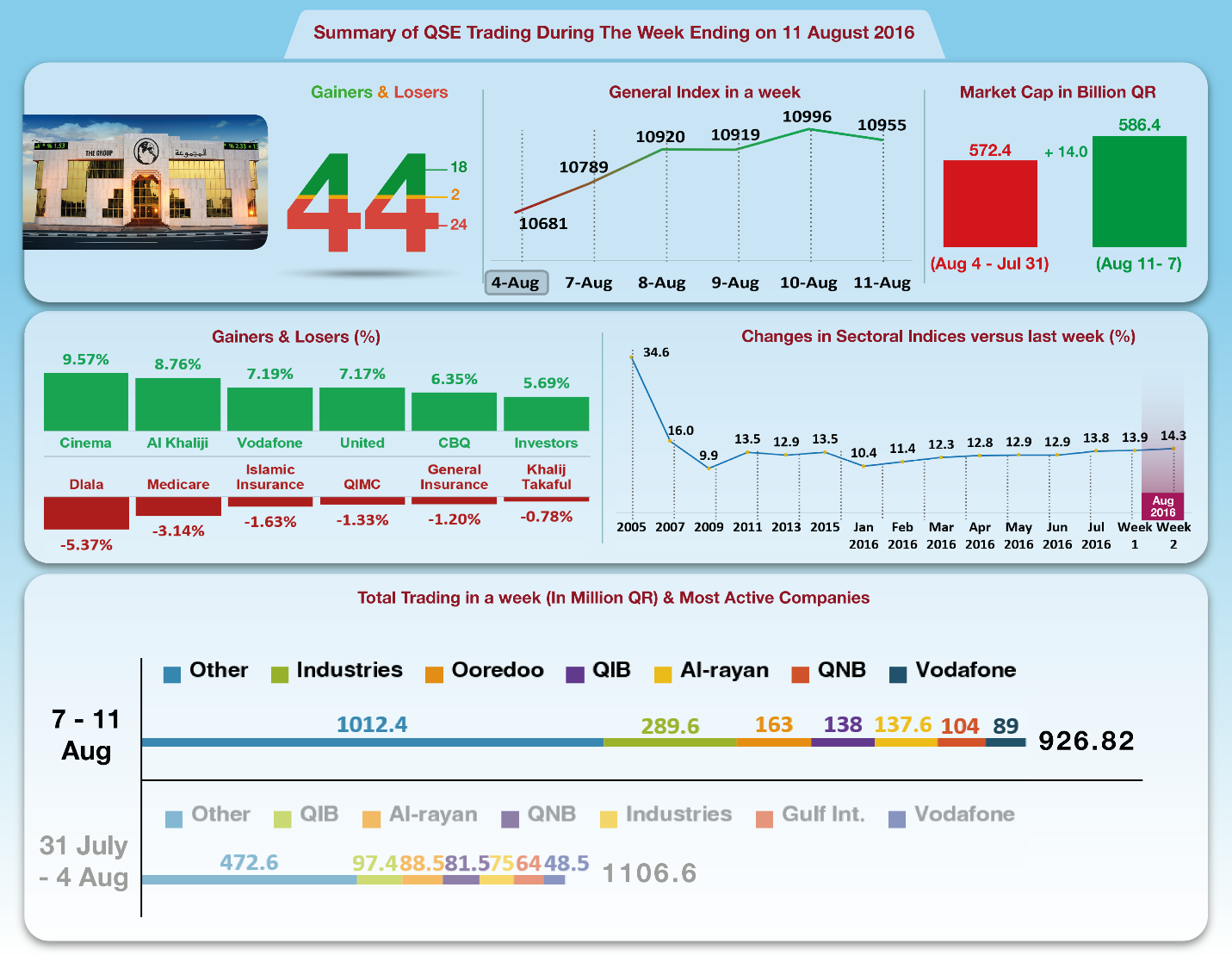

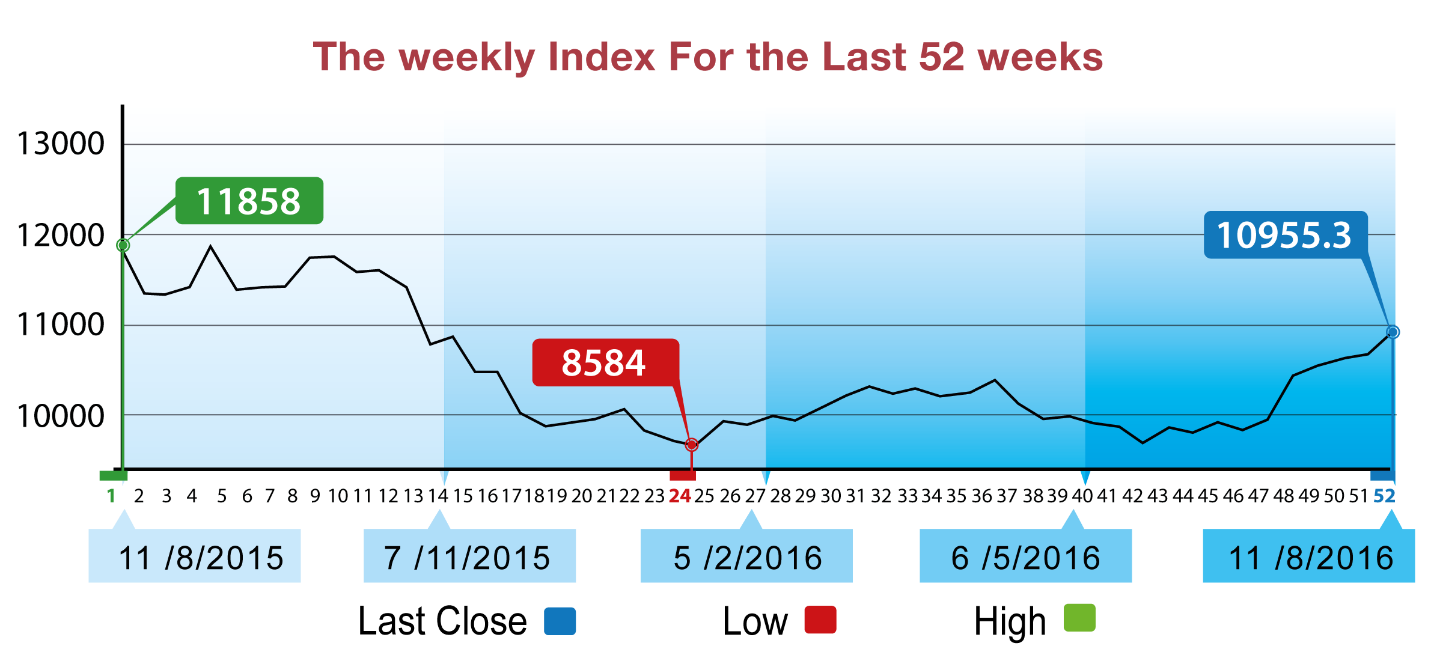

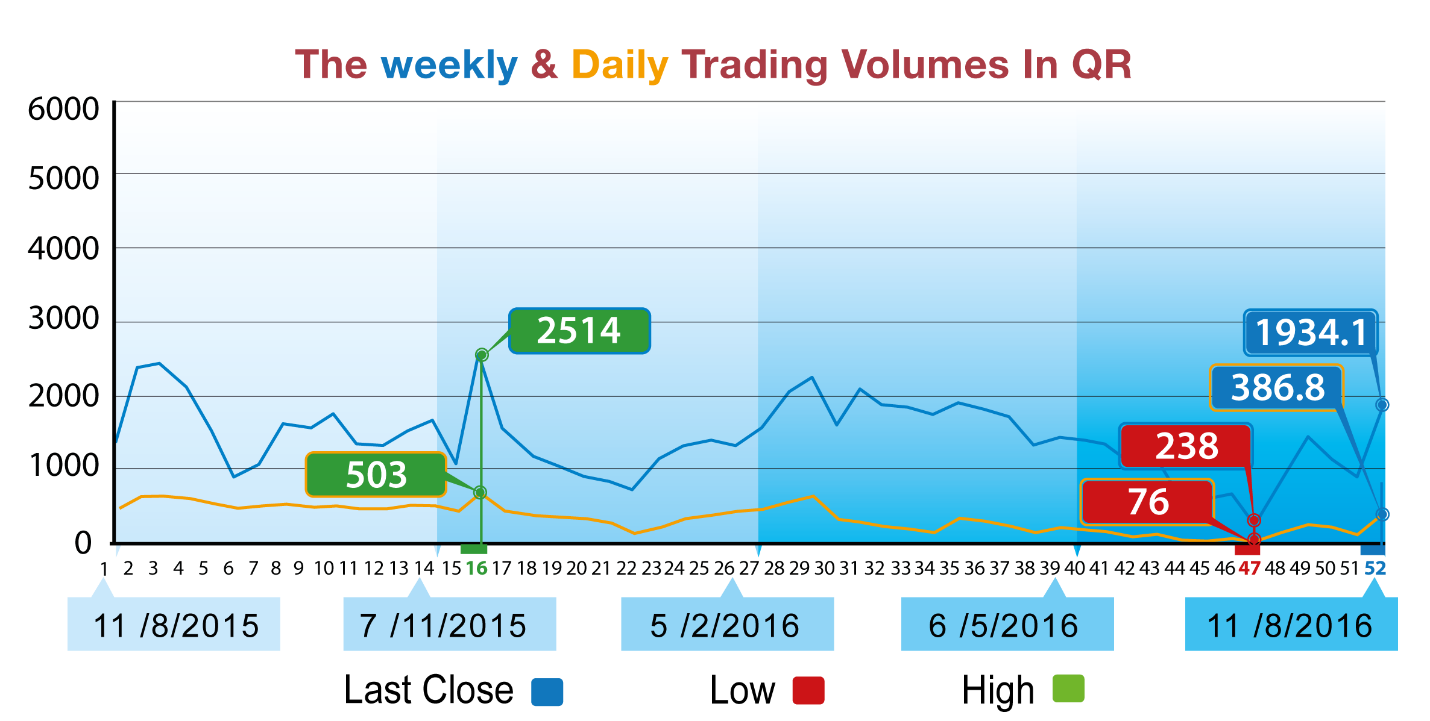

noticeable change marked the QSE this week, as trading volumes

increased by 108% to QR1934 million, with a daily average of

QR386.8 million. This increased boosted the liquidity of the

market, hence the rise of all shares and groups. The general

index managed to go past the resistance barrier of 10650 points

into a new resistance level at 110000 points.

External factors were also instrumental in this rise;

namely the steady price of OPEC oil well above $ 40 per barrel.

Half of the companies, which disclosed their financials this

week, posted an increase in their profit; namely Widam,

MESAIEED, Dlala, Al Meera, and Salam International. By the end

of the week, general index had risen by 274 points, or 2.57%, to

the level of 10955 points. The share price of 36 companies

increased, while seven ones went down. As result, the total

capitalization increased by QR14 billion to the level of QR586.4

billion. Price to earnings ratio (P/E) doubled 14.31 times,

compared to 13.95 last week. Weekly data has revealed that

foreign portfolios dominated net buy transactions worth QR 355.9

million, compared to net sale transactions by other categories

of investors, namely Qatari individuals. The Group reviews QSE

performance with illustrative

charts combined

with corporate business news, and a list of the affecting

economic factors.

Corporate News:

1-- Al Meera Consumer Goods disclosed its audited financial

statements for the period ended on 30.06.2016 showing a net

profit of QR102,350,485 compared to QR100,876,782 in the

corresponding period last year. Al Meera's total profit

increased 10.7% to QR 263.8 million in the first half of this

year, including QR 215.4 million as revenues from its business

activities, and the rest is made from other sources of income.

Total expenses increased 17.6% to QR137.1 million. As

result, net profit attributable to shareholders increased by

1.5% to QR102.3 million. The company incurred losses as result

of change in the fair value of investments worth QR 11.3

million, which reduced the comprehensive income to QR91.1

million.

2-- Doha Insurance disclosed its audited financial statements

for the period ended on 30/06/2016 showing a net profit of QR

20.9 Million Compared to QR 44.4 Million in the corresponding

period last year. Doha Insurance's net operational income

increased QR1.3 million to QR 48.3 million; but revenues from

other investments declined sharply to QR 6.4 million, compared

to 35.8 million in the same period last year. Expenses dropped

by 4.1 million to QR 33 million. As result, the profit

attributable to shareholders fell by 55 % to QR 20.1 million.

The company made profit from change in the fair value of

investments worth QR2.5 million; thus bringing the comprehensive

income to 23.4 million.

3-- Mesaieed Petrochemical Holding Company (MPHC) net profits in

the first half of the year rose to QR 489.7 million compared to

QR 402.8 million in the corresponding period last year. Earnings

per Share (EPS) amounted to QR 0.39 versus QR 0.32 in the

corresponding period in 2015.

The company's total income from its operations rose 21.1% to QR 453.4

million. Total expense slightly fell to settle at QR 8.6

million. As a result, net profit for the period amounted to QR

444.7 million, up 21.7% from the level reached in the

corresponding period last year.

4--

Medicare group disclosed the interim financial statement for the

six-month period ended June 30, 2016. The statements show that

the net profit is QR. 30,6 Million, compared to net profit

amounting to QR. 96 Million for the same period of the previous

year. Medicare group's total income dropped 35% to QR 100.1

million in the first half of this year. Public and

administrative expenses increased by 7% to QR 62.8 million.

Adding depreciation and financing expenses worth QR15.3

million, and other sources of income, then net profit drops 68%

to QR 30.6 million. Comprehensive income slipped to QR 28.3

million as result of losses in the fair value of investments.

5-- Qatar Islamic Insurance Company disclosed its reviewed

financial statements for the period ended on 30.6.2016. The

statement shows that the net profit is QR 35,7 Million compared

to net profit amounting to QR 50,1 Million for the same period

of the previous year. Qatar Islamic Insurance's total income

dropped 14.1% to QR56.5 million in the first half of this year,

including QR 40.3 million as agency fees. Total expenses

increased by 32% to QR 20.8 million, including QR 15.2 million

as public and administrative expenses.

As result, net profit dropped by 28.9% to QR 35.7

million.

6-- Dlala Brokerage and Investment Holding Company disclosed its

reviewed financial statements for the period ended on

30.06.2016. The statements show that the net profit is QR 1.25

million compared to net loss amounting to QR 16.98 million for

the same period of the previous year. Dlala's total income from

commissions dropped 43% to QR11.1 million in the first half of

this year. Total operational income decreased to QR 16.3

million. Expenses dropped by QR2.1 million to QR12.1 million.

Adding other items, including QR4.2 million as losses as result

of change in the fair value of investments, then net profit

amounts to QR 1.2 million, compared to net loss worth QR 16.98

in the same period last year. Comprehensive income reached QR

3.51 million, with a total loss of 4.7 million in the same

period last year.

7--

Mannai Corporation profits in the first half of the year fell to

QR219.6 million compared to QR 276.3 million in the

corresponding period last year. Earnings per Share (EPS)

amounted to QR4.81 versus QR 6.06 in the corresponding period in

2015.

Total revenues of Mannai Corporation in the

first half of the year declined 6% to QR 736.4 million, of which

QR 607.7 million direct activities profit. General,

administrative, selling and distribution expenses dropped 1.5%

to QR 407.8 million while finance charges and depreciation rose

to QR 109.8 million. As a result, net profit fell 20.5% to QR

219.6 million.

8--

Salam International Investment Limited Company

net profit in the first half of the year amounted to QR

47.5 million

compared to QR 44.9 million in the corresponding period last

year. Earnings per

share amounted to QR 0.42 versus QR 0.39 in the corresponding

period in 2015. Total operating profit for Salam International

in the first half of the year settled at the level of QR 303.1

million with a slight increase above the level reached in the

corresponding period last year. Total revenue rose 5.4% to QR

406.7 million. Total expenses rose 6.3% to QR 356.7 million. As

a result, net profit attributable to shareholders increased 6%

to QR 47.5 million.

9--

Widam Food Company

net profit in the first half of the year amounted to QR

44.1 million compared to QR 32.9 million in the corresponding

period last year. Earnings per share stood at QR 2.46 versus QR

1.83 in the corresponding period in 2015. Total operating loss

for Widam Company in the first half of the year declined 17.5%

to QR 110.9 million and government support decreased QR 3.4

million to reach QR 177.7 million. General and administrative

expenses rose 64.9% to QR 24.4 million. As a result, net profit

rose 34.3% to QR 44.2 million.

Affecting Economic Developments:

1--

Banks' consolidated balance sheet of June has been released, and

data shows an increase in total assets worth QR 0.8 billion to

QR 1178.6 billion. The total government and public sector's

deposits rose by 3.7 billion to QR 199.5 billion, while total

domestic debt dropped by QR 14.9 billion to QR 375.7 billion.

Private sector's credit increased to QR 421.1 billion and the

total domestic private sector deposits increased by QR 2.7

billion to QR 336.9 billion.

2--

OPEC oil prices increased by $1 to reach the level of $40.62.

3--

Last week, Dow Jones index rose about 32 points to reach the

level of 18576 points. US Dollar exchange rate fell to the level

of 101.32 yen and fell against the euro to become $ 1.12 per

euro. Gold price remained unchanged and stood at the level of $

1341.7 per ounce.

|