Home

/

News

Qatari QSE-Listed Banking Sector Major Benchmarks in 2019

· Aggregate

net profits grew above 5% to QAR 24.61 billion.

· Dividends

distributions constituted 43% of the total achieved net profits.

· Average

irregular loans ratio to total loans approached 2.6%.

Doha, 18 February 2020, by the Group Securities,

The Group Securities Company has issued its annual infographic report on

the Qatari banking sector performance during 2019 with a coverage of all

QSE-listed banks. The report presented; a reading to the most

significant cumulative financial data benchmarks for the year ended 31

December 2019 as shown in the banks’ financial statements (2019 gross

net profits), the average net interest margins (difference between the

paid interest on deposits and debt instruments to the interest received

on loans, investments and monetary instruments adjusted to

interest-generating assets), the growth in the loans portfolio, customer

deposits, assets’ quality, capital adequacy ratios (the defense line for

depositors’ monies that measures the bank’s ability to meet potential

losses and reflects the bank’s financial position) and cash dividends

distributions. The published infographics diagramed the most significant

benchmarks of the Qatari QSE-listed banks for 2019.

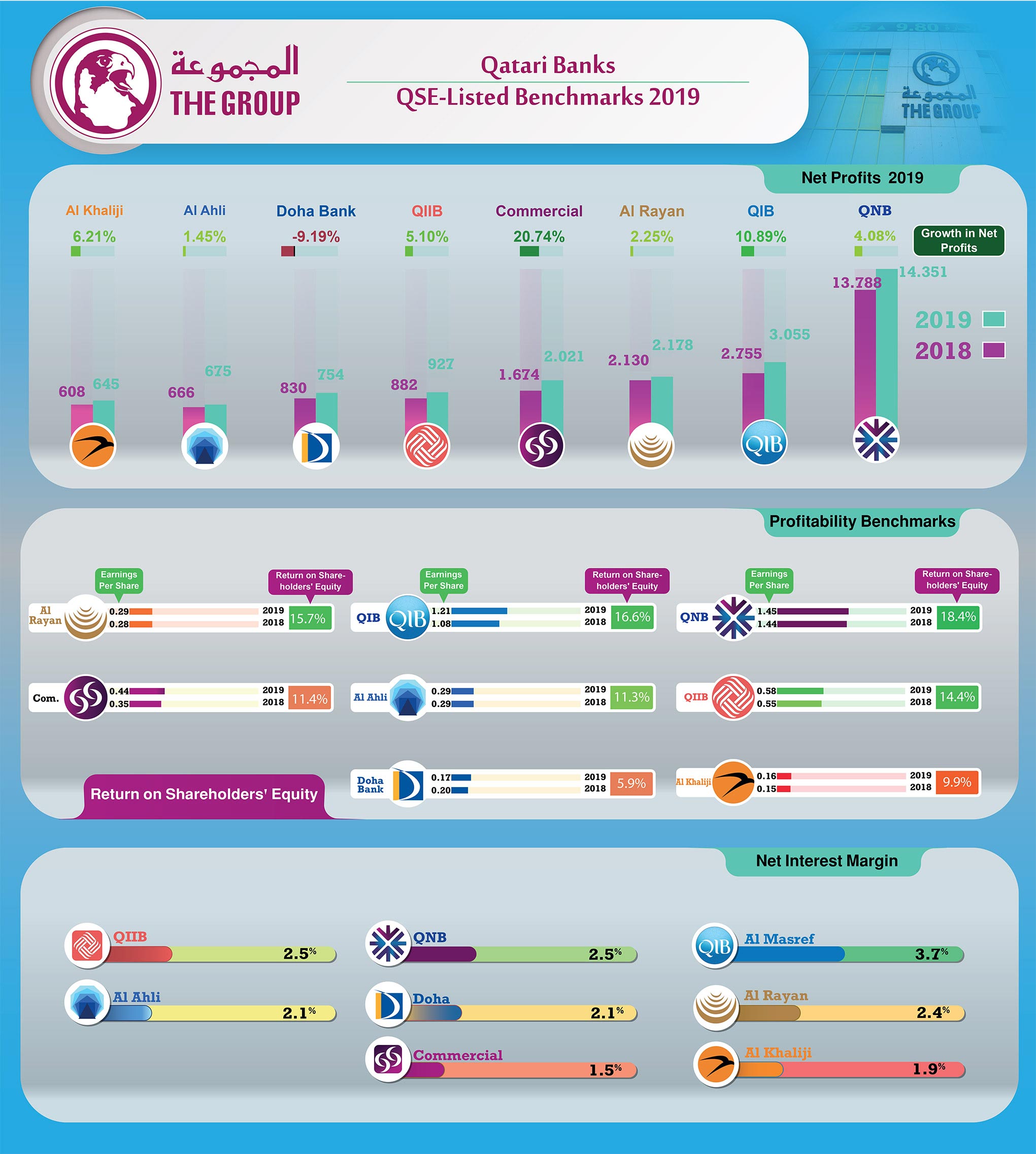

Aggregate net profits of the Qatari QSE-listed banks recorded a growth

of 5.5% during 2019 to amount QAR 24.61 billion compared to QAR 23.33

billion net profits for 2018. Qatar National Bank ‘QNB’

Group net profit comprised 58% of the sector’s net profits, followed by

Qatar Islamic Bank ‘QIB’ a share of 12% of the total net profits. The

highest profit growth was registered by the Commercial Bank of Qatar by

20.7% followed by Qatar Islamic International Bank ‘QIIB’ by 11%.

Average net interest margin ratio (the difference between the paid

interest on deposits and debt instruments to the interest received on

loans, investments and monetary instruments adjusted to

interest-generating assets) as of the year-end was roughly 2.3% of which

the highest ratio was registered by QIB by 3.75% vis-a-vis 1.75% for the

Commercial Bank.

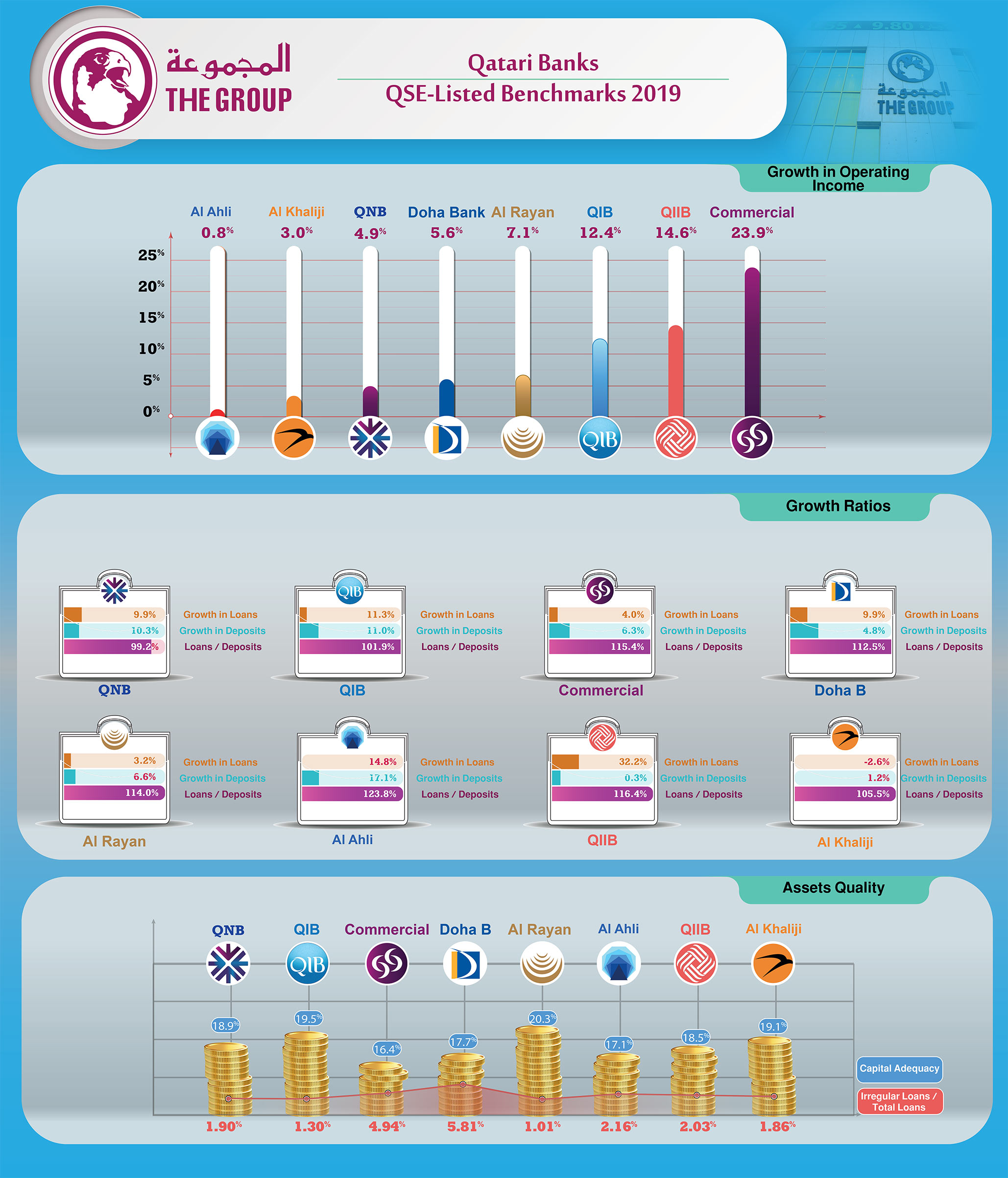

Qatari Banks aggregate Loans portfolio recorded a growth of 10% for the

year where QIIB registered the highest growth ration in its loans

portfolio by 32.2%. Conversely, Al Khaliji Commercial Bank loans

portfolio dwindled 2.6%.

Customer deposit for the year grew by 7% with Al Ahli Bank registered

the highest growth of 17.1% and QIIB recorded the lowest growth of 0.3%.

Asset quality on the other hand reflected irregular loans of 2.6% of the

Banks’ total lending portfolios where Al Rayan Bank occupied the minimum

ratio of 1.01% and Doha Bank recorded the maximum ratio by 5.8%.

Capital adequacy ratio (the defense line for depositors’ monies and

measures the bank’s ability to meet prospective losses and reflects the

bank’s financial position) reached 18.4% for the sector. Al Rayan Bank

recorded the highest ratio by 20.3% and the Commercial Bank of Qatar

recorded the lowest ratio by nearly 16.4%.

The disclosed total cash dividends distributions for the sector amounted

QAR 10.5 billion comprising 43% of the accomplished profits of 2019.