|

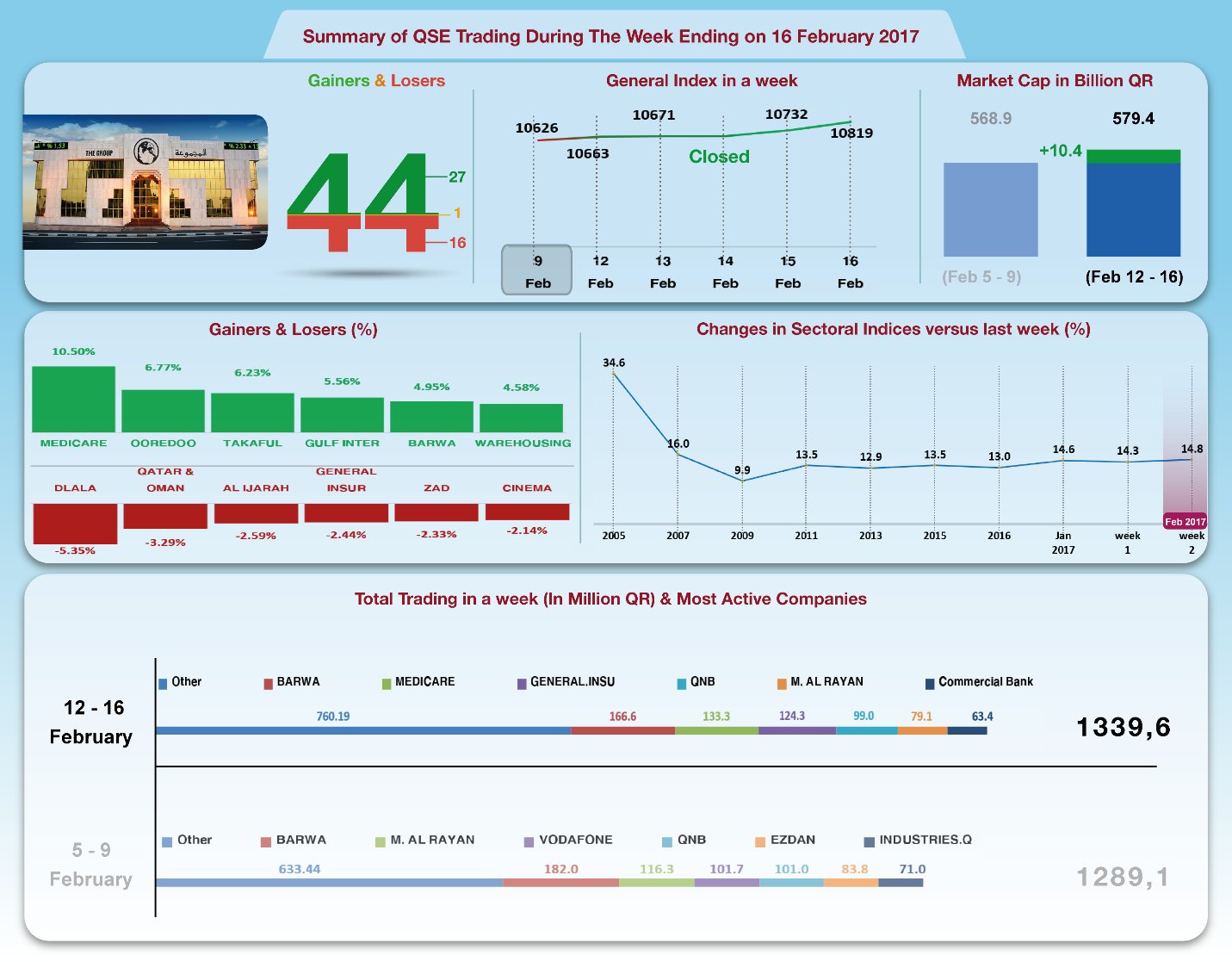

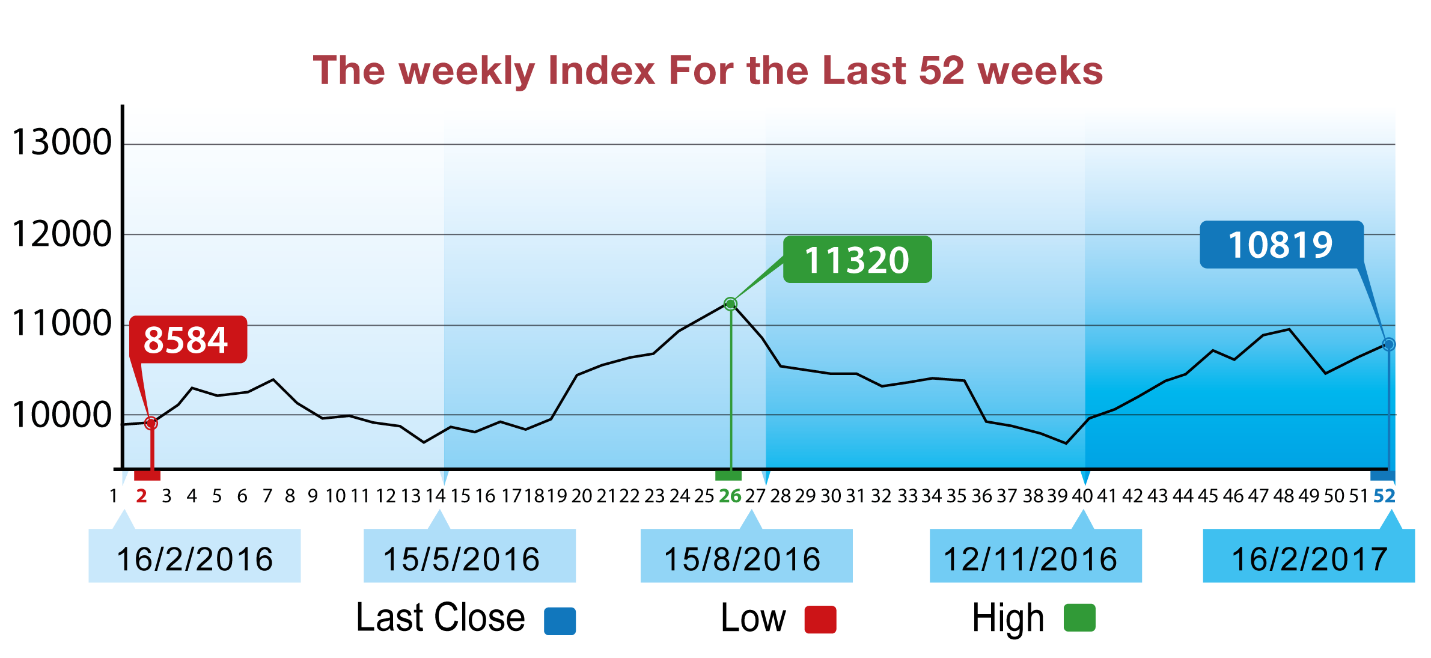

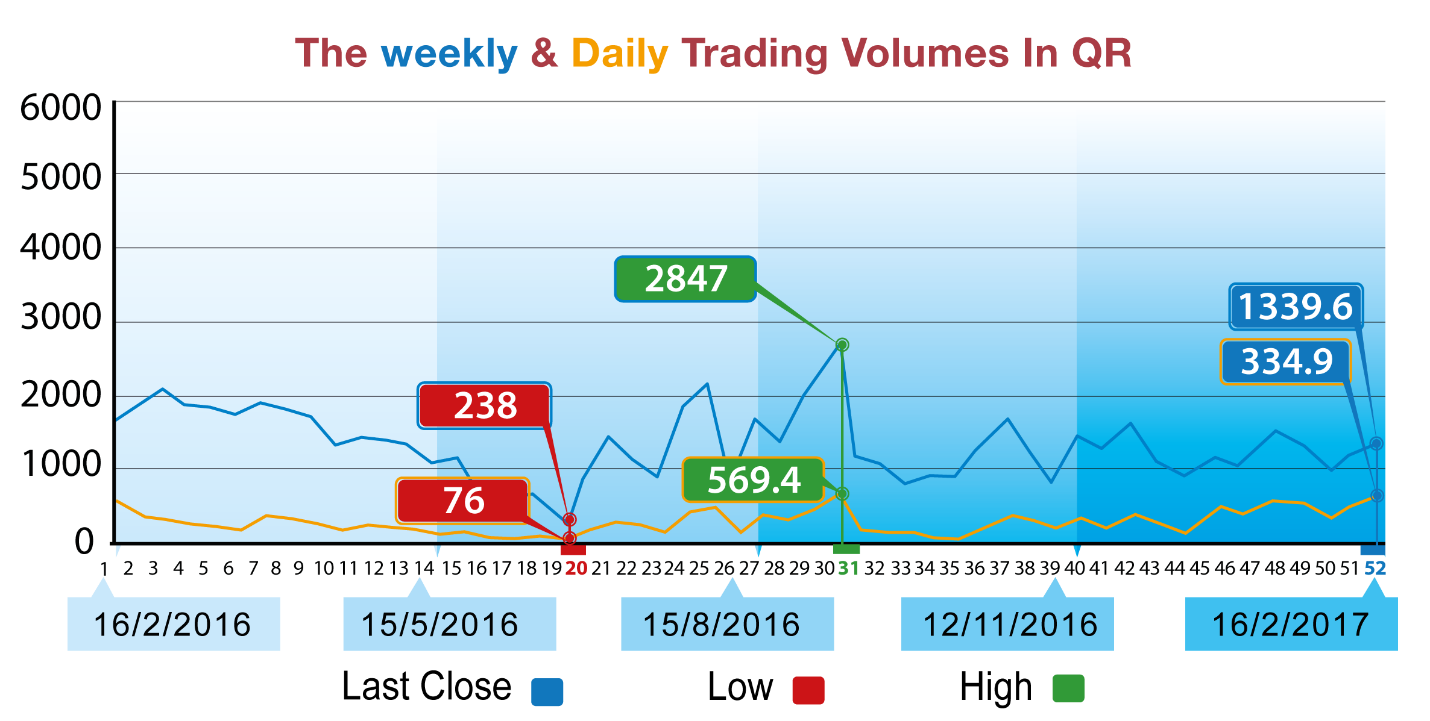

The Group Securities: Weekly Report on QSE Performance,

12-16 Feb 2017

Last week, only a few companies released

their financial results, namely Qatar

Islamic Insurance, Qatar General Insurance,

Qatar Oman Investment Co, and Waqood which

disclosed its results late on Thursday. All

of these financials were negative and less

than those of last year. Investment Holding

Group also disclosed the result of

subscription in its share, which did not

exceed 30% of the share capital. However,

despite these facts, daily average trading

increased a bit, and all sectoral indices as

well as total capitalization increased.

Non-Qatari individuals and portfolio

investors dominated net buying as against

net sale by Qatari portfolio and individual

investors. The Group reviews QSE performance

in this week with illustrative charts

combined with corporate business news, and a

list of the affecting economic factors.

Corporate News:

1— Qatar Islamic Insurance net profit

amounted to QR 63,502 million compared QR

81,988 million for the same period of the

previous year. Earnings per Share (EPS)

amounted to QR 4, 23 compared to QR 5, 47

for the same period of the previous year.

The Board recommended distribution of Cash

Dividends of 30 % from the share par value

i.e. QR 3 for each share for the year 2016.

The company's agency fees increased by QR5

million to QR78.3 million in 2016, while

total income dropped by 14% to QR104.3

million. Expenses increased slightly by

QR1.5 million to QR40.8 million. As result,

the company's net profit decreased by 22.5%

to QR 63.5 million.

2-- Qatar General Insurance & Reinsurance's

net profit is QR 219.3 million compared to

QR 925.7 million for the same period of the

previous year. EPS amounted to QR 2.51

compared to QR 10.58 for the same period of

the previous year. Qatar General Insurance

total income dropped by 50% to QR637.5

million compared to QR1227 million,

including QR203.7 million as net premium.

Total expenses rose by QR381.3 million

compared to QR320 million last year. As

result, the company's net profit

attributable to shareholders amounted to

QR219.3 million compared to QR925.7 million.

Comprehensive income dropped to QR 202.2

million.

3-- Qatar Oman Investment's net profit is QR

13,374,260 compared to QR 18,341,064 for the

same period of the previous year. ESP

amounted to QR 0.425 compared to QR 0.582

for the same period of the previous year.

The boards recommend the distribution of 5%

cash dividend equivalent to 50 dirhams per

share. Qatar Oman Investment's total income

dropped to 19.4 million compared to QR25.1

million in the last year, including QR14

million as net investment revenues.

Expenses increased slightly to QR6.33

million. As result, this year's net profit

fell by 26.8% to QR13.4 million. However,

the company incurred losses as result of

negative change in the fair value of

investment worth QR17.7 million, thus

turning profit into a loss in the

comprehensive income worth QR4.3 million,

compared to 6.96 million in the last year.

4-- Woqod disclosed its financial statements

for the period ended on 31.12.2016. The

statements shows that the net profit is QR

883,110,228 Compared to net profit amounting

Restated to

QR 1,050,060,646 For the same period

of the previous year. Earnings per Share

(EPS) / amounted to QR 9.68 For the period

ended 31.3.2016 to EPS amounted Restated to

QR 11.51

for the same period of the previous

year. Approval of the recommendation of the

Board to distribute the profits as a cash

dividend of 70% of the nominal value of

shares (7 Riyals per share), in addition, 9%

bonus shares (9 shares for every 100 shares)

for the fiscal year ending on 31/12/2016.

6-- Qatar First Bank said it sold part of

its stake in a Dubai-based healthcare

service provider, where the Bank owned 10.5%

of its shares.

Economic

Developments

1-- Banks consolidated balance sheet for

January has not been released yet, but that

is of December showed a rise in total assets

compared to November by about QR 70 billion

to stand at QR 1271 billion.

The total domestic public debt,

including bonds, increased by about QR 30

billion to QR 428 billion while the total

domestic private sector deposits rose by QR

4.5 billion to the level of QR 438 billion.

2--Last week, Opec oil prices settled at the

level of $53.14, slightly up by $ 0.38

compared to last Thursday.

3-- Last week, Dow Jones index gained 355

points to reach the level of 20624 points.

US Dollar exchange rate fell to the level of

112.82 yen, and $ 1.06 per Euro. Gold price

settled at the level of $ 1236 per ounce.

|